Gold prices are soaring.

Last month, the price of gold breached a new all-time record high of over $1,387 an ounce.

But with gold increasing almost 20% in three months, speculators concerned with a correction in prices may want to consider other hard asset commodities as an alternative investment.

So with that in mind, today I bring you five hard asset alternatives to gold to consider.

Five gold investment alternatives

Gold is a commodity. As such, the yellow metal derives a large part of its value from the balance of supply and demand.

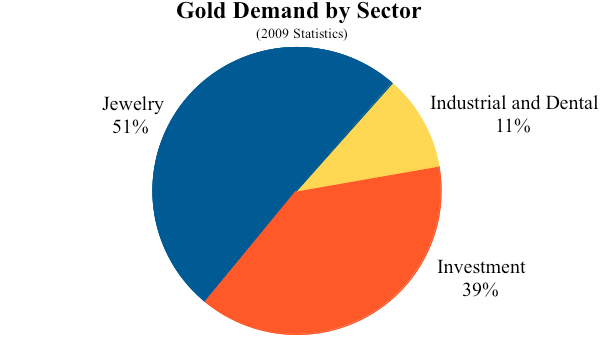

The majority of the world’s supply of gold comes from mining (58%) and recycling (42%). Meanwhile, global gold demand is dominated by the jewelry and investment sectors.

The applications, market, and dynamics of its supply-demand balance make the first investment alternative to gold obvious.

Gold Investment Alternative #1: Silver and other precious metals

Like gold, world supplies of silver and other precious metals — including platinum and palladium — are dominated by mine production and recycling.

In the case of silver, 80% of global supplies are mined while 19% are recycled. Meanwhile, worldwide supplies of platinum and palladium are more dependent on recycling and stockpiles.

Unlike gold, the demand for silver, platinum, and palladium comes principally from the industrial sectors.

Again, in the case of silver, the nearly half of worldwide demand comes from industrial applications.

The most direct way to investment in silver, platinum, and palladium would be to own the physical bullion.

There are several world governments and private refining companies that mint a wide variety of precious metal bullion bars and coins for investment purposes.

The easiest and most liquid way to invest in silver and other precious metals today, however, are exchange-traded funds (ETFs). Silver and other precious metal ETFs include:

-

iShares Silver Trust Fund (NYSE: SLV)

-

ETFS Physical Platinum Shares ETF (NYSE: PPLT)

-

ETFS Physical Palladium Shares ETF (NYSE: PALL)

Gold, silver, and precious metals have historically reacted sharply to movements in the U.S. dollar.

Other commodities that are similarly mined, used by variety of markets, and influenced by the American currency make up my next alternative gold investment.

Gold Investment Alternative #2: Crude oil, coal, and other energy commodities

Energy commodities such as crude oil, natural gas, and coal are non-recyclable, so all of the supply must come from production or stockpiles of previously produced energies.

Meanwhile, global energy demand is primarily driven by market size and economic factors.

And as commodities that are similarly influenced by the U.S. dollar, oil, coal, and natural gas have become attractive gold investment alternatives.

Speculators can get exposure to energy from various investment vehicles that range from options and futures to funds and equities.

However, I believe that the ETFs are the easiest and most liquid way to invest in the broad energy market right now, some of which include:

-

PowerShares DB Energy Fund (NYSE: DBE)

-

United States Oil Fund (NYSE: USO)

-

United States Natural Gas Fund (NYSE: UNG)

-

Market Vectors Coal ETF (NYSE: KOL)

Energy commodities are vital to our modern society. But without the next commodity, society would be underwater…

Gold Investment Alternative #3: Land

Will Rogers famously said, “Buy land. They ain’t making any more of the stuff.”

The world’s supply of land is rapidly being eaten up by an explosion in the growth of cities, suburbs, and farmland.

In fact the amount of arable land per person has been reduced in the past 40 years by half.

Like gold, land has historically served as a hedge against inflation. And owning a lot of land has traditionally been a popular investment for gold bugs and the autonomous.

Investors can get easy exposure to land through a handful of equities. You’ll want to check out an article I wrote back in February that outlined the six best land stocks to own.

Without land, the next two gold investment alternatives couldn’t grow.

Gold Investment Alternative #4: Timber

The demand for timber from emerging market is skyrocketing — particularly in countries like China and India. Last year, Canada exported 1.6 billion board feet of timber to China. This represented an 800% increase from 2006!

As a result, timber prices have been on fire for the past year and a half. Since January 2009, the price of timer has increased by over 80%.

And even though timber has outperformed the Dow Jones by four times since that time, prices are still nearly 40% lower than their 2004 highs.

There are many ways investors can get exposure to timber.

The most direct plays without trying to buy forests yourself, however, are timber stocks and ETFs:

-

Claymore Beacon Global Timber Index (NYSE: CUT)

-

Plum Creek Timber (NYSE: PCL)

-

TimberWest Forest (TSX: TWF.UN)

Gold Investment Alternative #5: Agriculture

Recent estimates predict stock market capitalization in emerging countries may grow fivefold over the next two decades to more than $80 trillion.

Recent estimates predict stock market capitalization in emerging countries may grow fivefold over the next two decades to more than $80 trillion.

More prosperity reaching the developing world, which represents a majority of the earth’s population, will result in a dynamic change in global diet from simple grains to meat.

One of the first things people do when coming out of poverty is increase the quality of their food.

And unless you think globalization will reverse, this shift probably represents one of the most monumental investing opportunity of our lifetime.

As with timber, speculators can invest in various agriculture-related investments including stocks, futures, and funds, which include:

-

PowerShares DB Agriculture ETF (NYSE: DBA)

-

Market Vectors Agribusiness ETF (NYSE: MOO)

-

iPath Dow Jones AIG-Agriculture ETN (NYSE: JJA)

-

iPath Dow Jones AIG-Grains ETN (NYSE: JJG)

Conclusion

With the price of gold screaming higher, it’s worthwhile to take a look at other hard asset investment alternatives.

Each of the gold investment alternatives I’ve mentioned today offer their own strengths and weaknesses.

Most importantly, they are all good ways to diversify your holdings away from gold if you’re worried about a crash.

Good Investing,

Luke Burgess

Editor, Wealth Daily

Investment Director, Hard Money Millionaire and Underground Profits