4 "Renewable Royalties" and How to Claim Them

Instagram and TikTok are ablaze with videos from purported “financial experts,” most of whom still live under their parents’ roof, telling people how they can “get paid.”

And these days, a lot of those videos are about certain incentives regarding renewable energy production and electric vehicles included in the Inflation Reduction Act.

Now, they’re not completely wrong. There are a lot of incentives tucked in there to encourage everyone from major corporations all the way down to individual households to reduce their carbon footprints.

But all of the incentives individuals can claim come in the form of tax credits, which is another way of saying money off your overall tax bill.

And that’s great. It either means you get a bigger refund or you get a smaller bill come next April.

But it doesn’t necessarily mean that you’re going to get rich from it the way these so-called “finfluencers” say you will.

There are a lot of ways for individuals to cash in on the incentives the government is offering, though.

And some of them actually pay cold, hard dollars and cents.

But before we get to my favorite one of those, let’s talk a little bit about the tax credits these internet “gurus” are pitching as get-rich-quick schemes…

Because they are worth your time if you’re in the market for some solar panels or a new car, or are considering some home improvements in the coming years. Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

The Full Scoop on These Tax Credits

First off, let’s talk about the one getting the most attention online: the EV tax credits.

Starting next January, you might get up to $7,500 off on your taxes if you buy a new EV or a fuel cell electric vehicle. But there's some fine print:

- Income Limits: If you're filing jointly, you’ve gotta earn less than $300,000 (or $150,000 if you're single) to grab that credit.

- Vehicle Price Caps: Cars need to be below $55,000, while SUVs and trucks should be under $80,000 (although they might have to update that for inflation).

- Other Must-knows: Your vehicle needs a battery of 7 kWh or more and it should be assembled in North America.

Oh, and if you're buying a used EV, there's a tax credit for that too! You could get up to $4,000 or 30% of the vehicle price (whichever is lower), but make sure:

- Your income is less than $150,000 for joint filers or $75,000 for singles.

- The car's price is under $25,000 and the car is at least two years old.

- It's purchased from a recognized dealer.

Just keep in mind that these tax credits don’t directly slash the vehicle price. They reduce what you owe when you file your taxes.

Although I have heard of people getting the credit added to their down payment by the dealership, so you never know.

Next up are the solar tax credits to encourage anyone who’s been thinking about a home solar installation to get off the fence.

If you’re such a person, just know that you can now claim a credit on your taxes worth between 22% and 30% of the installation costs.

If you decide to add some energy storage devices like lithium batteries, those could be covered by this credit too.

And for this one, there aren’t any income or claim limits. Anyone can claim them, and if you can’t use the whole thing in one year (because there’s no limit to how big it could be), you can roll it forward.

Just remember, you've got to own the solar setup — no renting or leasing.

And finally we get to the home improvement section of this tax credit multi-mart, where those of you making your home more energy-efficient can save a few bucks on your taxes too.

Whether you’re putting in more efficient windows, better insulation, or a fancy new HVAC system that’ll lower your energy needs, you could save as much as $1,200 on your annual taxes.

If you put in a heat pump or a biomass stove, you could claim up to $2,000.

And even if all you do is get a home energy audit to see where you could improve, you can still claim $150 off your tax bill.

None of these credits are likely to make you rich, but they’ll help make you less poor next time the taxman comes calling. And they’ll help subsidize the cost of those new things you bought to get them.

Real Renewable Royalties

Now, those tax credits are all well and good and I highly suggest you claim them if you’re eligible.

I don’t, however, recommend spending money you weren’t planning to just to lower your tax bill.

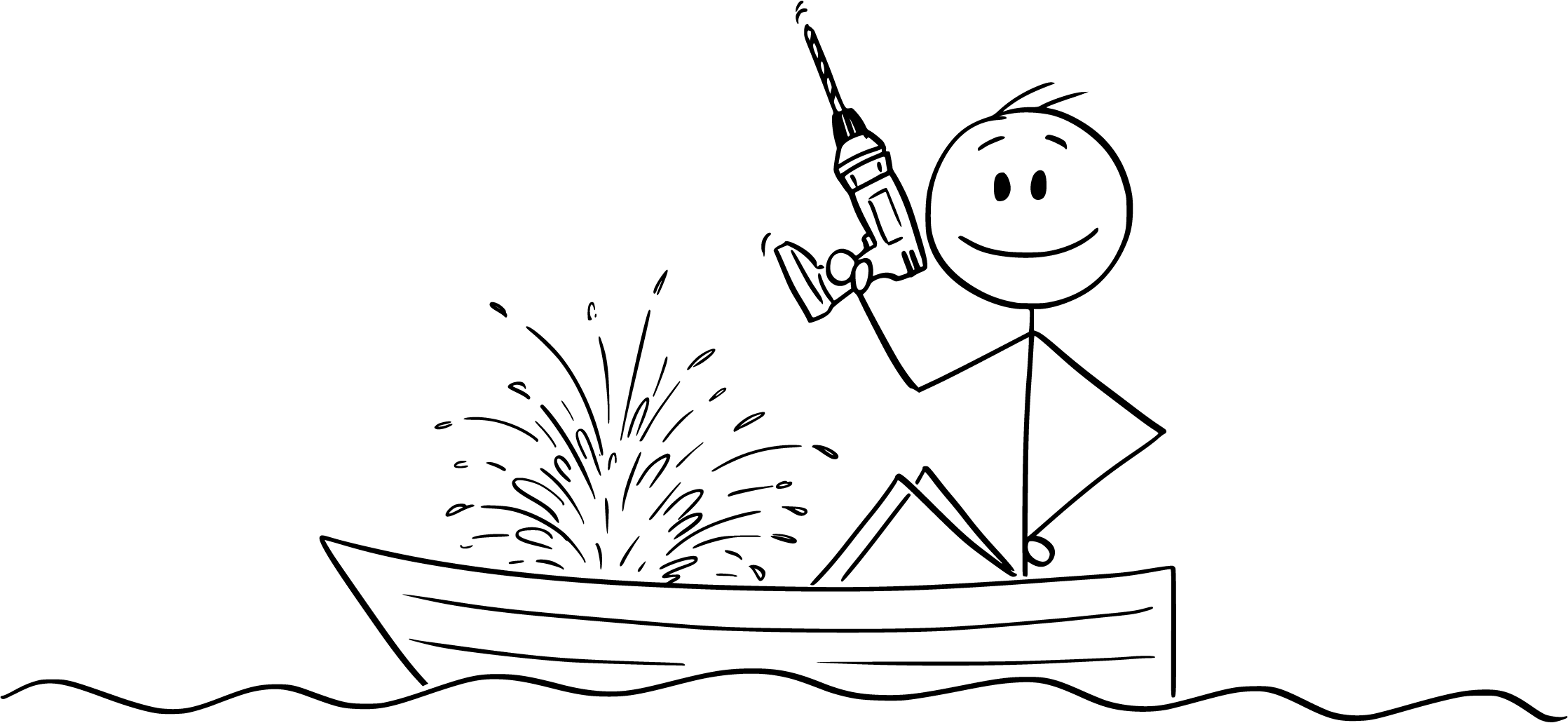

That sounds a lot like cutting a hole in the boat to let the water drain out, to me.

But there are, as I hinted at earlier, several ways that individuals like you and me can benefit from the corporate incentives hidden away in recently passed legislation.

And today, I’d like to talk about my favorite.

The Eureka Effect

With 1.7 million electric vehicles on the road in the U.S. and another 14.8 million globally, I started thinking that there had to be a way to make money off of that other than the obvious but risky strategy of betting on individual carmakers.

So I started doing some research into the opportunities surrounding the EV industry and the growing market for its consumer products.

And then I came across some hidden incentives in the IRA and some other recent bipartisan legislation.

The government is literally giving away hundreds of billions of dollars to any companies that will help the EV market not only keep growing, but completely replace the market for internal combustion cars.

It’s paying manufacturers for every car they can make. It’s paying dealers for every one they can sell.

And it’s shelling out the biggest bucks to get a nationwide network of half a million or more EV charging stations out there to keep those cars quite literally humming along.

The eureka effect refers to the common human experience of suddenly understanding a previously incomprehensible problem or concept.

And when I saw all these incentives after researching those tangential industries that could also benefit from the global adoption of electric vehicles, it was like a lightbulb went off above my head.

Eureka! I had just uncovered what could become the biggest, most successful income stream of my career.

You see, there’s a massive push to get EV charging stations installed across the country.

But the government mostly only owns land out in the Midwest and northwest where there aren’t many people and are even fewer EVs.

The rest of it is national parks, forests, and other historic or iconic (or should I say “ironic”) sites such as the newly designated Ancestral Footprints of the Grand Canyon monument.

And those aren’t really the most convenient places to put EV chargers either.

The companies that make the chargers own some factories and a headquarters or two, but again, those aren’t convenient places for people to come charge their cars.

These chargers have to go where the people already are. And what better place to put them than at service stations, truck stops, convenience and grocery stores, and malls?

There are tons of people used to stopping at those places in their cars. And they’ll stay even longer if they’re waiting for their batteries to fill up.

That’s likely to lead to increased revenues for the stores at those locations.

Now here you might be thinking that I’m going to recommend an investment in those stores. But I’m not.

You see, those stores also don’t own the buildings they’re in. Neither do the gas stations, most truck stops, or the malls.

Those properties, the real estate itself, is typically owned by a third party and leased to the vendors who operate them.

And the properties where the charging stations are being installed can charge a premium since they’re bringing in well-heeled clientele with time on their hands while their cars get a boost.

So the next step was to single out those companies. Who owned the real estate? And which owners were going all-in on EV charging stations? And which of those owners were investible?

Again, all this was to answer the question of how I could profit from the growth of the EV market.

You Get Paid While They Get Charged

Well, after asking myself those questions and doing a whole lot of research into real estate and landlords and who owns what and what they’re doing with it, I finally uncovered what I’m convinced is going down as one of the biggest money giveaways in history…

I found a way to, essentially, collect a small fee every time someone stops by one of these hundreds of thousands of properties to plug their vehicle into one of the charging stations.

And that’s why I call it Plug-in Payouts. We get paid out because more and more people are plugging in.

You see, a small group of those companies that own all the prime EV charging real estate realized that they were sitting on a gold mine.

And they made the decision to get as many EV chargers at their properties as possible, and I don’t think even the most optimistic among them imagined that it would be such a huge success.

The customers love it because they can charge their cars in a convenient location.

The tenants love it because they’re getting even more customers, and those newcomers are sticking around longer and spending more as their cars charge.

And the companies love it because these chargers have made their already-prime real estate even more desirable. Now they’re able to charge more money to rent it out.

So these companies are just raking in the dough now. They’re collecting more and higher rents from their tenants, they’re making money off the chargers when people pay for the electricity…

AND they’re able to cash in on all those billion-dollar government giveaways tucked into the legislation we discussed earlier.

But while that’s great for them, you’re probably wondering how it helps me — or, more importantly, you.

The Chosen Few

And the thing is that among those companies that own the real estate, are installing the chargers, and are now raking in big bucks…

Well, a few of them are required by law to share their profits with shareholders like you and me. All you’ve got to do is buy some of their stock and you get a share of the profits.

And as those profits grow, so will your share of them. It’s as simple as that.

But just to give you an idea of how big they could get, let me tell you how big they already are: $563 MILLION!

Yeah. These Plug-in Payouts are already worth over a half a billion dollars per year. And they haven’t even really gotten started growing yet.

As more and more people adopt EVs and need places to plug in and charge up, I expect that grand total to surpass $1 billion each year in no time at all.

The sky really is the limit to how high these payouts could get in the very near future with all the push to get more EVs and more EV chargers on the roads.

That’s why I put together a report and presentation for the members of my income-focused investing community, The Wealth Advisory.

That’s also why I want to share both of them here with you today.

I want everyone to get in on what I’m becoming more and more sure will be one of the absolute biggest, most profitable income streams I’ve ever discovered.

So read the report. Give the presentation some of your attention.

And then get yourself invested so you can claim a share of these huge and soon-to-be-even-bigger Plug-in Payouts.

To your wealth, Jason Williams After graduating Cum Laude in finance

and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private

sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team

responsible for billions of dollars in daily trading. Jason left Wall Street to found his own

investment office and now shares the strategies he used and the network he built with you. Jason

is the founder of Main Street

Ventures, a pre-IPO investment newsletter; the founder of

Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock

newsletter. He is also the managing editor of Wealth

Daily. To learn more about Jason, click here. Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube