Even with the economic collapse at the forefront of investors’ and consumers’ minds, most people don’t easily forget the miserable housing collapse of the past three years.

With the housing crisis comes discussion of foreclosures and housing prices (even new legislation giving U.S. visas for foreigners purchasing a home). But there are more statistics about our nation’s housing that matter to – and affect – both our humble abodes and the nation’s economy…

In the past year, the number of homes listed for sale in the largest U.S. cities has fallen 20%, while the number of homes on the market has dropped. A report released last week by Realtor.com shows the average time listed homes have been on the market has remained the same at 107 days.

Why is the length of time houses spend on the market high… but the sales of homes so low?

According to a report from 24/7 Wall St.:

Wilmington, N.C., tops the list with houses remaining on the market for 164 days. That compares to a city in bad shape, like Detroit, where the number is only 65 days.

Wilmington’s figure is not necessarily a bad sign. A city where listed homes have been on the market for a long period may be one where many homeowners still believe there is a chance they can make a sale.

Detroit’s figure is probably low because people are no longer listing their homes for sale due to a lengthy and depressed housing market.

One way to rate the housing market of a city or region is by its foreclosures.

The foreclosure figures coincide closely with a high number of days on the market. Of the top cities where homes are on the market for the longest period, foreclosures are above the national average: 1 in every 605 (as of September 2011).

People who have to sell their homes will obviously keep them on the market for as long as it takes to sell. But eventually, these homeowners are unable to make their mortgage payments.

By analyzing the pricing and listing data, Wealth Daily has identified whether the number of homes available increased or decreased, and how much prices have changed during that time.

Below is the most recent foreclosure rate heat map of the United States and the foreclosure activity counts by state.

The 6 U.S. Cities Where You Will Not Be able to Sell Your House

Savannah, Georgia

|

||||||

| Rank: | City: |

Time on Market: |

Change in # of listings: |

Median list price: |

Foreclosure rate: |

Population: |

| 6 |

Savannah, Ga. | 147 days |

-35.66% (11th largest) |

$199,900 (51st highest) |

1 in every 541 homes |

130,331 |

Savannah ranks in the top cities with the largest decreases in home listings in the United States, with a serious drop of 35% in just one year in parallel with home prices dropping by 5.19%. Currently, the city has just 1,484 listings; the median time on the market for these listings has sunk more than 50% in the past year. This is the greatest drop in the country.

The state of Georgia is currently on one of the highest foreclosure actions regions in the country with 11,552 foreclosures properties. One in every 352 houses is foreclosed.

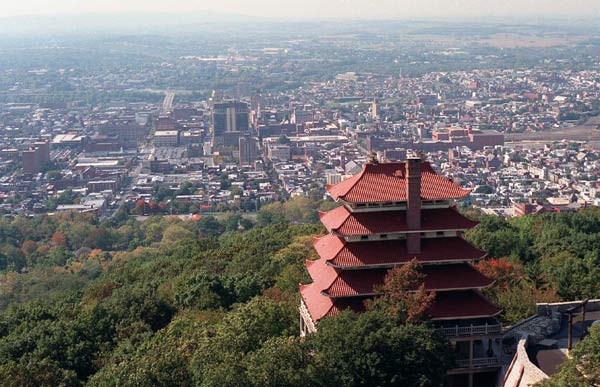

Reading, Pennsylvania

|

||||||

| Rank: | City: |

Time on Market: |

Change in # of listings: |

Median list price: | Foreclosure Rate: |

Population: |

| 5 |

Reading, Pa. |

147 days |

-11.95% (100th largest) |

$184,900 (69th highest) |

1 in every 771 homes |

81,207 |

One of the poorest cities in the country with a median income of only $28,098, this old industrial section of Pennsylvania has been hit hard by the housing market. According to the New York Times, Reading was at the top of the list of cities with more than 65,000 people with the highest proportion of residents living in poverty. Although that statistic will hurt consumer confidence and directly affect the housing market, the uplifting note is that Pennsylvania as a state has a modest amount of foreclosures (2,953) with 1 in every 1,869 houses, something they can hang their hat on.

Gainesville, Florida

|

|||||||

| Rank: | City: |

Time on Market: |

Chang in # of listings: |

Median list price: |

Foreclosure Rate: |

Population: |

|

| 4 |

Gainesville, Fla. |

150 days |

-20.36% (53rd largest) |

$164,900 (96th highest) |

1 in every 935 homes |

95,447 | |

Home of the University of Florida, Gainesville actually shares this spot with four other Floridian cities in the top 10 because of its large condo market. In August, condo sales jumped up 13%, with 51 condos selling in that month alone. The reason: affordable prices in comparison to home real estate. Condo median prices dropped 13% to $69,400 from $79,500 and the real estate market has still yet to recover.

Many Florida cities were affected by a large population growth in the past two decades. From 2000 to 2010, Gainesville grew 30% in size, therefore severely impacting the housing market.

Naples, Florida

|

|||||||

| Rank: | City: |

Time on Market: |

Change in # of listings: |

Median list price: |

Foreclosure rate: |

Population: |

|

| 3 |

Naples, Fla. |

156 days |

-37.83% (6th largest) |

$369,000 (12th highest) |

1 in every 356 homes |

21,804 | |

Being the worst place to try and sell your house in any state is difficult, but when you’re also a city within the most ravished state for real estate, it’s an outright disaster…

Naples has one out of every 356 homes foreclosed – almost twice the national average. Houses are foreclosed so frequently that the Florida Fair Foreclosure Act was signed this month to streamline the foreclosure process. All within the past year, Naples has been hit with a large amount of foreclosures at once and the median home listing price jumped by more than 23%. As for comparing the city’s figures with the entire state, Naples is right on par: 1 in every 368 housing units foreclosed – a whopping 24,077 properties in total.

Myrtle Beach, South Carolina

|

|||||||

| Rank: | City: |

Time on Market: |

Change in # of listings: |

Median list price: |

Foreclosure rate: |

Population: |

|

| 2 |

Myrtle Beach, S.C. |

161 days |

-14.00% (91st largest) |

$174,950 (82nd highest) |

1 in every 207 homes |

22,759 | |

Myrtle Beach is in a unique position, as housing is more seasonal than static. The city is located in Horry County, a region that has more than tripled the number of houses for seasonal use than any other county in North Carolina.

As houses along the ocean have a high price tag, they are also the ones with the highest vacancies, as they are not the owners’ primary homes. Foreclosures are more common among oceanfront residences because the owners who cannot afford the mortgage are more accepting to foreclose than to give up their primary house. The number of home foreclosed in South Carolina are not as astronomical – above national average, actually – with 1 in every 775 homes foreclosed. But due to Myrtle Beach’s miserable numbers, the state’s figures drop as a whole.

Wilmington, North Carolina

|

|||||||

| Rank: | City: |

Time on Market: |

Change in # listings: |

Median list price: |

Foreclosure rate: |

Population: |

|

| 1 |

Wilmington, N.C. |

164 days |

-21.31% (48th largest) |

$244,250 | 1 in every 4,504 homes |

106,476 | |

Although having an incredibly low foreclosure rate of 1 in every 4,504 homes and quite a soft housing market, Wilmington drags the time a home is on the market out. But the silver lining is that their foreclosure rate is dramatically less than the state’s figures of 1 in every 1,951 housing units foreclosed.

So why does Wilmington top our list with the longest time on the market? As we mentioned earlier, homeowner confidence is very high. Their median list price remains quite high, so the length is not necessarily a bad sign. Next year, three of Wilmington’s counties are forecast to grow faster than the national average, which is why the median list price has increased within the past year.

Wilmington has many indications of its economy recovering. But in order to sell a home, you may need to wait a little longer than you’d like.

Conclusion

The figures indicate the housing market will recover – and in fact, it has already started to – as prices have begun to rise and foreclosures slack.

A good sign of recovery is actually homes staying in the market longer nationwide because homeowners that see a market recovery will put their homes up for sale. Of course, this means inventory will rise… But if the recovery is efficient, that increased inventory will eventually fall.

As is the case in any market, as soon as confidence picks up from the consumer, a recovery will follow.

societal