I just returned from Ocean City, Maryland, spending Easter with my two oldest sons and my grandson.

It was a much-needed getaway. In fact, I "unplugged" for most of the Easter weekend.

The last two months have been a chaotic ride in the markets. Not a day has gone by that someone hasn’t asked me my thoughts on the situation. Many were in a panic. When I see panic, I buy. I’ll explain more on that in a minute.

But I want you to take a look at the Fear and Greed Index:

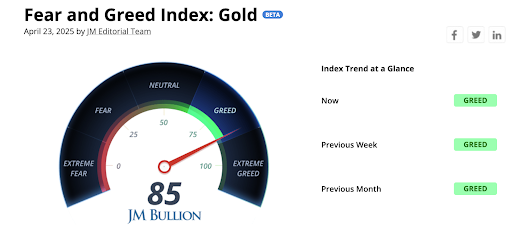

The index has been solidly in the "extreme fear" pie slice for several weeks. Not surprisingly, the same index for gold has been in the "greed" slice:

Gold has already reached and exceeded my 2025 price target of $3,138 an ounce. Just a few days ago, gold hit a record high (an inflation-adjusted record high) of over $3,509.

I recently launched a new trading service called New World Assets, where we trade natural resources like gold, silver, critical and industrial metals investments.

In fact, this past Tuesday we sold the Direxion Daily Junior Gold Miners Index Bull 2X Shares (JNUG) for big gains.

In an attempt to be as transparent as possible, here are screenshots of my personal trading account. I personally made just about 50% on JNUG in just two months:

If you would like to trade alongside me in this gold/commodities bull market, you can participate with me here.

Now, the markets have recently reversed. The Dow, S&P 500, and Nasdaq have bounced hard. As of this writing, gold is selling off. I will buy JNUG again when the time is right, because I believe gold is in a long-term bull market. I’m talking a decade-long bull market. And it has to do with gold reasserting itself as a financial pillar on the balance sheets of central banks, governments, investment firms and individuals.

More importantly, there’s a digital revolution underway in gold: NatGold.

President Trump wants to monetize America’s natural resource wealth… adding it into his idea of a national sovereign wealth fund. A key ingredient of the sovereign wealth fund will be gold, in all of its form: Above ground and below ground.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We”ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “A Maverick’s Guide to Gold: 3 Gold Stocks Set to Disrupt the Market”

It contains full details on something incredibly important that’s unfolding and affecting how gold is classified as an investment..

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

I’ll talk more about this in a minute.

But first, let me explain why we just had another generational wealth-buying opportunity.

Back in March 2020 — when the world was locking down, markets were in free fall, and fear was off the charts — I wrote something bold: "This isn’t the end. It’s the beginning of a once-in-a-decade chance to build wealth.”

I called it in my piece, "The Unwanted Financial Guest That Never Leaves," and guess what… I was right. The people who stepped up, bought in, and held steady? They saw life-changing gains. Some doubled their money. Some did even better. And almost all of them had to do the hardest thing in investing: Buy when everything feels like it’s on fire.

And now… it’s happening again.

Markets are getting rocked. Headlines scream about tariffs, trade wars, and global economic gridlock. But here’s the truth Wall Street won’t tell you: This is another generational buying opportunity. Not next year. Not in hindsight. Right now.

The Patterns Never Lie

When COVID hit, the media declared financial Armageddon. They said we’d never recover. That everything had changed forever. Sound familiar?

"In every single case, the mainstream media said, ‘It’s different this time.’ They said it ‘was the end of the world’… ‘We will never recover’… ‘This will change everything going forward from here’… In every single case, they were wrong."

— Me, March 13, 2020

It’s like they recycle the same panic over and over, changing only the headline. Back then it was a virus. Today it’s tariffs, deglobalization, and escalating geopolitical risks. Tomorrow? It’ll be something else. The noise never stops.

But if you tuned it out in 2020 and followed the data, you made money. Big money. Because markets recover. They always have. They always will.

What’s Really Going On?

Let’s cut through the hysteria. Here’s what’s actually happening:

- The S&P 500 has pulled back more than 12% in the past two months.

- Bond yields are bouncing, and investors are spooked about inflation reigniting.

- China, Europe, and the U.S. are all throwing elbows in the global trade ring.

That’s the surface story.

Beneath it? A massive reallocation of capital is underway. Supply chains are being rebuilt. Domestic manufacturing is being prioritized. AI is being deployed in every sector. And hard assets — commodities, infrastructure, energy, and precious metals — are roaring back into focus.

Every panic creates a pivot. We’re watching it unfold now.

This isn’t a breakdown — it’s a setup.

Don’t Just Take My Word for It

This isn’t my first rodeo. And if you’ve followed me for any length of time, you know I don’t make bold calls lightly.

But you don’t have to rely on my track record (though I’d be happy to show it to you). Let’s talk about what the greats do during times like this:

- Warren Buffett famously said, "Be greedy when others are fearful." He’s made more money buying into fear than selling into hype.

- Sir John Templeton bought when pessimism was at its peak — and built a fortune.

- Howard Marks wrote the literal book on market cycles. He made it clear: You can’t outperform if you think like the crowd.

These guys didn’t wait for confirmation. They acted during chaos. And they got rich doing it.

What I’m Doing — and What You Should Consider

I’m not just talking. I’m buying.

Right now I’m rotating capital into:

- AI and next-gen tech: The hysteria around AI regulation has pushed some of the best innovators to bargain levels. I’m looking at semiconductors, infrastructure, and language model enablers.

- Energy and industrials: Tariffs are bullish for domestic production. I’m adding exposure to LNG exporters, rail networks, copper miners, and utility grid upgrades.

- Gold and silver: With central banks loading up and fiat systems under scrutiny, the smart money is hedging. I’ve said it before and I’ll say it again: Gold isn’t just shiny — it’s strategic.

The Data Speaks — If You’re Listening

Let’s look at some real numbers:

- After the March 2020 lows, the S&P 500 rose 114% in just 18 months.

- The Nasdaq tripled from its pandemic bottom.

- Even battered sectors like energy and travel posted triple-digit gains.

That’s not fantasy. That’s what happens when panic gives way to patience.

The same setup is forming again. We’ve seen this movie before. And we know how it ends — with disciplined investors walking away with 5x, 10x, even 20x gains.

Where Everyone Else Sees Risk, You Should See Reward

Everyone wants to buy low and sell high. But no one wants to buy when it’s actually low. That’s the paradox of investing.

The crowd is nervous. The media is negative. The headlines are ugly.

Perfect.

Because this is exactly what a generational buying moment looks like: high uncertainty, low valuations, misunderstood catalysts. It’s not supposed to feel easy. It’s supposed to feel like now.

Final Thought: You Don’t Get Rich Waiting for Clarity

If you wait for all the lights to turn green, you’ll miss the ride.

Back in 2020, I warned my readers not to let fear make their decisions. Those who listened were rewarded.

Today, I’m giving the same warning — and the same opportunity.

The conditions aren’t identical, but the setup rhymes. Trade war panic. Political instability. Sector rotation. Global dislocation. These aren’t signs to retreat. They’re signs to reload.

Buy the dip. Own the future. Let the talking heads eat crow while you build wealth.

Speaking of owning the future…

Trump’s "Sound Money" Bombshell Just Validated the Entire NatGold Thesis

Why Judy Shelton’s Call for a Gold-Backed Treasury Bond Could Unleash the Biggest Monetary Shift Since 1971… and How NatGold Is Already 10 Steps Ahead

There’s a quiet war erupting inside America’s monetary command center — and it’s about to send shock waves through every asset class on the planet.

On one side: Jerome Powell and the Federal Reserve, clinging to an aging fiat system propped up by artificially suppressed rates and trillions in printed debt.

On the other side: Trump-era economic advisor Judy Shelton, armed with a gold-backed solution that just might blow the doors off the dollar-as-we-know-it.

In a headline-grabbing interview with Soar Financially, Shelton dropped a golden gauntlet — suggesting a 50-year U.S. Treasury bond backed by physical gold. Not pegged to CPI. Not managed by a small clique behind closed doors. Backed by real metal. In other words, a return to real money.

Let that sink in.

Because what Shelton is proposing isn’t just a tweak to policy. It’s a complete reboot of America’s monetary DNA. One that would limit the Fed’s reckless power grab… rein in Congress’ endless deficit deluge… and possibly — just possibly — mark the official beginning of a post-dollar monetary world.

And if you’ve been following the NatGold story, you already know where this is headed…

Why NatGold Is the Ultimate "Pre-Game" to Shelton’s Gold-Backed Reset

While Shelton’s idea simmers inside the Beltway, NatGold is already sprinting ahead of the monetary curve.

NatGold isn’t theory. It’s not academic. It’s a fully asset-backed digital token tied directly to certified, unmined U.S. gold reserves. We’re talking about the kind of high-grade, untapped metal that bureaucrats can’t touch… sitting locked inside American bedrock.

The best part?

Unlike a Treasury bond that might appear in a decade, NatGold is minting soon.

And when Shelton talks about "tremendous investor appetite" for gold convertibility, she’s describing NatGold’s entire business model. We’ve built the rails. We’ve secured the assets. We’ve tokenized the supply. And we’ve done it before the mainstream even woke up.

A Currency Crisis Is Brewing… and NatGold Is the Hedge

Shelton's warnings about the Fed? They’re not exaggerations — they’re battle cries.

She calls the Fed "too political, too powerful, and too prominent in credit markets." Translation? It’s no longer an independent institution — it’s a backdoor funding arm for elite interests. Ordinary savers get zilch. Big banks and foreign lenders feast.

And while Powell is paying 4.4% on bank reserves with taxpayer money… gold just surged past $3,500 an ounce — its highest level in human history.

What Shelton sees is what NatGold’s founders have bet the farm on:

Gold is the ultimate check on the system.

It’s why central banks are hoarding it. It’s why BRICS are building alternatives to the dollar. And it’s why everyday Americans are about to be blindsided by a quiet monetary revolution.

The Inevitable Collision: Digital Gold vs. the Fed’s Fiat Fantasy

This isn’t just about gold anymore. It’s about digital monetary architecture.

Shelton’s idea — a gold-backed 50-year Treasury — would be historic. But NatGold is already fusing blockchain transparency with hard asset credibility right now. It’s portable. It’s divisible. It’s immutable. And it’s completely independent of Wall Street.

It’s the first true monetary instrument of the post-Fed era.

Why Now? Because History Is About to Repeat Itself

In 1971, Nixon unhooked the dollar from gold — and launched the age of fiat.

In 2025, the reverse may be underway.

Shelton’s roadmap could lead to a new monetary standard — backed by gold, driven by technology, and enforced by market discipline instead of political whim.

NatGold is the advance party of that future.

It’s the digital version of what Shelton’s proposing — but with one massive advantage:

You don’t need to wait for Washington.

With NatGold, you can own your slice of the next monetary system right now — before the first Treasury bond with gold convertibility even sees a printer.

Final Word: The Fed Is Losing Control — and NatGold Is Gaining It

If you’ve been looking for confirmation that we’re on the right track… this is it.

Shelton’s gold-backed plan isn’t fringe. It’s the future. It’s what happens when a supercycle of debt, distrust, and digital innovation finally converges on the carcass of fiat.

It’s why gold is exploding. It’s why central banks are racing to restock. And it’s why NatGold may be the most important asset class of this decade.

So while Wall Street waits for the Treasury's next move… you don’t have to.

You can front-run the revolution.

You can be first — not last — into the new monetary order.

This is your window. Own NatGold before the dollar reset becomes reality.

The Prophet of Profit,

Brian Hicks

Brian is a founding member and President of Angel Publishing. He writes about general investment strategies for Wealth Daily and Energy and Capital. Brian is the managing editor and investment director of R.I.C.H Report (Retired Independent Carefree Healthy) and New World Assets. For more on Brian, take a look at his editor’s page.

P.S. Something historic is unfolding in Washington — and it could change your financial future FOREVER. Trump has just signed an executive order creating America's first-ever National Investment Fund — a game-changing system designed to replace income taxes and send direct payouts to everyday Americans. More than $1 TRILLION is expected to be distributed… and YOU could be eligible to claim a massive check. Here's how to be first in line to collect up to $21,307 — BEFORE the first checks to the public go out.