They say good things come to those who wait.

That’s previously been the case for Apple fans awaiting the newest gear from the Big Tech giant at the company’s yearly Worldwide Developers Conference (WWDC).

But those who watched the first presentation from the most recent 2023 conference were left wondering what the heck just happened.

In a grueling and comically cringy presentation, out-of-touch executives at Apple explained the newest features of their lineup of products, from the $7,000 Mac Pro with four graphics cards that no one needs and the newest M2 Ultra chip that still can’t play most video games to the $3,500 Vision Pro mixed-reality headset that no one can afford.

But somewhere in Silicon Valley, a group of executives is shaking hands and congratulating each other for a job well done while Mark Zukerberg is shaking in his boots.

That’s because the Vision Pro headset is a huge step for the company but also a huge risk.

The standard play for Apple has always been to create a new product that people don't just want but need — or at least think they need. (Think the iPod, iPad, iPhone, and AirPods.) Then the company hypes it up at an investor conference and sells tens of millions products, generating massive revenue and driving up the stock price.

But as Vox reported, the launch of the VR/AR headset feels different:

The most logical argument is that Apple doesn’t really think it will sell tens of millions of these things, in this form, at $3,000 a pop. Rather, it thinks the initial buyers will be developers, hobbyists, and Apple superfans. And Apple believes it will learn a lot about the device’s potential once they’re out in the wild, with real people testing them and providing feedback. And that years down the road, when costs come down and the tech improves and there are multiple killer apps for this stuff, Apple’s headset will take off.

The product isn’t due out for another year, so we still have time to see how it plays out.

But for now, Apple’s nudging out the competition in the space like Microsoft, Google, and Meta, who’ve all pretty much fallen flat on their faces by delving into the metaverse. Mark Zuckerberg reframed his entire company to focus on the metaverse, throwing tens of billions of dollars down the drain in the process.

As for Apple, the sharks are starting to circle it, as the new headset isn’t very impressive… yet. Sure it has a plush head strap and lets you watch 3-D movies in surround sound and layer holographic objects in your environment. It even has a creepy digital eye rendering that makes it look like you’re wearing a digital sleep mask.

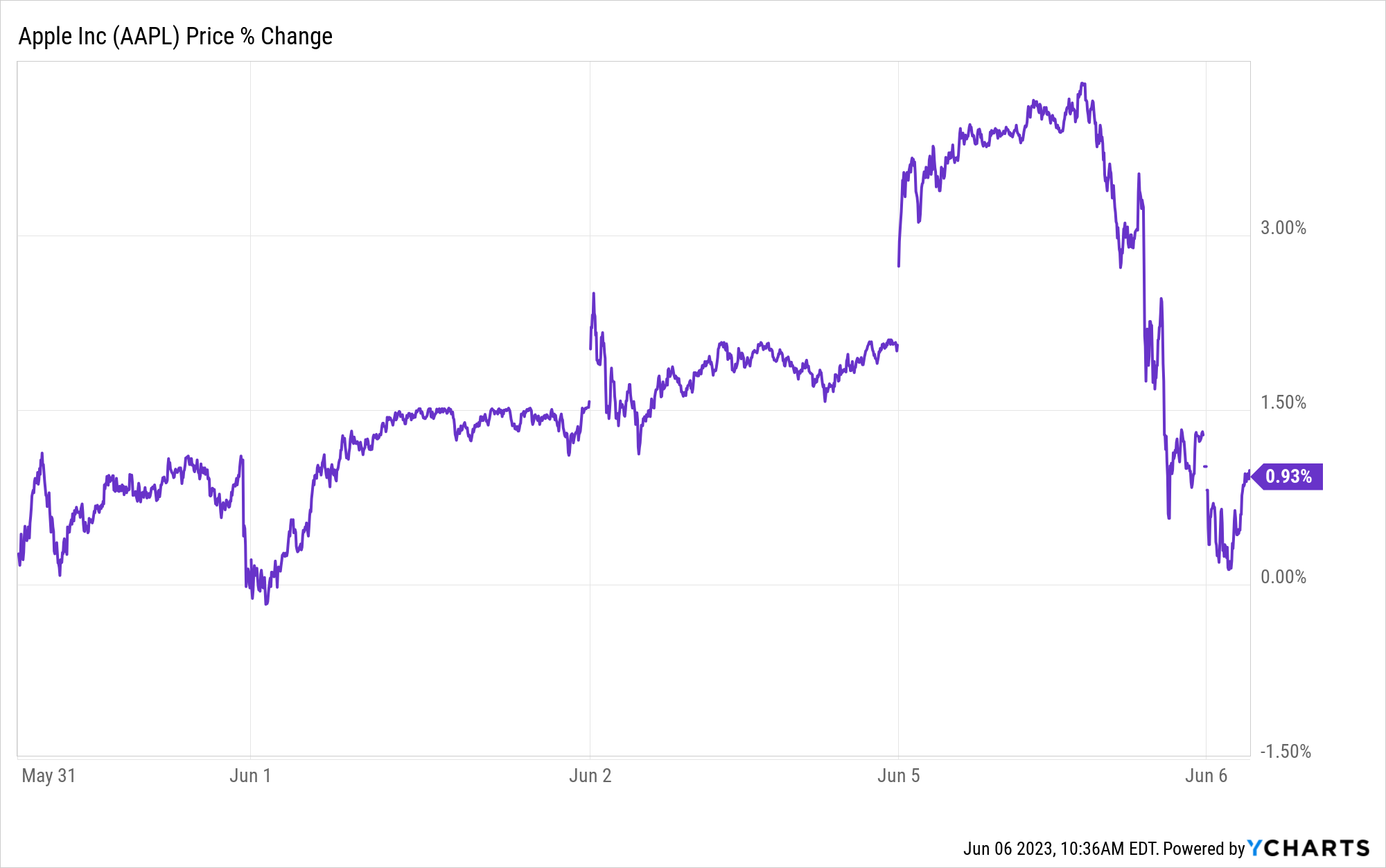

But after reaching all-time highs before the big day, the stock dropped nearly 4% after the announcement.

In an interview with GQ, Tim Cook laid out the vision for the product:

If you think about the technology itself with augmented reality, just to take one side of the AR/VR piece, the idea that you could overlay the physical world with things from the digital world could greatly enhance people’s communication, people’s connection. It could empower people to achieve things they couldn’t achieve before. We might be able to collaborate on something much easier if we were sitting here brainstorming about it and all of a sudden we could pull up something digitally and both see it and begin to collaborate on it and create with it.

And so it’s the idea that there is this environment that may be even better than just the real world — to overlay the virtual world on top of it might be an even better world. And so this is exciting.

The idea has legs, for sure. We’re not far away at all from speaking with holograms across the world. I’m imagining Princess Leia in Star Wars: “Help us, Apple. You’re our only hope.” Tim Cook continued by saying, “Pretty much everything we’ve ever done, there were loads of skeptics with it.” The Apple CEO just needs to be careful that he doesn’t sound too much like Zuckerberg or the stock will suffer.

Ultimately, it’s the future potential of the device that has investors drooling. In fact, the conference has sent shares of companies associated with the new device to new heights.

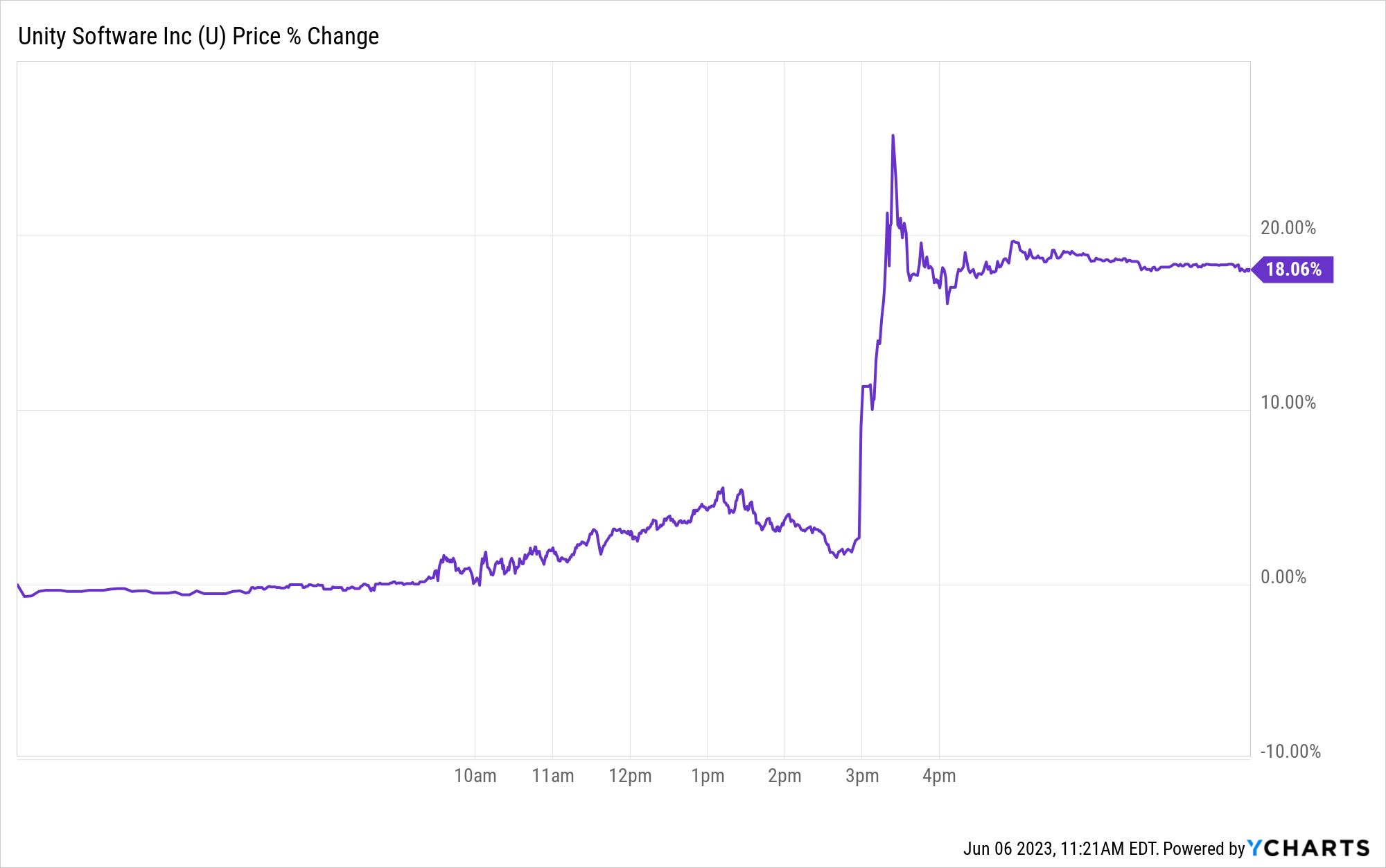

Apple announced two new partnerships during the show, one with media giant Disney (NYSE: DIS) and one with gaming company Unity Software (NYSE: U). Disney had a nice pop on the news.

And Unity shot up so fast that many brokerages had to halt trading.

That’s why these Apple conferences are still relevant and we need to pay attention.

And it’s why the richest people on Earth, including company executives and our very own members of Congress, have been getting in on the trend. Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

I cross-reference my various sources every day to try to catch members of Congress in the trading act. Here’s what I found from a site called Quiver Quantitative. Leading up to the big conference, lots of Congress members were buying up shares of Apple…

They’ve also been dabbling in a little-known company called Coherent Corp. (NYSE: COHR) that makes optical materials and semiconductors. The company has a partnership with… guess who… Apple. Coherent's tech is used in its LCD and OLED displays.

As Tim Cook said, there will always be naysayers. But there will also always be companies profiting behind the scenes. That’s why we at Wealth Daily pull back the curtain on the top tech trends to give you the best and least-covered stocks.

So what’s the next step?

Jim Cramer thinks you should sell. He recently said, “Unless you’re terminally greedy or totally brain-dead, you take some profits while you have them. This is not the time to double down, it’s the time to ring the register on some of your gains.” If you follow the reverse Cramer tactic, that could indicate more gains are ahead.

I’ll stick with following congressional trades.

Tracking the richest investors is like playing a game of poker and knowing exactly what cards your opponent has. After all, Congress knows the next trends that will take off better than anyone else. They write the law, for crying out loud.

That’s why I track congressional trading in my premium trading service Insider Stakeout.

It's how we knew about the Apple trades and Coherent trades well ahead of the crowd.

In fact, just last week we closed out 80% gains and are gearing up to do it again this week.

We're looking at a new trade now that could blow those gains out of the water.

Join me today to stay in the loop.

Stay frosty, Alexander Boulden After Alexander’s passion for economics and investing drew him to one of the largest financial publishers in the world, where he rubbed elbows with former Chicago Board Options Exchange floor traders, Wall Street hedge fund managers, and International Monetary Fund analysts, he decided to take up the pen and guide others through this new age of investing. Alexander is the investment director of Insider Stakeout — a weekly investment advisory service dedicated to tracking the smartest money on the planet so that his readers can achieve life-altering, market-beating returns. He also serves at the managing editor for R.I.C.H. Report, a comprehensive service that uses the highest-quality investment research and strategies that guides its members in growing their wealth on top of preserving it.

Check out his editor’s page here. Want to hear more from Alexander? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

Editor, Wealth Daily

Check us out on YouTube!

Check us out on YouTube!