That’s because the price of natural gas has collapsed to a 7-year low.

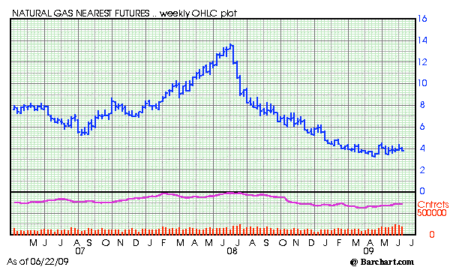

Here’s a chart of the price of natural gas for the past 2 years:

While most commodities have bounced back from their financial crisis lows (like oil, see below), natural gas prices remain below $4 per mcf.

Why?

We now have the answer.

Last week, it was reported that America’s natural gas reserves are much larger than previously thought.

That’s because of a new technology which has allowed producers to drill for gas in shale rock (like that found in the Barnett Shale). Now, the country’s estimated reserves are 35 percent higher than just two years ago and have reached the highest level in 44 years.

The report comes at a time when natural gas is being touted as a way to help reduce U.S. dependence on foreign oil and cut emissions that lead to global warming.

According to the report:

The country’s estimated total natural gas resources stand at 2,074 trillion cubic feet, an increase of 542 trillion cubic feet from its last report.

The figure includes 238 trillion cubic feet of proven gas reserves as established by the Department of Energy and 1,836 trillion cubic feet of reserves labeled as probable, possible, and speculative.

The report reinforces a study released last year for the natural gas-backed American Clean Skies Foundation. It found the U.S. had 2,247 trillion cubic feet of natural gas reserves — a 118-year supply. The U.S. consumes about 22 trillion cubic feet of gas per year, almost all of it produced in the U.S.

Natural gas is used to generate about a fifth of the nation’s electricity. It emits about half of the heat-trapping greenhouse gas that coal does. Those who are pushing natural gas production the hardest, like Texas oilman T. Boone Pickens, have promoted natural gas as a transportation fuel that could be used to reduce dependence on foreign oil.

According to Pickens, "I launched the Pickens Plan a year ago to help reduce our dangerous dependence on foreign oil, and using our abundant supply of natural gas as a transition fuel for fleet vehicles and heavy-duty trucks is a key element of that plan. On the same day this report is going out, diesel prices are again on the rise, squeezing the trucking industry. Now more than ever we need to take action to enact energy reform that will immediately reduce oil imports."

Thursday’s report said shale now makes up one-third of the 1,836 trillion cubic feet of potential resources, much of it from a re-evaluation of shale gas in the Marcellus basin as well as the mid-continent region, the Gulf coast, and Rocky Mountain areas. Reserves jumped 16 percent overall from the group’s last report two years ago, and estimates could go even higher because not all areas that have shale have been tested and explored.

Even though natural gas prices are trading at a 7-year low, I’m buying. It’s the one commodity that hasn’t rebounded from the sell-off experienced during the economic crisis.

My guess is natural gas prices will increase off their lows, as the surge in reserves was already priced into the market.

An easy way to play the rebound in natural gas is the US Natural Gas ETF (UNG). UNG is an ETF I own in my personal trading account.

Profitably yours,

Brian Hicks