Isn’t it weird that we, as a society, practice football more than we practice managing our life savings?

Think about it. If you play a sport with any regularity, you also probably spend some of your free time practicing. After all, it’s helpful to work on your skills and technique in a risk-free, non-competitive context before you play for points.

But have you ever applied the same principle to your money management skills?

Paper trading allows you to test out your techniques and theories on the market using imaginary “paper” money. And as you’ll see in a moment, there are a variety of paper trading programs packed with useful features at your disposal.

But very few people use them. I had never practiced buying or selling stocks with paper money before I bought my first stock with real money. I’m willing to bet the same was true for you.

And that’s pretty backwards. We basically expect new investors to take the field as a starting quarterback in the NFL when they’ve never even thrown a football before — despite the fact that there are great training facilities all over the place.

Why Practice with Paper Trading?

The most obvious benefit of paper trading is risk-free experience. It allows you to get a feel for unfamiliar markets, positions, and strategies without any chance of losing a penny.

But the psychological benefits might be even more valuable. Research suggests that many traders over-trade due to anxiety or lack of confidence about their strategy — and that this over-trading drags down returns.

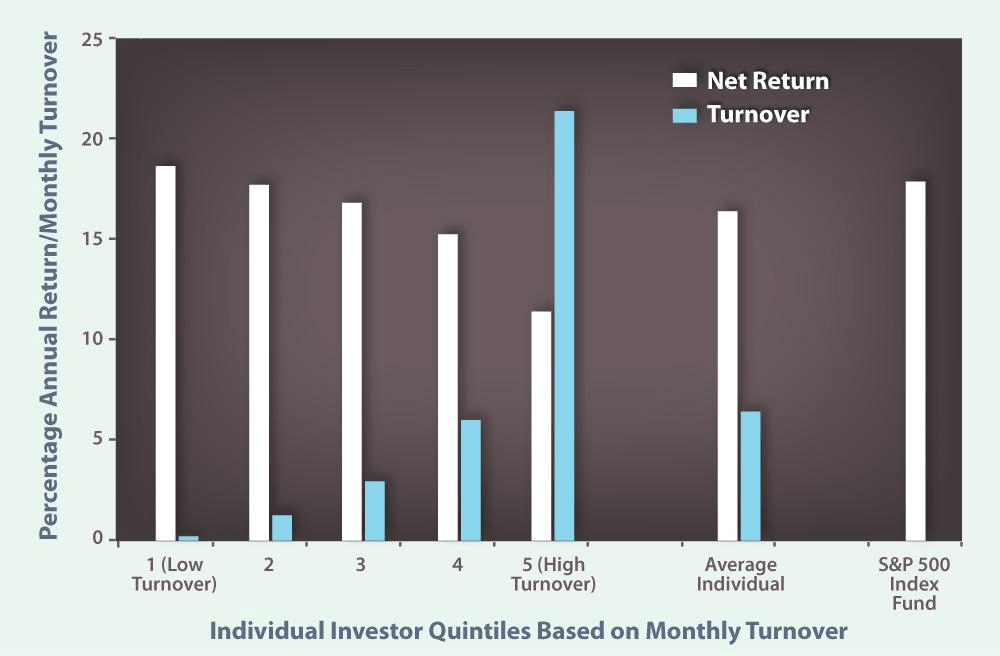

Brad Barber, a professor of finance at the University of California, Davis, studied the relationship between monthly portfolio turnover and returns for individual traders. As you can see from the graph below, he found that the more skittish and hyperactive traders are, the worse they do…

Source: Brad M. Barber and Terrance Odean, The Journal of Finance

Paper trading allows you to overcome this skittishness by practicing. In short, it gives you more familiarity with the markets and steadier hands. It’s a great idea for investors of all stripes — and it’s especially helpful for novices.

With all that in mind, let’s learn about three of the most popular and versatile paper trading platforms online today.

NinjaTrader

NinjaTrader is a financial technology (fintech) company that produces several software products, including a low-cost trading platform and a free paper trading platform.

NinjaTrader offers paper trading capabilities across a wide variety of asset types. It’s especially well-suited to forex and futures trading, but it can also be used to practice stock trading with some light customization.

In addition to its paper trading capabilities, NinjaTrader also offers advanced charting tools and backtesting capabilities to its free users. Check it out here.

Stay on top of the hottest investment ideas before they hit Wall Street. Sign up for the Wealth Daily newsletter below. You’ll also get our free report, “Seven Techincal Analysis Tools for Investors.“

paperMoney by TD Ameritrade Thinkorswim

TD Ameritrade’s Thinkorswim platform is one of the most popular pieces of trading software on the market today — and for good reason. One of its best features is paperMoney, a downloadable trading simulator.

It offers all users a virtual margin account and a virtual IRA with $100,000 of imaginary money. It also offers backtesting capabilities and simulations of different kinds of orders. Check it out here.

TradeStation

TradeStation is another downloadable desktop-based trading platform that offers a wide variety of paper trading features. It’s free for all TradeStation customers.

You can use it to practice your hand with a variety of different assets, including stocks, bonds, options, ETFs, and more. It also offers advanced order simulations and strategy automation tools — and the nifty ability to reset your paper trading account at any time. Learn more here.

What Paper Trading Can’t Teach You

It’s hard to overstate the experiential and psychological benefits of paper trading for investors, just as it’s hard to overstate the benefits of practice for athletes.

But running drills can’t teach you everything you need to know about football, and paper trading can’t teach you everything you need to know about investing.

There are certain elements of randomness in real financial markets that simply can’t be modeled in paper trading software. Spreads fluctuate, orders get rejected, glitches happen.

And while some of the platforms discussed above have a “reset” button that allows you to get all of your original paper money back, there’s no such button when you’re trading real money.

In other words, paper trading can help prepare you for the ups and downs of real trading, but it’s not quite the same as having actual money on the line.

Investors who are ready to take the dive into trading with real dollars — and who want the help of a trusted expert — should check out Alex Koyfman’s Penny Stock Millionaire service here.

Until next time,

![]()

Samuel Taube

Samuel Taube brings years of experience researching ETFs, cryptocurrencies, muni bonds, value stocks, and more to Wealth Daily. He has been writing for investment newsletters since 2013 and has penned articles accurately predicting financial market reactions to Brexit, the election of Donald Trump, and more. Samuel holds a degree in economics from the University of Maryland, and his investment approach focuses on finding undervalued assets at every point in the business cycle and then reaping big returns when they recover. To learn more about Samuel, click here.