Should You Buy Physical Gold?

You don’t have to be a doomsday prepper to see the many advantages of investing in gold.

The yellow metal’s price is uncorrelated with stocks, bonds, and other assets. It tends to go up when everything else is going down. And it has a long history of being used as an emergency store of value by people fleeing from violence, persecution, and economic instability.

But there are many different ways to invest in gold. In this age of easy access to gold mining and streaming stocks, gold funds and gold certificates, is buying physical gold worth the hassle?

The answer to that question depends heavily on your own preferences, risk appetite, and financial situation. Today, we’re looking at two pros and two cons of physical gold ownership.

Pro: Holds Value in a Crisis

Want to hear a shocking statistic?

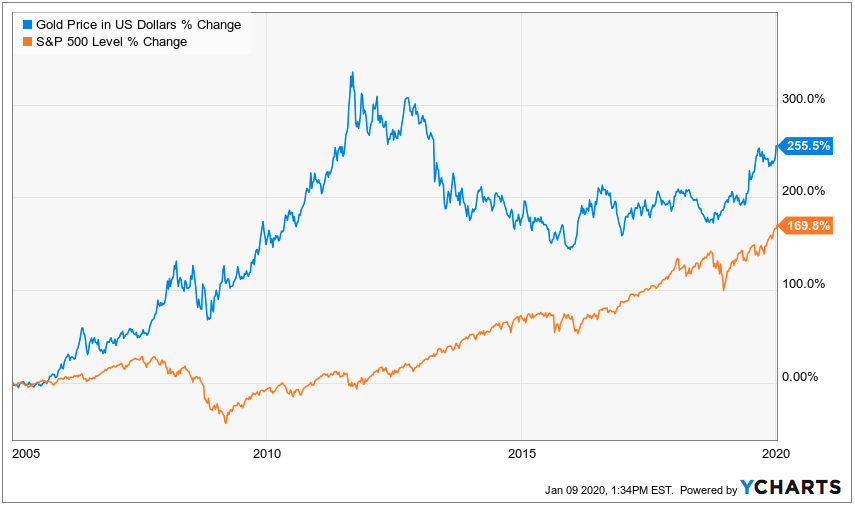

Gold has outperformed the S&P 500 over the last 15 years by a wide margin.

As you can see above, that’s largely because the price of an ounce of gold surged to record highs amidst the fear and uncertainty of the Great Recession, while the S&P 500 — like all the other major equity indexes — sank.

This is just one example of how physical gold holds — and even gains — value during crises. History provides many more.

Refugees fleeing southern Vietnam at the end of the country’s civil war used gold bars to pay smugglers for safe passage to China and elsewhere. Argentineans have used it for decades as an emergency transaction medium during the country’s many currency crises. And Venezuelans are hoarding gold today as law and order breaks down in the hyperinflation-afflicted country.

If you’re aiming for readiness in the event of a crisis, physical gold is a better choice than gold certificates, equities, or funds because it’s physically in your possession and is completely removed from the banking system (which would likely restrict access to assets like gold stocks in the event of a catastrophe like the ones described above).

Con: Storage & Security Expenses

Of course, physical possession comes with its disadvantages as well as its advantages.

Physical gold owners have to mitigate the risk of theft by keeping their gold in a secure place, like a safe or a bank deposit box. Those security measures cost money — and thus they effectively reduce physical gold’s returns as an investment.

And while gold doesn’t tarnish, it can be scratched, dented, or dulled if it isn’t treated properly.

Physical gold owners often spend time, money, or both cleaning and maintaining their collections — and these are additional expenses that investors must take into account.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We”ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “A Maverick’s Guide to Gold: 3 Gold Stocks Set to Disrupt the Market”

It contains full details on something incredibly important that’s unfolding and affecting how gold is classified as an investment..

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

Pro: No Counterparty Risk

When you buy stocks from a broker, shares of a mutual fund from a custodian, or even certificates of deposit from a bank, you are trusting a financial institution to not lose or steal your money — and to dutifully give it back to you when you request it.

In finance, the risk of an institution failing to honor its obligations in a transaction is called counterparty risk, and physical gold is one of a few assets that pose no counterparty risk.

Counterparty risk might sound like a doomsday-prepper-ish thing to worry about, but it has been a pertinent concern for American investors in the not-so-distant past.

In the early days of the Great Recession, as banks like Washington Mutual, Bear Stearns, and IndyMac rapidly failed, depositors were unable to access assets at these banks, and some were never able to recoup all of their holdings.

After all, the Federal Deposit Insurance Corporation (FDIC) only insures up to $250,000 per account, and FDIC claims can take weeks to process. Physical gold ownership can help investors avoid these headaches during a bank failure.

Con: Premiums and Discounts

Of course, by eliminating the counterparty risk posed by financial institutions, physical gold owners also lose the liquidity offered by financial institutions.

Physical gold can be hard to buy and sell on a whim, and doing so can involve additional expenses like shipping and inspection.

As a result of these expenses, physical gold investors often find themselves buying gold at a premium and selling it at a discount in order to compensate dealers, inspectors, and other industry staff for their work.

The Takeaway

In summary, it’s hard to think of a better-performing asset in times of political or financial crisis than physical gold. But stashes of the yellow metal also suffer from disadvantages like storage and transaction costs.

Investors who are looking for an easier way to protect themselves in the event of a crisis should check out Bull and Bust Report.

Editor Christian DeHaemer has been tracking a set of companies that could help you prepare, protect your money, and even profit during the coming downturn. Read more here.

Until next time,

![]()

Samuel Taube

Samuel Taube brings years of experience researching ETFs, cryptocurrencies, muni bonds, value stocks, and more to Wealth Daily. He has been writing for investment newsletters since 2013 and has penned articles accurately predicting financial market reactions to Brexit, the election of Donald Trump, and more. Samuel holds a degree in economics from the University of Maryland, and his investment approach focuses on finding undervalued assets at every point in the business cycle and then reaping big returns when they recover. To learn more about Samuel, click here.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.