Here at Wealth Daily and our sister site, Energy and Capital, our goal is to help you make the right financial decisions.

Sometimes that means telling you to avoid a certain stock or sector. Sometimes it means telling you to go all-in.

Today is one of those all-in articles…

When Wireless Isn’t Really Wireless

You’ve likely heard talk recently about the growing 5G wireless network. If you’ve been reading my articles, you’ve heard a lot about it and the profits it will deliver shrewd investors.

You’ve heard how it’s going to completely change the way we live. It will allow for connected cities that are more accessible for those of us with physical handicaps. It will create smart homes that adjust temperature and lighting while you’re on your way home and even pour you a glass of wine if they detect you’re feeling a little stressed from work. It will allow virtual reality and augmented reality to blend seamlessly with the real world.

It will be amazing once this new wireless network is up and running!

But there’s one problem… It’s not really wireless at all.

You see, in order to store all the data that all those new connected devices will create, you have to have a physical connection to storage facilities.

And these facilities, also known as server farms, are only linked to the outside world with one kind of connection. It’s the only one that can handle speeds fast enough to keep up with 5G.

And it’s called fiber optic cable. So the network may be “wireless” but it’s not “cable-less.” And without these cables, 5G networks cannot and will not ever exist.

But investors aren’t paying attention to that fact right now. They’re just looking at who’s going to be the winner of the 5G race or who’s going to hang the antenna from their towers.

That creates an opportunity for investors who know what the real backbone of the 5G network is. And I’ve got a list of fiber optic companies helping create that backbone that are all trading for less than $10.

But before I get to those, let’s talk a little bit about what fiber optics are and why they’re so critical for the 5G network.

When Wires Aren’t Really Wires

Fiber optic cables are cables made from a bundle of optical fibers. Optical fibers are flexible, transparent strands made by pulling glass or plastic to a diameter slightly bigger than that of a human hair.

They’re called optical fibers because they’re used to transmit light from one end of the cable to the other. If you’ve ever had a doctor look inside you with a scope, those images that came up on the display screen were transmitted over optical fibers.

That’s a very important role fiber optics plays. But it’s not the only one. You see, fiber optics are widely used in communications because they allow transmission over long distances at higher bandwidths.

If you were to put that into wireless terms, they’re like a combination of 4G (that can travel long distances) and 5G (that can handle high bandwidths).

The 5G network will be a combination network of sorts. It’ll have 4G capabilities to send signals through buildings and over long distances. And it’ll have 5G capabilities to handle tons of data.

But the only way to get those data into server farms (and access them again quickly) is for the wireless network to be wired into the servers with fiber optics (which aren’t really wires at all).

So you’re starting to see why fiber optic cables are so critical to the deployment of 5G across the globe.

Without those physical connections to the storage centers, there’s no efficient way to store the data and no easy way to access them when we need them.

And investors are starting to catch on as they search for the best fiber optics stocks to play this long-term trend.

But most of the easy-to-find fiber optic stocks are already trading close to $100 a share. And the big gains aren’t coming from incumbents in this new industry.

If you want the really massive profits from fiber optics, you’ve got to dig a little deeper to find companies that haven’t already been bid through the roof.

Fortunately for you, I love digging deeper into investments. And I’ve found several fiber optics stocks that are still trading under $10 but likely won’t stay there long.

So now that you’ve got a better grasp of what it is and why it’s so important, let’s talk about the companies that could turn a small investment into a relative fortune.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. When you become a member today, you’ll get our latest free report: “The Nvidia Killer: Unlocking the $100 Trillion AI Boom.”

It contains the most promising AI companies and sectors poised for explosive growth. Our team of expert analysts has conducted thorough market research to uncover a hidden gem currently trading at just $2.

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

Three Fiber Optics Stocks Under $10

First on my list is Optical Cable Corporation (NASDAQ: OCC). This Roanoke, Virginia-based company manufactures the cables that will connect the 5G wireless network to the real world. The company’s cable is used mainly for telecommunications and is sold in the U.S. and 70 other countries worldwide. Plus, OCC has a deal to make military-grade tactical fiber optic cable for the U.S. military.

And its shares trade for around $2.50 right now. But earlier this year, they were changing hands for as much as $3.60. And they’ve been as high as $6 in recent history. As investors look for companies likely to ride the fiber optic wave created by 5G, these shares could easily hit their old heights and score investors a 50%–150% gain.

Next up is NeoPhotonics Corporation (NYSE: NPTN). Founded in 1996, NeoPhotonics makes and sells optoelectronic products that transmit, receive, and switch high-speed digital optical signals for communications networks. So we’re talking about the circuits, transceivers, and semiconductors needed to send and receive data over fiber optics networks.

The company’s been growing revenues since 2018 and is currently bringing in about what it was when shares were worth $18. Those shares are currently trading right around $5. But they’ve got the potential to jump to $10 in just a matter of weeks. That could score investors a quick double. And then you’d be set up to watch the shares slowly grow to all-time highs as the 5G network expands and NeoPhotonics’ devices become even more in demand.

My third fiber optic stock under $10 is a little bit of a stretch. When I was planning this article, it was trading around $9. It’s come up some in the few days since, however, and is now sitting right at $10. But it’s a really good one and it’s got the potential to deliver a 50% gain in just a couple of weeks.

I’m talking about Applied Optoelectronics Inc. (NASDAQ: AAOI). Initially this wouldn’t have made the list, but shares got whacked in the tech selling that hit the market at the start of the month and dropped back below $10. That’s after running up nearly 200% over the last six months.

AAOI is a leading provider of fiber optic networking products for internet data, cable television, fiber to the home, and telecommunications. The company makes a range of communications products at varying levels from components to ready-to-run equipment.

Shares have been as high as $100 in the past and could get back up there given some time and the right catalysts. But even a run back up to last month’s levels of $15 would score investors a 50% gain from current levels.

Bonus: The BEST Fiber Optic Stock Under $10

So there you have my three top fiber optics stocks under $10. However, there’s one more out there that doesn’t make fiber optics but is potentially more likely to rally thanks to interest in this industry.

Instead of making the components of the fiber optics networks and hoping companies opt for its products, this company spent the last five years building the nation’s largest fiber optic cable network.

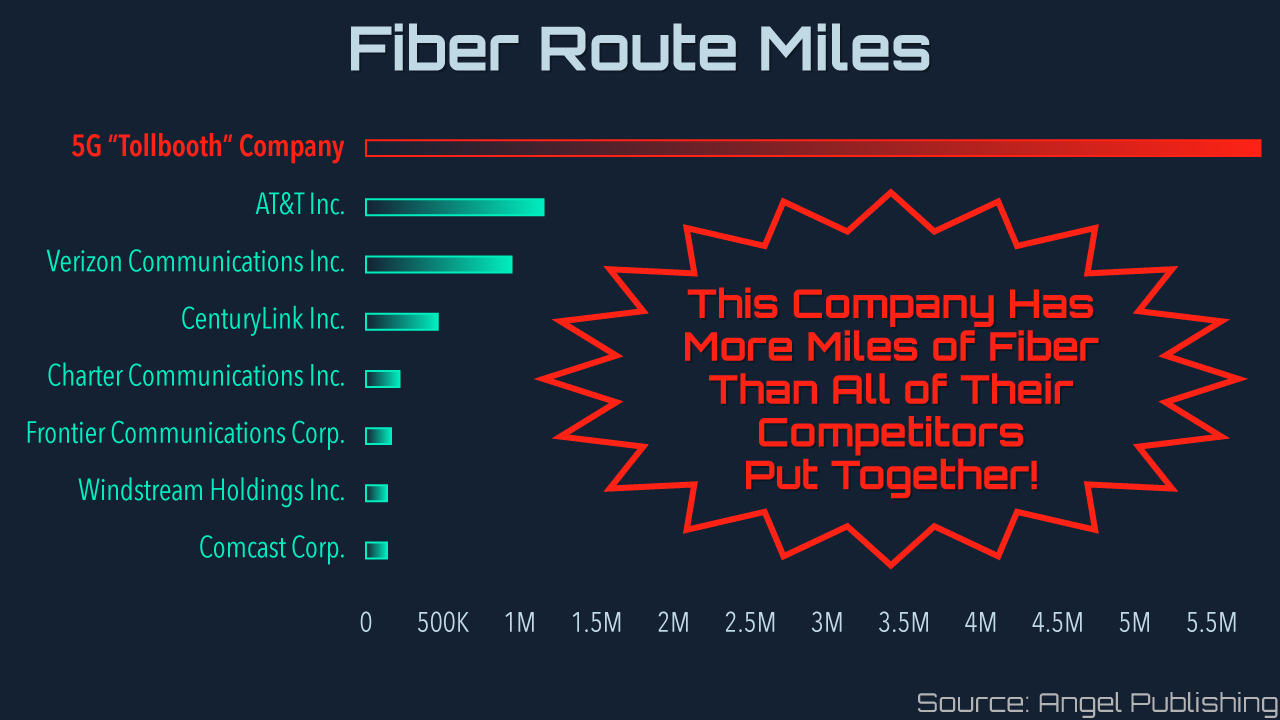

It’s got more of this critical asset than all of the telecommunications companies (Verizon, AT&T, and T-Mobile) have combined. It’s even got more than them plus the top cable providers in the country.

And it’s giving companies access to that network for a small fee (kind of like a tollbooth to get off the back roads and onto the highway).

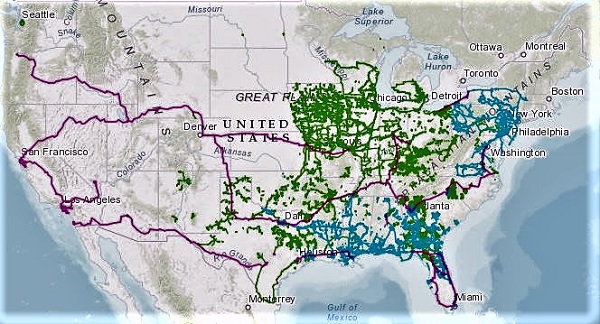

So it should be no surprise that the only cities with true 5G access are ones on this company’s network. It’s a pretty powerful visual to see the network:

And then see the U.S. cities with 5G:

Every single city that has 5G access is also on this company’s network. That’s why all the wireless carriers already have contracts in place with this company. And that’s why even the U.S. government has inked multimillion-dollar deals, too.

This company owns the one asset that is 100% critical to successful 5G deployment. And it’s got more of it than any other company out there.

Investors haven’t caught on yet, however. And the share price is sitting right around $10 as I type this article. But that’s not going to last. Just a few weeks back, you could have picked them up for only $5. And you’d already be up nearly 100%.

But the rally is far from over. This stock could easily double again in the coming months. And by the time all is said and done and our nationwide 5G network is up and running, we’re talking about a stock that could be worth $68 or more.

Get Paid to Get Profits

Plus, in order to get special treatment from the government, the company has agreed to share nearly all of its fiber optics profits with investors. So not only will you have shares that could easily double, triple, or even give you a 10x return, but you’ll also get paid to watch them run up the charts.

I can’t think of a better deal than future profits plus guaranteed income. That’s why I’m so adamant that everyone reading this gets a stake in this stock.

And that’s why my partner and I put together a presentation explaining the opportunity, laying out all the details of the company and showing how and why it’s going to lead the pack.

You can get access to that presentation by clicking this link.

It’s very informative and I highly suggest you take a few minutes from your day (or weekend) to give it a view. Once you’re done, you’ll be all set to capture massive profits and collect steady income from this fiber optics toll collector.

But if you prefer to digest your information in the written form, I’ve got something for you too. We also created a report that includes all the same details as the presentation.

You can read that by clicking this link.

The Need for Speed

Whether you watch the video or read the report, I implore you to get the information as soon as possible. This stock is way too cheap considering the value of the assets it controls.

And that low price isn’t going to last. So you need to act quickly. In this race, it’s the speedy hare that comes out on top, not the slow and steady tortoise.

The next time I write to you, the stock could be trading at $15 already. Or $20. Or $25 as it shoots up the charts toward $68 or more.

So end this week by taking some time to learn how to get involved. And then you can start next week by watching your profits begin to add up.

You can get all the information you need to get started here.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube