In case you haven’t been paying attention, you should know that African oil explorers are on the move.

Here is one we own in Crisis & Opportunity that goes by the name of Cove Energy:

Since September 2011, the stock has more than doubled.

Time to Buy the Wildcatters

The stretch of ocean between East Africa and Madagascar, called the Mozambique Channel, is one of the five places on earth that hasn’t been adequately explored for oil.

It might have something to do with the fact that the Mozambique flag has an AK47 on it…

But that’s old school stuff.

Communist revolutionaries are now hard-core capitalists.

Mozambique’s economy grew at 6.7% last quarter and will grow around 7% in 2012.

The currency, the metical, gained 19% against the dollar this year and was the second best performer in the world.

Mozambique — and Africa in general — produces a great deal of resources, from oil to magnetite.

Africa is the last continent that produces more hard commodities than it consumes.

And as East Africa is closer to booming markets such as India and China, it is long-forgotten East Africa that is receiving the lion’s share of foreign direct investment.

Biggest Find in a Decade

Andarko Petroleum (APC), the $40 billion dollar Texas oil company, recently found between 15 and 30 trillion cubic feet of recoverable gas in the Mozambique Channel.

That’s a lot. It’s more than BP’s proved reserves.

It might be the biggest gas field found in the last decade.

Andarko’s stock is up about 15% since it found this massive energy source. That’s a nice return, don’t get me wrong; I’ll take it.

But Cove Energy, which has the adjacent license, has more than doubled.

And that’s because Andarko is a massive company with its fingers in many pots. One gas find — even a huge one — won’t move its stock very much.

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “Investing in Rare Earth Stocks.”

It contains full details on how you should be investing in rare earths.

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

That’s why you buy the pure plays.

A few months ago, Cove Energy was a $500 million company.

It was a small energy exploration company — the type of company known in the business as “a wildcatter.”

This type of company takes risks and finds hydrocarbons. It goes where the big dogs fear to tread. It gets there first with the most.

There are a number of these companies around, and I just love them — companies like Kodiak, which is up more than 500% in the last two years…

Or Cheniere Energy (LNG), which makes natural gas infrastructure and is up about 600% in the same time frame.

Sure, it’s a volatile sector. Wildcatters are leveraged up to the price of oil.

But if you haven’t noticed, oil is now holding steady above $100 a barrel. And because everyone is afraid of the next global economic disaster, these stocks are undervalued.

Imagine what would happen if the economy starts to improve…

The motto of my trading service Crisis & Opportunity is “Buy fear and sell greed.”

Right now, the global investment community is in transition, switching from the psychology of fear due to the great recession to one of increased risk-taking.

Investors are looking at their bonds, which are returning yields well below the rate of inflation, and thinking:

What happens when people start hiring again?

What happens if we go to war with Iran?

What happens if Libya, Iraq, and Nigeria descend into petroleum-destroying civil wars?

There are any number of supply-and-demand scenarios that could put oil back at an all-time high.

Lundin Companies

I’ve found one small wildcatter that owns a great deal of oil properties in East Africa.

This stock is starting to move — and is up $0.50 in the past few months to $1.70…

And the best part is that it is in partnership with The Lundin Group.

If you don’t know The Lundin Group, you should. They have the best track record of any investment capitalist I know off.

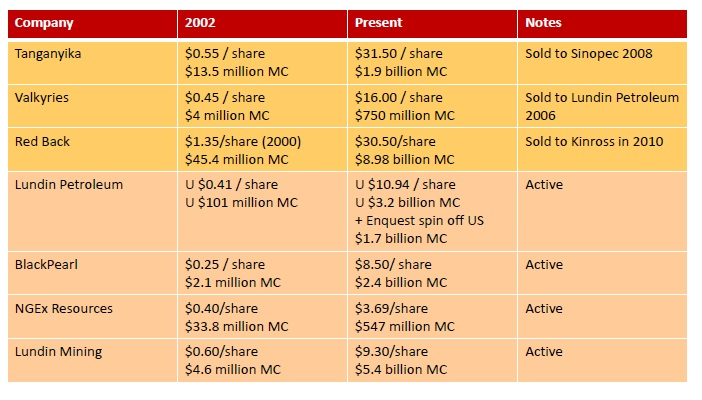

Check out the deals they’ve done over the past nine years: Out of seven companies, The Lundin Group is averaging returns in excess of 10,600% over a nine-year period. Those are facts.

Out of seven companies, The Lundin Group is averaging returns in excess of 10,600% over a nine-year period. Those are facts.

A $852 investment in 2002 would be worth $1 million today.

It is no wonder the Lundin name is spoken with whispered awe in the oil and mining community…

The Lundin Group is now going full force in East Africa.

As I mentioned above, the way to get the most returns is to buy the small “pure play.”

To get complete articles and information, join our newsletter for FREE!

Plus receive our new free report,Options Made Easy

Wealth Daily Members Receive:

Daily commentary and advice from financial market experts.

Access to some of the best gold, silver, and option stock picks around.

Foresight designed to help you stay on top of the market.

All the best,

Christian DeHaemer

Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.