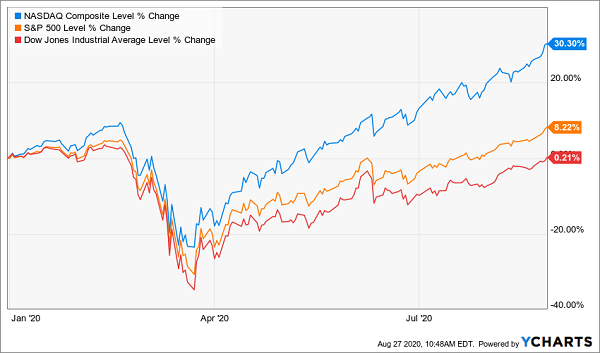

The markets are up! The Nasdaq is up over 30% YTD. The S&P 500 is up nearly 10%. And the slow-moving Dow just popped back up into positive territory for the year.

Calculating from the mid-March lows, those figures get even more impressive looking with the Nasdaq up 71%, the S&P up 56%, and the Dow up 54%.

If you were just looking at the indexes, you’d think we were pretty much recovered from the economic turmoil that sent us into a new recession and bear market.

But if you dig down into the actual stocks that make up those indexes and see which ones have been pulling the whole barge up the river, you start to wonder if we’re really recovering at all…

Tugboat Stocks

The Dow is the most referenced index in the world. And at one time, it was a pretty good representation of the U.S. economy. But that was back when there were only a handful of major public companies.

Now there are thousands of public companies in the States. And those 30 stocks in the Dow just don’t really paint a clear picture. So let’s look at the S&P 500 since it’s made up of 500 U.S. companies of varying sizes instead of just 30 massive ones.

When you look at the S&P 500 and see which stocks are outperforming, you see they’re almost all technology stocks of some sort. Financial tech, medical tech, biotech, education tech, etc.

Tech stocks are acting like a tugboat on a canal and moving the whole index up with them.

But those are stocks that benefit from coronavirus and the lockdowns it’s induced across the country.

And you start to think, The market isn’t betting on a full economic recovery at all. It’s betting that this stuff sticks around for a while.

If the market were really betting on an economic recovery, you’d see real estate outperforming. You’d see travel stocks getting attention. You’d see the airlines start to come back up from the depths.

But you’re not seeing that, are you? And that’s because the stock market is a “discounting mechanism.” I’ve explained before what discounting means, but I’ll give you a quick refresher now.

When the market discounts something, it’s not lowering the price and putting it on sale. But that’s what most people think when they hear the word “discount.” When investors discount, they’re taking into account potential future events and pricing them into the stock.

So if the market is pricing all these stay-at-home stocks and fight-the-virus stocks really high now, it means the market thinks those companies are going to keep seeing a lot of business in the near future.

And if those businesses are going to get a lot more business, that suggests we’re going to be dealing with this virus for a while. And we’ll be dealing with the economic consequences of rolling lockdowns for a while, too.

What’s an Investor to Do?

With those tech stocks up so high right now, it feels a lot like we’re in a bubble. And you know what happens to people who buy at the top of a bubble… They get wiped out and never want to invest again.

But those stocks have looked like they’re in a bubble for over a month now. And they’re still heading higher on the back of easy monetary policy from the Fed.

And that breeds FOMO (fear of missing out) in retail investors and FOMU (fear of meaningfully underperforming) in asset managers.

Retail investors worry they’re missing out on the rally and get off the sidelines to buy in. That influx of new money sends the stocks higher.

And asset managers who think valuations are stretched and that there’s a disconnect between the market and the economic reality worry they’ll lose their customers or jobs if they don’t get in on the rally, which they think is pure insanity.

But as they pile into the stocks that are going up, they send them even higher with that fresh capital and stay behind the guys (general term) who’ve been buying since March.

So you can’t really sit it out because there’s this “wall of worry” the markets are climbing. And there’s no way to tell when we’ve gotten to the top of that wall.

So you buy. And if you listen to the talking heads on TV and the financial media, you buy the stocks that have been going up. Because that’s what they tell you to buy.

I’m not even kidding. I saw a headline this morning from a typically reputable source that read, “Tech Stocks Rated Top Buy This Month.”

Really?! Wow! Did you need an advanced degree from Harvard Business School to figure that one out?

Probably not. And while I don’t have a degree from Harvard, I have done some post-graduate work there. But I don’t even need that to tell you this:

Buying into the stocks everyone else is buying is not how you make massive profits.

Yes, you’ll probably catch a wave of gains as the bubble approaches its bursting point. But eventually you’re going to get caught in the correction as those assets fall from favor and new ones replace them.

Where’s the Next Big Gain Coming From?

That’s the question you need to ask yourself. Where am I going to find the next stocks that get sucked into a frenzy of hype and headlines?

Well, you’re already on your way with your subscription to Wealth Daily. It’s one of the ONLY places where you can find unbiased opinions on the economy. And it’s probably the only news source that’s got your best interests at heart.

That’s why you hear about incredible stocks here before the mainstream financial press starts talking about them. Because our goal here is to give you the best opportunities to make extra income, bring home massive profits, and take control of your own future.

It’s not to get more viewers or convince advertisers to pay us millions to run their commercials. It’s to help you. Plain and simple.

That’s why you’ve heard about stocks like Alkaline Water Company (NASDAQ: WTER) here before anyone else even knew about them. And that’s why you had a chance to ride those shares up from around $0.40 to nearly $2.50.

If you’d taken my advice back then, you could have turned $10,000 into a new Range Rover.

Being a Wealth Daily member also got you access to “Prime Profits” payouts. It’s why you’re one of the few investors outside super-wealthy circles to have the opportunity to collect these massive cash payouts from Amazon without ever owning shares of its stock.

Where else are you going to learn about programs like “Prime Profits?” Nowhere, that’s where.

Speaking of those massive payouts, the next one is coming in mid-September and you’re still eligible to collect a share. The total amount has yet to be announced, but my conservative estimate puts this one at about $428.5 MILLION.

You can learn how to get set up to collect part of the next massive “Prime Profits” payment by watching this presentation (or reading this report).

Payments will be calculated by September 14 and if you’re late, you’ll have to wait for the next round. So if you’re not set up to get them yet, I urge you to take a few minutes today (or over the weekend) to register.

Those are just two of the incredible opportunities for massive profits and enormous income you’ve gotten thanks to your membership to Wealth Daily.

And today, I’ve got another for you…

“It’s a Big Club and You Ain’t In It”

These days, I really miss people like George Carlin. He wasn’t afraid to tell the truth. He wasn’t afraid to say what people needed to hear. And he wasn’t afraid to call it like he saw it.

But I can’t imagine a comedian like George Carlin could make much of a career in today’s “woke” world. I mean, I’m pretty sure we #canceled a sense of humor a few years back. But I digress.

Carlin had a bit about how messed up the world was. And he said it was never getting any better because the world was a big club made of super-wealthy businesspeople and you weren’t a member.

And he was right about a lot of what he said. Politicians are bought and paid for. They exist so we think we’ve got some power. But they make decisions that benefit their wealthy friends who keep their bank accounts flush with “contributions.”

And for years, they, the politicians, were the gatekeepers for the elite. They made sure the elite stayed elite and did everything they could to keep anyone else from joining the club.

In the past, the most profitable investments were off-limits to 99% of the population. I’m talking about investments in private companies.

You had to be incredibly well-connected to even find out about them. And you had to be super-wealthy to participate. Part of that was because the minimums for individual investments were in the hundreds of thousands of dollars.

But the other part was because there was a law that literally forbade anyone with less than $1 million in cash from investing in private companies. If you weren’t already rich, the only legal way you could invest was if your family started the company.

And that cut 99% of the investing world out of the most lucrative investments in history. I’m talking about the early investors who funded eBay while it was private who made a 105,000% gain when their shares went public. And the early investors who helped LinkedIn grow into a public company. They walked away with 261,000% profits.

That’s compared with 336% for LinkedIn’s public shareholders and 872% for eBay’s public stock investors.

And I’m talking about the Airbnb investors who’ll exit with at least a 799,990% gain when the company lists in the next few months.

And I’m talking about the folks who funded Amazon while it was still based in a garage with a cardboard sign made with Sharpies. Those investors made a whopping 13,999,900% profit on their shares. And if they’re still holding them now, they’ve made even more.

The numbers aren’t even comparable. Private investors take home the lion’s share of the profits, even on super-successful public investments like Amazon.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”

It contains full details on why dividends are an amazing tool for growing your wealth.

Power Profit to the People

But that’s all changed thanks to landmark legislation that recently passed Congress. And now the profits can go to the people because everyone can invest in this incredibly profitable market.

The legislation is called HR 3606 and it’s opened up the private markets to anyone who’s 18 years of age or older. It effectively removes the limits that kept anyone but millionaires from investing.

And on top of that, it’s helped reduce the minimum investments to something the other 99% of us can actually afford. Thanks to HR 3606, even if you’ve only got $100 to your name, you can still invest in the private markets.

That’s opened up the VIP room of the stock market to the rest of us. And it’s opened up a tidal wave of potential profits for retail investors at the same time.

Now you can invest in the next eBay before it goes public. And you can capture those massive gains when the next LinkedIn gets sold to a bigger firm like Microsoft.

Most importantly, you can capture the astronomical gains Amazon’s early investors got and turn a $100 initial investment into a $14 MILLION fortune.

But with the potential for massive rewards comes risk. Lots of startups never make the big time. And of those that do, only a handful really take off like Amazon or Airbnb did.

But there’s more risk than just the companies failing. There’s the risk that you’re investing in a scam. These companies don’t have to report to the SEC because they’re still private.

And there are a lot of folks out there who don’t mind running a scheme to get themselves richer while putting others in the poorhouse.

So unless you’ve already got experience in the private markets, you’re likely to get hoodwinked by one of these scammers.

And that’s where the opportunity I mentioned so many lines before comes into play.

Main Street > Wall Street

I’ve got that experience. And I can sniff out a scam from a mile away (maybe even farther).

And I want to help you find the best private investments with the biggest potential to deliver you 10x, 100x, even 1,000x returns.

So I’ve founded an entirely new kind of investment advisory service that focuses entirely on these private opportunities open to all investors.

I comb through the financial statements and perform my own audits of the company’s numbers. I read through all the official filings and documents to really understand who owns what and which companies still have room for new investors to profit.

And I steer my readers away from the scammers out there trying to take advantage of inexperienced investors.

We’ve already helped fund four private companies in just the past few months. And we’re about to see our first one list in an IPO.

But we’re not even close to finished. In fact, we’re just getting started.

So before we get too many more lucrative private deals under our belts, I want to offer you a seat at the table, too. I want you to join me and the founding members of Main Street Ventures.

Because I’m so adamant that the retail world gets in on these private opportunities, I’ve made it as easy as possible to get started.

As a member, you’ll get access to all the deals I approve as soon as they’re open for investment. But you’ll also get a crash course in private investing — how to buy, how to sell, how to allocate, how to find your own deals.

And I’ll walk you through every deal we make with how-to videos on setting up accounts and making investments in private companies. Plus, you get access to our VIP members-only website and customer service team.

I’ve spent countless hours getting the website set up so that all the information you need to get started is right at your fingertips. And I’ve spent even more time working with my customer service team to make sure they’re able to answer any other questions you might have.

And of course, you get access to me. If there’s ever an issue, concern or question that our VIP team can’t help you with (it happens once in a while), they’ll put you directly in touch with me so I can talk you through whatever’s going on.

I really want you to be able to take advantage of this market. And I want to help make sure you’re not a victim of the unscrupulous folks out there trying to steal your money.

However, because of the nature of these deals (there’s limited availability when you’re investing in private stock), I can only accept so many investors. Otherwise the deals would fill too quickly for everyone to get a piece of the action.

I’ve got a few spots still open. And I want you to get one of them.

So I urge you to watch this presentation that better explains the markets, the opportunities, and how you can get started today.

Or if you prefer to read more about private investing and the massive rewards that can be had, you can access a report that contains all the same information as the presentation.

It really doesn’t matter to me how you get the information. I just care that you get it.

And I care that you get it before our next lucrative private investment closes and your opportunity for a 1,000x private gain closes with it.

So take a few minutes to watch my presentation or read my report. And then join me and the others who are already profiting from this lucrative corner of the investing world.

I can’t wait to see you on the other side.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube