Behold... The Armageddon Chart

Dear Reader,

Want to see an image that predicts financial and industrial collapse on a global scale?

Here it is:

What you’re looking at is a chart of lithium demand compared with lithium supply.

It’s as basic as it gets and illustrates a problem unlike any other the world has faced in modern history.

Now, this chart comes with a companion, which you can see below:

This graphic, tracking the price of lithium over the past decade or so, is the direct result of the first chart and proof that this catastrophe is already underway.

Now, to add some color to this theory, let me draw a parallel from recent history.

Since the turn of the 20th century, some of the biggest armed conflicts and some of our farthest-reaching policies have been guided by the quest for oil in one way or another.

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

Lithium Is More Than Just Oil 2.0

Oil is the reason behind all of our excursions into the Middle East. Oil is the reason Japan attacked Pearl Harbor, which plunged the U.S. into World War II.

Oil is a major part of why the USSR and Germany ended up on opposing sides of that same war.

Oil is why Iran and Iraq spent eight years destroying one another.

Oil and gas are why Russia remains a global power and not a largely irrelevant dusty backwater.

Any way you look at it, control over fossil fuels is behind just about every global alliance and conflict right up into today.

Because oil is what drives the modern world, it is therefore also the most important strategic resource known to man.

Today, lithium is replacing oil as the world's premier energy storage medium, but unlike oil, which provides the energy that motivates our heavy machinery, lithium drives absolutely everything.

And not just cars, buses, trains, and ships. Lithium drives our personal wireless devices — all 16 or so billion of them, as of this year.

It drives the tiniest machines, which we keep in our pockets, and now it drives the biggest machines as well.

Lithium's importance is universal. So much so that the comparison to fossil fuels is woefully deficient in expressing its importance.

In the next decade, as demand continues to skyrocket on the heels of the electric vehicle revolution, we’re going to be stuck in an ever-expanding deficit.

An Addiction That's Just Starting

We need more of it. I can’t put it much more plainly than that.

We need a lot more of it, but with current production methods, it simply isn’t there.

Lithium takes too long to locate, too long to mine, and too long to process.

Even if an energy company were to find the world’s biggest lithium resource today, it would be at least five years or so before battery-grade lithium would leave their facilities.

Which means we need a solution that’s no less revolutionary than the global lithium changeover itself.

Whoever finds such a solution and is able to deliver millions of tons of lithium to end users faster and more efficiently, is going to rake in untold wealth.

In the process, the balance of power will shift — the same way it did when the nations of OPEC took the reins of the oil market in the mid-20th century.

Right now, this exact course of events is quietly unfolding in northwestern Alberta.

A small Canadian technology company has found a way to extract lithium from the unlikeliest of sources: Oil field brine ponds.

You read that right. Lithium, the world’s answer to fossil fuels, sits dissolved in hundreds of brine pools that for the last 40 years have been used to pull oil and gas from deep within the earth.

It Was There All Along…

There’s a lot of it. More than 4.3 million tons — enough to satisfy global demand for the next three years all by itself.

This company, which, unsurprisingly, was founded by a group of petrochemical experts, has figured out an ingenious method of filtering that brine at a 97% efficiency.

There is no exploration required.

We know where it is and how much there is.

No mining is necessary.

In the space of two months, the brine solution can be processed and returned to the brine ponds for continued use, while the lithium — some of the cleanest there is — is ready to ship to corporate clients for final implementation.

That’s up to 10 times faster than traditional extraction methods.

This method is so innovative and so revolutionary that end users — I’m talking about major electric vehicle-makers whose thirst for the metal is the primary driver of the market — are already making inquiries.

And yet this company, which is just a couple years old, is currently trading at a paltry $20 million market cap.

Now, with a valuation that tiny, you would expect this firm to be at the very beginning stages of its work, but that’s not the case here.

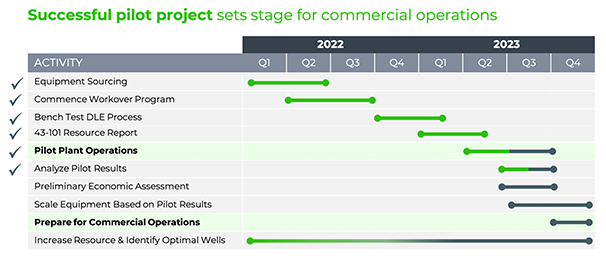

This company already has the tech ironed out and has a pilot plant ready to go. It expects to be in commercial production by the middle of next year.

That means that just 12 months from now, it could be processing at a rate of 1,000 tons per year, ramping up to 20,000 tons/year in short order.

The Most Undervalued Stock Trading Today?

What would this do to the market capitalization?

Well, at a production cost of between $3,000 and $4,000 per ton and a market price of over $70,000 per ton, a production rate of 1,000 tons per year should take the company's market cap from $20 million to around $220 million — a 1,000% gain for just this first stage of commercialization.

At 20,000 tons, we’re talking closer to $1.4 billion in annual revenue, with a valuation exceeding $4 billion.

In all, the lithium on this one single property is worth close to $320 billion based on today’s market prices, but chances are this company will never get anywhere near harvesting the entirety of the resources.

A massive buyout by a major energy company like Exxon or BP is far more likely.

I made a major bet on this firm’s future in my own portfolio.

Today, I’m giving you the opportunity to see all of my research so you can weigh the possibilities yourself.

This could be the fastest-moving stock I’ve ever come across, so I urge you not to wait.

All of the info you need is right here. Access is free to our Wealth Daily readers and you can see it all instantaneously.

Fortune favors the bold, Alex Koyfman His flagship service, Microcap Insider, provides market-beating insights into some of the fastest moving, highest profit-potential companies available for public trading on the U.S. and Canadian exchanges. With more than 5 years of track record to back it up, Microcap Insider is the choice for the growth-minded investor. Alex contributes his thoughts and insights regularly to Energy and Capital. To learn more about Alex, click here.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.