Some of the best lumber stocks to buy now are expected to grow in the long term, driven by factors such as the increasing demand for new housing and the growing popularity of wood-frame construction.

5 Best Lumber Stocks of 2023

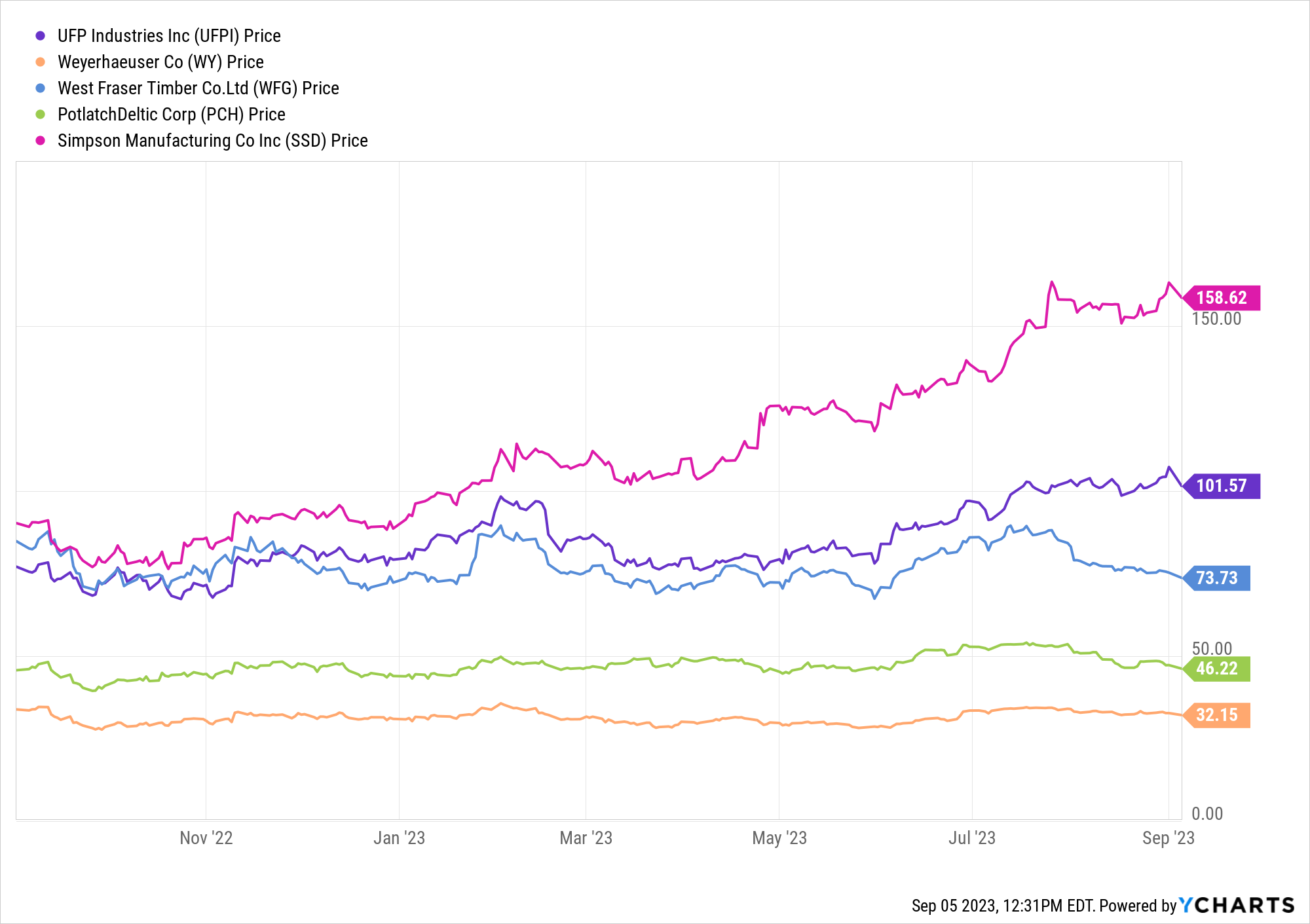

- UFP Industries (NASDAQ: UFPI)

- Weyerhaeuser (NYSE: WY)

- West Fraser Timber (NYSE: WFG)

- PotlatchDeltic (NASDAQ: PCH)

- Simpson Manufacturing (NYSE: SSD)

[QUIZ] 46 BILLION Barrels of Oil?! A massive $5.9 trillion oil boom is about to take place. Three tiny companies just acquired the rights to mine an untapped patch holding 46 billion barrels of oil in a mystery location… And it even has the potential to reach $9 trillion in value if prices reach $200 per barrel! So which country do you think will lead this upcoming oil surge? Think you know the answer? See if you’re right!

Is Lumber A Good Investment Right Now?

Traditionally, the fall is not the best time to invest in lumber stocks. The price of lumber tends to fall starting around Labor Day and reaches its bottom around Thanksgiving. As with any seasonal investment, you might consider reevaluating lumber stocks in the winter of 2023.

It is important to note that historical data and does not guarantee future performance. The price of lumber can fluctuate significantly, and you should always do your own research before making any investment decisions.

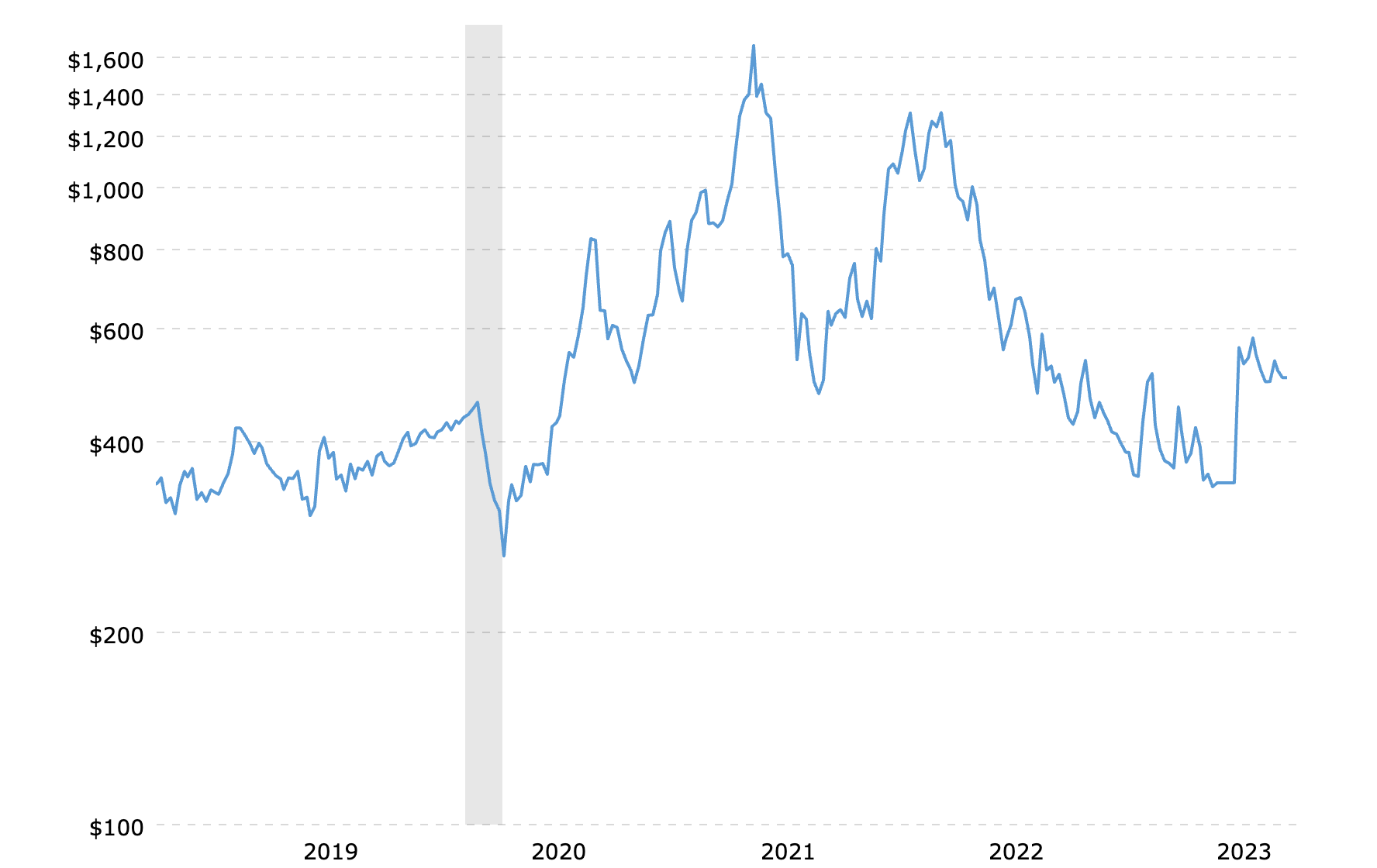

As you can see, the price of lumber has been volatile over the past two years. The price has peaked around $1,700 per thousand board feet in May 2021, but dropped all the way below $350 in July of 2023.

How To Buy Lumber On The Stock Market

When choosing lumber stocks, it is important to do your own research. Consider factors such as the company’s financial strength, growth prospects, and valuation. Investors should remember that the lumber market is cyclical and that there are some risks associated with investing in lumber stocks.

However, the long-term outlook for the lumber market is positive. These stocks could be good investments for investors who are looking to capitalize on the growth of the industry.

Here are some additional factors to consider when choosing lumber stocks:

- Timberland base: A company with a large timberland base is better positioned to weather fluctuations in the lumber market.

- Production capacity: A company with a large production capacity can meet the growing demand for lumber.

- Financial strength: A company with strong financials is better able to weather any challenges that may arise in the lumber market.

- Growth prospects: A company with good growth prospects is more likely to see its stock price appreciate in the long term.

Here are Five of the Best Lumber Stocks to Buy in 2023:

1. UFP Industries (NASDAQ: UFPI)

UFP Industries stands out as a prominent manufacturer of wood products. Their extensive portfolio includes lumber, plywood, and oriented strand board (OSB). With a history of consistent profitability, the company has established itself as a leader in the industry. Its robust financial performance is bolstered by its strategic positioning to capitalize on the enduring demand for lumber. As construction and infrastructure projects continue to thrive, UFP Industries remains a key contributor to the supply chain, providing essential building materials that fuel growth and development.

2. Weyerhaeuser (NYSE: WY)

Weyerhaeuser, a major player in the forest products sector, excels in the production of lumber, pulp, and paper. The company boasts an expansive land base and ranks among the top lumber suppliers in the United States. Its extensive operations are a testament to its commitment to sustaining the forests it relies on. Weyerhaeuser’s vast resources and industry expertise enable it to meet the nation’s growing demand for high-quality lumber while maintaining environmentally responsible practices, making it a crucial contributor to both the construction and paper industries.

3. West Fraser Timber (NYSE: WFG)

West Fraser Timber, headquartered in Canada, commands a prominent position in the global lumber industry, particularly in the production of softwood lumber. The company’s commitment to sustainability sets it apart, aligning with the increasing demand for green building materials.

West Fraser Timber is well-equipped to meet the needs of builders and developers as the construction industry evolves toward eco-conscious practices. The company provides sustainable and reliable wood products that contribute to environmentally friendly construction projects worldwide.

4. PotlatchDeltic (NASDAQ: PCH)

PotlatchDeltic specializes in timberland ownership and management across the United States and Canada. With a strong emphasis on sustainable forestry practices, the company is positioned to thrive in an era of growing environmental awareness and eco-friendly construction. Its extensive timberland holdings and sustainable approach ensure a steady supply of lumber for various applications. PotlatchDeltic’s commitment to responsible land management aligns perfectly with the increasing demand for lumber from sources that prioritize long-term forest health and sustainability.

5. Simpson Manufacturing (NYSE: SSD)

Simpson Manufacturing distinguishes itself as a manufacturer of wood products and fasteners, catering to the construction industry. Innovation is at the core of the company’s strategy, positioning it as a forward-thinking industry leader. As the demand for wood products in construction continues to rise, Simpson Manufacturing’s focus on developing cutting-edge solutions and fasteners that enhance the quality and efficiency of construction projects places it in a prime position to meet the evolving needs of the construction industry. Its commitment to innovation contributes to the advancement of modern construction practices, further solidifying its role in the sector.

Best Lumber Stocks to Buy in 2023 – Final Thoughts

Finally, if you are looking to invest in lumber stocks for the short term, it is important to do your research and consider whether or not you believe that lumber prices will continue to decline.

However, if you are looking to invest in lumber for the long term, the outlook is more positive. As stated before, factors such as the increasing population and the need for new housing are expected to continue to drive the demand for lumber.

However the cyclical nature of the lumber market may cause various periods of time when prices decline. For more information on lumber stocks and other wealth building tools, sign up for our free Wealth Daily newsletter today.