Dear Reader,

Last month, German chemical giant Evonik made headlines when it made an undisclosed investment in a Chinese lithium-ion battery company, SuperC.

Normally, this would hardly be news, except that SuperC isn’t just another Chinese battery producer.

This company is currently researching the potential for graphene additives to their traditional Li-ion batteries.

"By investing in SuperC, we are supporting a cutting-edge technology with a promising future. High-performance batteries are a crucial factor in accelerating the electrification of road transport and permanently reducing CO2 emissions," says Bernhard Mohr, head of Evonik's venture capital unit.

The CEO of SuperC, Di Sun, also commented: "With our technology, we want to pave the way for the next generation of batteries. We are pleased to have Evonik as a strong and international partner at our side."

While the drawbacks of lithium batteries — charge delay, short life span, and potentially dangerous instability being at the top of the list — are well known, the Chinese master plan for decades now has been to become the world leader in lithium and lithium-ion battery production. Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

What Space-Age Material Can Halt the Chinese Plan for World Domination in Its Tracks?

Or to put it more elegantly, the Chinese Communist Party’s plan was to turn China into the Saudi Arabia of the post-fossil fuel world.

Since the turn of the century, the CCP has made major inroads in the acquisition of lithium mining properties and exploration companies and has pumped trillions of yuan into lithium-ion battery production…

Which makes this move to evolve the current global benchmark for distributed energy storage solutions somewhat of a shock.

But maybe it shouldn’t be.

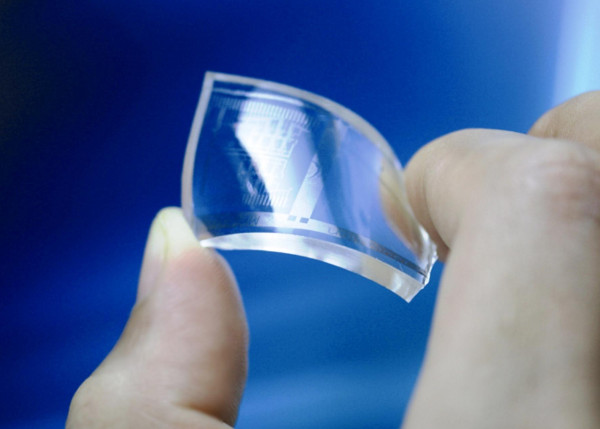

Graphene, since its advent in the first decade of the 21st century, has become famous for its incredible physical properties.

It’s one molecule thick.

It’s 200 times stronger than steel.

It’s the best known thermal conductor known to man.

Next-generation circuitry can be printed directly on it, ending the need for silicon chips once and for all.

The list of potential applications grows every day, but rechargeable batteries may be among the most important class of products that can benefit from graphene as a key ingredient.

It Won Its Key Researchers the Nobel Prize In 2010

Early graphene battery research has determined that a rechargeable battery with a graphene cathode could potentially last for 3–5 times the number of charge/discharge cycles as a traditional Li-ion battery.

It could hold between 1.5 and 2 times the amount of energy.

And, most dramatic of all, a graphene cathode battery could charge as much as 70x faster.

That would mean you could charge an EV from zero to capacity in less time than you currently take to pump your gas.

Pretty impressive, right? Well, here’s the most important fact that I left out: The company that did this research and is already manufacturing commercial-grade graphene batteries… isn’t Chinese at all.

In fact, it’s Australian, with its headquarters and state-of-the-art production facility in Brisbane.

For several years now, this company has been focusing on creating a next-generation, 100% lithium-free battery.

The problem, until recently, was that graphene was just too costly to produce in the volume required to supply the consumer market with affordable batteries.

The Last Hurdle

All of that changed when a revolutionary development in the production of graphene — also made by this company — dropped the cost of production by orders of magnitude.

Today, the company makes some of the best graphene in the world using nothing but natural gas and electricity, and does it cheaply enough for a competitive graphene alternative to be economically viable at scale.

Taking all this in context, it’s no wonder that the Chinese are now scrambling to kick-start their own graphene battery industry.

Their very future, which they’ve staked on lithium, is now under threat, and for once, there’s nothing they can do about it.

This Australian company makes its batteries 100% in-house, with no need to rely on third-party suppliers for the critical components of its new product.

In today’s hostile geopolitical climate, it’s this supply chain independence that just may be the biggest benefit of all.

Now, for the final, most important piece of information.

This Australian company is public. It’s still small because of its focus on a sector that, for all intents and purposes, didn’t exist a few years ago, but therein lies its greatest potential.

Lithium Was Coal… This Is Jet Fuel

At the moment, this company trades in the $2 range. Its total market cap barely exceeds $200 million.

The market that these batteries will disrupt, however, is predicted to be worth over $200 billion by the end of the decade.

At the current market cap, this company may well be the biggest bargain anywhere on the public markets today.

I’ve been following the story for a while now, and it’s time that all of my Wealth Daily readership became aware.

To make things easy for you, I asked my video team to produce a brief presentation covering all of the main points.

It just takes a few minutes, but if you’re even considering making an investment in tomorrow’s rechargeable batteries, consider this a crash course.

You’ll learn about the technology, the market, and the company behind it all. After that, the choice is up to you.

Once this ball gets rolling and the story gets out, I expect the company to move out of the microcap space in short order.

Smart investors will make their moves before all of that happens.

Get started by checking out my video right here. Access is instant and free. We won’t even ask for an email.

Don’t wait to read about this in Forbes. Get the actionable information right here, right now.

Fortune favors the bold, Alex Koyfman His flagship service, Microcap Insider, provides market-beating insights into some of the fastest moving, highest profit-potential companies available for public trading on the U.S. and Canadian exchanges. With more than 5 years of track record to back it up, Microcap Insider is the choice for the growth-minded investor. Alex contributes his thoughts and insights regularly to Energy and Capital. To learn more about Alex, click here.