Dear Reader,

The fate of the entire electric vehicle industry may have been decided three weeks ago.

Let me elaborate.

Twenty-two days ago, on February 27, two companies signed what’s called a "memorandum of understanding" concerning a future partnership.

One of these companies, which was not named in the press release due to a non-disclosure agreement, is a large-scale supplier for the automotive industry.

Based in Europe, this company is a 25,000 employee strong operation — making it major player on the world stage.

The second party to this pending agreement is a Calgary-headquartered tech company that’s pioneered a cutting-edge artificial intelligence technology that optimizes the performance of modern electric motors.

This second firm is far smaller. Fewer than 100 employees.

Here’s how this relationship is going to function moving forward: The automotive equipment supplier is going to spend the next two quarters testing the technology, and once expectations are satisfied, this memorandum of understanding (MoU) will turn into a definitive agreement and a press release from both parties will make all the details of the deal public information. Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “Investing in Rare Earth Stocks.” After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

It contains full details on how you should be investing in rare earths.

A Turning Point for the EV Sector?

That’s expected in Q3 of this year, but what exactly is at stake?

Well, despite the legalese that tends to fog things up in situations like this, don’t fall into the trap of underestimating the significance of this relationship.

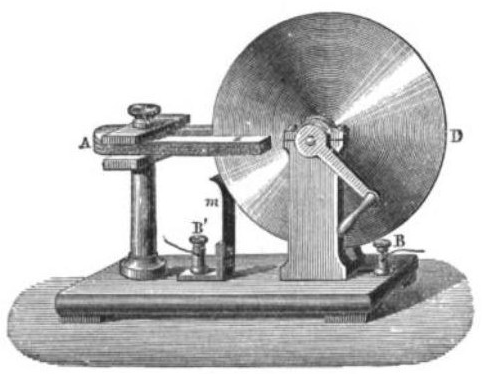

The AI technology in question here represents the most important evolution in electric motor design since the very advent of the mechanism by British engineer Michael Faraday back in the 1820s.

In the 200 years since those first prototypes, much has changed.

Today the electric motor is the single most important electrical device known to man.

More than half of all energy generated by mankind ends up powering some variety of the mechanism, whether it’s the tiny one responsible for the vibration feature on your smartphone or one the size of a house powering a quarter-million ton cargo ship.

The motors themselves, however, have changed very little.

They’ve grown bigger and stronger and faster, but one key deficiency has followed the electric motor around since the very beginning.

When Good Enough Is No Longer Good Enough

The problem with Faraday’s original design was buried in the heart of the electric motor — the copper coil.

Because the flow of charge was unregulated inside this coil, electric motor performance always fell short of potential.

Energy was lost to heat and resistance, which in turn affected power output and service life.

What the smaller party of this MoU was able to do was regulate incoming charge using precisely trained AI algorithms.

Referred to as "dynamic power management," it turned a chaotic process into a precisely controlled science.

The result was instant and substantial.

When installed on an electric motorcycle, power was measured to go up 25%, with no increase in energy input.

A difference of that magnitude would transform the EV market overnight.

A "Technological Dreadnought"

No EV-maker without it would be able to compete, performance- or cost-wise, plain and simple.

Which is why this memorandum of understanding could be the most important legal document signed in recent memory.

With the backing of the unnamed European parts supplier, this technology can finally hit the market in a meaningful way.

Now, while I can’t say anything about the automotive giant on the other end of the deal, there’s plenty I know about the Canadian firm.

As you may have guessed, it’s small and it’s young. The power management technology it has pioneered is the sole focus of its business efforts.

The company is also public. It trades on both Canadian and U.S. exchanges.

Shares, as of today, are priced at less than $2 on the U.S. side — giving the company a market cap of just a hair over USD$250 million.

I think you’re starting to see the opportunity here.

A Last Chance for the Smart Money

Licensing alone for something as substantial as this could be worth billions of dollars annually.

Companies like Tesla, Toyota, Volkswagen, and any other automotive brand that’s staked its future on the EV revolution will all be jumping at the chance to acquire it.

Bottom line, this MoU may be the last stage of this company’s life cycle before it explodes into the global name this technology warrants.

Once the results are in later this year, that is precisely what will happen.

There is much more to this story, of course.

If you want to learn more about the technology, the company, and the future of the market, I’ll make it easy for you.

I've taken all my research and knowledge, and compressed it into a quick video presentation.

You never know. It might just change your life.

One more thing before I leave you to it…

A really interesting thing about this company is that despite staying completely under the radar of the mainstream financial media, it’s still managed to 7x its share price since 2018.

That’s just a taste of what’s in store for shareholders once full-scale commercialization kicks off.

Nothing is more valuable than timely information… and frankly, I don’t know if I’ve ever seen a better example.

Get informed now. Enter here.

Fortune favors the bold, Alex Koyfman His flagship service, Microcap Insider, provides market-beating insights into some of the fastest moving, highest profit-potential companies available for public trading on the U.S. and Canadian exchanges. With more than 5 years of track record to back it up, Microcap Insider is the choice for the growth-minded investor. Alex contributes his thoughts and insights regularly to Energy and Capital. To learn more about Alex, click here.