This time next year, the world’s most advanced lithium producer is going to be making lithium from the byproduct of fossil fuel production.

This producer — more of a tech company, really — is about to start tapping into one of North America’s most abundant lithium resources with a process that’s nothing short of revolutionary, resulting in what's been dubbed "black lithium."

Let me explain to you how it works.

There’s an oil and gas property up in northwestern Alberta that for the last 40 years has been steadily pumping out fossil fuel using water from hundreds of brine ponds scattered around a 671-square-mile tract of land to push the product out from deep within the Earth.

Brine ponds just like the one pictured below.

In the process, this brine has picked up lithium — a lot of it — and locked it into the solution.

Over 4.3 million tons in all, dissolved in close to 100 billion barrels of this brine.

The fact that it’s present in the solution is no surprise. People have known about it for decades.

What they haven’t known is how to extract with anything approaching economic efficiency.

That’s where this high-tech lithium producer comes in. Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

Black Lithium: Better in Every Way

Founded and run by veterans of the petrochemical industry, this company has come up with a way to filter the lithium out of the solution at an efficiency of 97% or better.

Once filtered, the brine is returned to the collection pools and can be reused.

Meanwhile, the filtration facility collects the lithium and makes it ready for transportation.

The process is cheap, clean, and up to 20 times faster than the current standard methods of production.

Best of all, the most time-consuming and uncertain aspect of lithium production — exploration — gets completely removed from the cycle.

No exploration, no mining, no environmental impact like the kind typically associated with modern rechargeable battery production.

With lithium selling for upward of $70,000 per ton on the open market today, this company can generate about $66,000 of pure profit for every ton processed.

At those rates, that 4.3 million-ton resource is worth close to $322 billion.

This Single Resource Could Satisfy Global Demand for Years

Now, you might be thinking that with this level of innovation, this company is some giant corporation looking for yet another side business to bolster its bottom line.

Nothing could be further from the truth. As of this morning, the company’s market capitalization is just over $20 million. It is, by almost every definition of the term, a technology startup.

What it isn’t, however, is early in the process of bringing this technology to market.

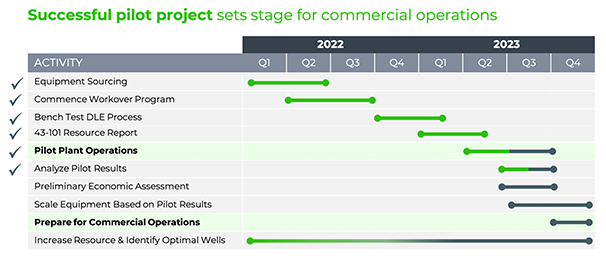

The timetable has already been established, and commercial production is expected to kick off by the middle of next year — less than 12 months from now.

Which means this microcap, trading for just $0.20 on the open market today, could command a market capitalization of a quarter-billion dollars once the first stage of commercial production is achieved…

And over $4 billion by the time the next stage — 20,000 tons of annual production — comes along shortly thereafter.

Because there is so much brine and so many brine ponds, scaling will be quick and straightforward.

I know it all sounds a bit too good to be true, but this is exactly how disruptive technologies take hold of the industries in which they operate.

China's Lithium Monopoly Could Already Be Dead

Sudden, dramatic, and world-changing.

Of course, with this much potential, we probably won’t ever see this stock trading for $200 or anything close to it.

What’s far more likely is a massive buyout by a big-name energy company looking for a quick and novel way to tap into the rapidly expanding lithium market.

Nevertheless, this story has already spread so fast that lithium end users — I’m talking about actual electric vehicle producers looking for North American suppliers to feed their battery production operations — are already reaching out and making serious inquiries.

Put it all together and you get what could be the most explosive investment opportunity trading on any exchange anywhere in the world today.

Yes, there is a lot more to this story.

I’ve been looking into it for weeks now and have recently released my research to my premium readership.

Today, I’m giving our loyal Wealth Daily readers a firsthand look at my findings.

Want to see why I’ve added this company to my personal portfolio?

Enter here to get the whole story.

Fortune favors the bold, Alex Koyfman His flagship service, Microcap Insider, provides market-beating insights into some of the fastest moving, highest profit-potential companies available for public trading on the U.S. and Canadian exchanges. With more than 5 years of track record to back it up, Microcap Insider is the choice for the growth-minded investor. Alex contributes his thoughts and insights regularly to Energy and Capital. To learn more about Alex, click here.