If you’re not paying particularly close attention, it might feel like we’re near the end of the COVID-19 pandemic and the associated stock market rout.

The Dow is up by a few points in the last month, the May jobs report came in stronger than expected with 2.5 million new jobs added, and many states are starting to lift their lockdowns.

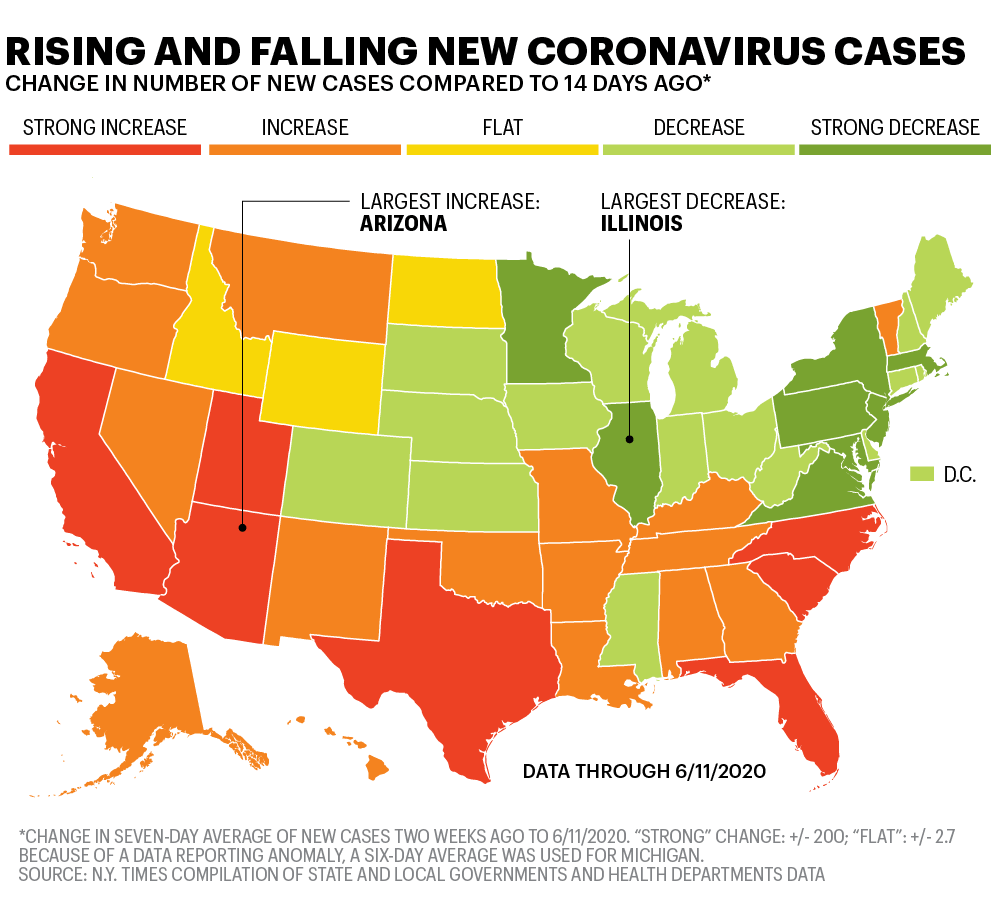

But none of those things prove that this virus is actually on the decline. In fact, data from mid-June appear to show a second wave of infections, especially in eager-to-reopen states like Florida as well as states like California which have not previously seen high infection rates.

Source: Fortune

Today, we’re looking at the probable impact of this second wave of COVID-19 on the stock market — and discussing how you can prepare your portfolio.

A Second Wave of Lockdowns?

It’s worth remembering that the current economic downturn isn’t a direct result of COVID-19 but rather an indirect result of the lockdowns imposed to curb its spread.

In particular, the service industry — which employs tens of millions of Americans in hotels, bars, restaurants, and so on — was almost immediately shuttered at the beginning of the pandemic due to the inherent riskiness of customer-facing service jobs.

In May and June, some states like Florida and Texas relaxed their lockdowns and allowed hospitality businesses to reopen — only to close them again.

In the last two weeks, California, Texas, and Florida have started to shut down their bars for a second time amid large surges in cases.

If similar increases are seen across the other 47 states in the coming weeks (and lead to similar re-lockdowns), they could quickly wipe out most of May’s job gains. After all, food and beverage jobs accounted for 56% of those added in the month.

And there’s one particular portion of the service industry that could be especially hard-hit…

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks.” It contains the best dividend growers to add to your portfolio and full details on why dividends are an amazing tool for growing your wealth. After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.The Best Free Investment You’ll Ever Make

The Stocks That Could Be Hardest Hit by a COVID-19 Resurgence

COVID-19 is particularly devastating to hoteliers. The pandemic has mounted a three-pronged attack on their revenue streams. Social distancing mandates have decreased room rentals by depressing travel, effectively eliminating the lucrative events and conventions business and taking a bite out of hotel food and beverage sales.

The latter revenue stream can account for as much as 20% of a hotel’s overall income, according to Hotel Business Review — and as we’ve seen in Florida, Texas, and California — it’s about to get whacked again by a second wave of COVID-19 cases.

That’s especially devastating to large hoteliers like Marriott International (NASDAQ: MAR), whose room and event businesses never really recovered from the first wave.

In its most recent quarterly report, Marriott reported a 92% drop in earnings year over year on a 78% decline in revenues — much of which was attributable to an 84% decline in rental revenues. These grim numbers sent the stock tumbling but not enough to bring down its price-to-earnings (P/E) ratio to a reasonable level.

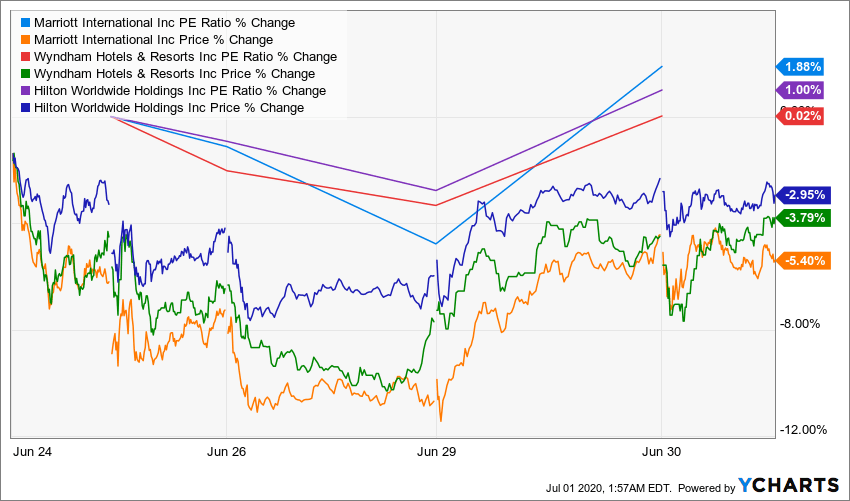

Marriott’s P/E ratio currently sits at a rich 30.82. Rivals Hilton Worldwide Holdings (NYSE: HLT) and Wyndham Hotels & Resorts (NYSE: WH) also have P/E ratios north of 25.

And as you can see above, all three have seen their prices fall while their P/E’s rose in the last few sessions, indicating that the stocks are still overpriced after the recent selling action.

In summary, a second wave is coming — and it’s coming for hospitality stocks.

How to Prepare Your Portfolio

In addition to avoiding hospitality stocks, investors should prepare for wider hits to the consumer discretionary sector in the event of new lockdowns — and to the economy as a whole.

As I’ve discussed at length in my last few columns, lockdowns mean mass unemployment; and mass unemployment means lots of household belt-tightening, which can depress consumer spending (70% of America’s GDP) and thus further raise unemployment.

And investors who are looking to get ahead of the financial “double dip” caused by the incipient second wave should check out Bull and Bust Report.

Editors Luke Burgess and Christian DeHaemer maintain a special gold and metals portfolio for crises like this — and that portfolio is currently up by more than 80%. Read more here.

Until next time,

![]()

Samuel Taube

Samuel Taube brings years of experience researching ETFs, cryptocurrencies, muni bonds, value stocks, and more to Wealth Daily. He has been writing for investment newsletters since 2013 and has penned articles accurately predicting financial market reactions to Brexit, the election of Donald Trump, and more. Samuel holds a degree in economics from the University of Maryland, and his investment approach focuses on finding undervalued assets at every point in the business cycle and then reaping big returns when they recover. To learn more about Samuel, click here.