This guy must be high!

That’s what I thought after reading the following sentence in a recent Motley Fool piece…

There simply aren’t any enticing investments at the moment to take advantage of marijuana’s state-level expansion, meaning you safest best is to monitor marijuana’s expansion safely from the sidelines.

Tell that to the members of my Green Chip Stocks community who bought the following stocks last year after I recommended them…

OrganiGram Holdings (TSX-V: OGI)

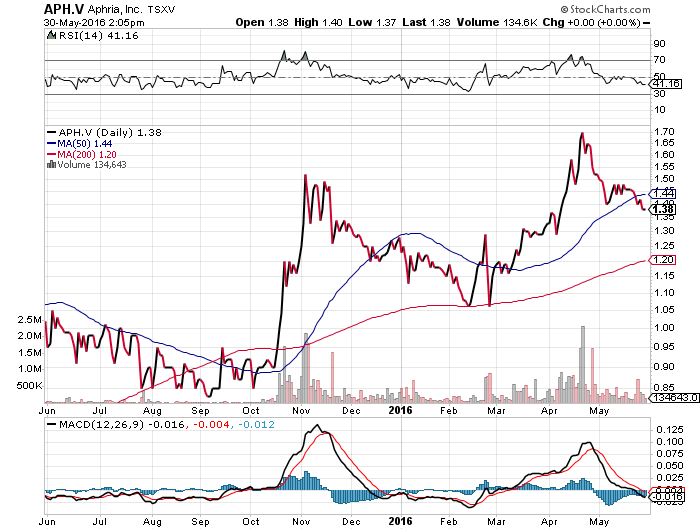

Aphria (TSX-V: APH)

Canopy Growth Corporation (TSX-V: CGC)

The truth is, there are plenty of enticing investments at the moment, but most folks have no idea how to access them.

A Very Profitable Leper

It is true that in public markets, quality legal cannabis stocks are hard to find.

Approved producers in Canada are good bets, as the government has signed off on those companies to grow and sell cannabis today for medical purposes and next year for recreational purposes.

There are about five quality plays there with more going public this year. The others, including the stocks I listed above, can be bought and sold now on the TSX Venture exchange and over the counter in the U.S.

Of course, for a lot of investors, there’s a certain amount of fear associated with investing in stocks that trade over the counter. But what you have to understand about the cannabis industry is that it’s still considered a leper that’s not usually allowed to cross the velvet rope to get into Nasdaq or NYSE parties.

Denied!

Last week, decision-makers at the Nasdaq denied a listing for a company called MassRoots (OTC: MSRT), a social platform that caters to cannabis users and supporters.

According to the press release, the Nasdaq determined that MassRoots may be deemed as aiding and abetting the distribution of an illegal substance. So I suppose that means if you ever bought any of the stock, you’re attempting to build a fortune on drug money. How absurd!

I actually thought the denial would’ve been based more on market cap or trading volume, but reps from Nasdaq did confirm the denial was based on the fact that the company was essentially a street corner drug pusher. Which, of course, it is not.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they

hit Wall Street. Become a member today, and get our latest free report: “Why You Need to Fire Your Money

Manager.”

It contains full details on why money managers are overpaid and provides you with

tools for growing your wealth. On your own terms. No fees, no comission.

The bizarre thing, however, is that the Nasdaq already allows cannabis-related stocks to trade on the exchange.

GW Pharmaceuticals (NASDAQ: GWPH) and Zynerba (NASDAQ: ZYNE) are just a couple. And these three companies are actually involved in buying and testing cannabis. They physically take possession of the plant.

MassRoots, on the other hand, does not.

That being said, I do believe the days of this kind of random discrimination are coming to an end.

The truth is, as more and more states legalize and the Fed continues to lighten up on prohibition (although this is happening at a snail’s pace), other cannabis and cannabis-related companies will start to list on the Nasdaq and even the NYSE. It’s inevitable.

And this is why I recommend sinking your meat hooks into a few of the more successful players right now — while they’re still relatively unknown and trading on the smaller exchanges. Because mark my words, when these companies do get big enough to list on the Nasdaq or the NYSE, they’re going to launch into the stratosphere. I want you to be in before that happens.

To a new way of life and a new generation of wealth…

Jeff Siegel

@JeffSiegel on Twitter

@JeffSiegel on Twitter

Jeff is a contributing analyst for New World Assets. For more on Jeff, go to his editor’s page.