Investing in the Philippines

“Where are we going to get a decent judge by tomorrow?”

That’s what the lady at the table sitting next to me asked her husband.

Your editor happened to overhear it, had the answer, and it led to one of the best investment opportunities of the next decade…

It was about nine months ago. I’d just flown into Manila in the Philippines. I was hungry. And after checking into my hotel, I stepped out to grab a quick bite to eat (it’s amazing how big an appetite you can build sitting for 18 hours).

Shortly after sitting down to my meal, I overheard the woman’s plight.

She was organizing a beauty contest and one of the judges had dropped out.

I couldn’t help myself. I mean, judging a beauty contest — in Manila of all places…

Who could pass this up?

So I interrupted, offered my condolences, implied that I had nothing better to do, and let her convince me how I would be doing her a favor.

After calling her colleagues and excitedly explaining how she got a “real American” to fill in, she gave me the address and time and we parted ways.

The next day I mapped everything out, got some folks at the hotel to go over the landmarks that would guide my excursion, and started on my way to the contest.

What I saw surprised me.

Like China — Only 10 Years Behind

As I walked to the event, I passed bums, beggars, street vendors pitching everything from cigarettes to Viagra, and everything else you’d expect to see in downtown Manila.

I turned a corner and suddenly found myself walking through an extremely nice area. There were fountains, gardens, music, and none of the other stuff.

I was in a giant outdoor mall.

I looked around and saw nothing but affluence: The stores were the places most guys go to when they’re still in that stage where they spend all their money trying to impress their new girlfriend.

And they were packed with people, most of whom were walking around with multiple bags filled with stuff. No one was just hanging out like they do here in the U.S…

They were all spending money.

Then it hit me: Was I in China, only 10 or 20 years ago?

As always, data provided the answer.

The Economic “Sweet Spot”

In The Stages of Economic Growth: A Non-Communist Manifesto, W.W. Rostow breaks down an economy’s development into five stages:

- Traditional Society

- Preconditions for Take-Off

- The Take-Off

- The Drive to Maturity

- The Age of High Mass Consumption

The definitions are self-explanatory. For example, the United States is in the mass consumption stage. China is driving to maturity. Most of Africa has been mired in traditional societies for centuries.

But the Philippines is in the sweet spot. It’s at the critical point where fortunes can and will be made: the take-off stage.

And taking off it is…

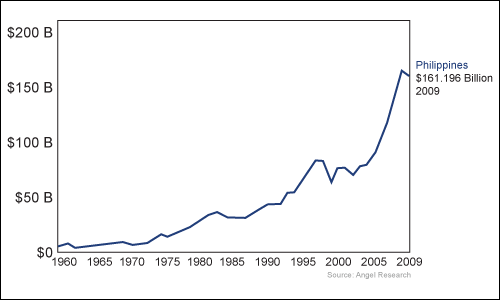

The World Bank chart shows the Philippines GDP has grown steadily over the last 50 years. It was slow at the beginning, but now it’s accelerating fast.

Growth has been so strong that the Philippines is quickly becoming one of the few remaining hyper-growth economies in the world. Its GDP grew 7.1% last year. The credit crisis — which has mired the global economy — was barely a speed bump on its growth trajectory.

Naturally, Wall Street has already caught a whiff of the growth trend in the Philippines. They’ve put together a country ETF for the Philippines: The iShares MSCI Philippines (NYSE: EPHE) began trading late last year.

But it’s still too early for most investors. The ETF’s average volume is still about 1/500th that of more mainstream countries’ ETFs like China and Brazil.

When it comes to investing though, it’s best to be where others aren’t yet.

But there’s even more to the story…

The Fuel for the “Take-Off”

Every society has gone through the same stages. Dozens have made it through them, imploded, and gone through them again.

Each time they’ve gone through them, they’ve always had “fuel” for their take-off stages. That fuel is often natural resources.

Think about it like this: Every great society has been founded in an area abundant with natural resources. Whether it was water and fertile soil thousands of years ago, or timber, coal or oil, and minerals in the last few hundred years, natural resources were always essential elements.

But today, in a much wealthier world, many factors are hindering natural resource production.

The United States and the rest of the mass-consumption societies are increasingly turning away from production and have become more focused on other things.

Take California, for instance. It still has massive reserves of oil both onshore and off. Those resources, however, cannot be tapped… not for a lack of technology, capability, or anything like that; they’re off limits merely because the government and environmentalists don’t want them to be developed.

Russia is another example. There are tremendous reserves of oil, natural gas, minerals, and timber. They are a huge part of the Russian economy. However, they remain largely untapped due to widespread corruption and poor property rights.

How soon will it be until BP or other oil majors put billions of dollars into another Russian energy project after the last one was taken from them by bureaucratic fiat?

The Philippines is doing the exact opposite. And it’s reaping the rewards.

The best example: The country recently changed its mining law to make it easier for foreign companies to come in and explore, develop, and mine the country’s vast resource base of copper, gold, oil, and other commodities.

It has plenty of fuel for takeoff, and it’s tapping into it all as fast as it can.

Winning Big in the Philippines

The Philippines is just one example of the many countries that are reaching the point where they make extraordinary leaps and bounds.

The top-performing stock market of any developing country since the credit crisis has not been the headline-makers like China and Brazil…

The big winner is Colombia, a country better known for the drug trade than exploiting its vast resources of copper, gold, and timber.

Meanwhile, the economic malaise in the West just seems to become more stagnant. Europe is perpetually on the verge of collapse. The U.S. has been avoiding making any sensible economic policy decisions since the credit crisis kicked off. And the next round of “fixes” will be more borrowing, spending, and printing… the results of which will surely be the same.

But in the end — if you’re willing to look beyond your borders and stereotypes — you’ll find a world of growing wealth and populations looking to get their piece of the global economic pie.

There are billions of people out there hungry for a more comfortable life and willing to make it happen for themselves.

We’ll be revisiting the Philippines for sure. When we do, we’ll find more opportunities. And we’ll cash in a favor…

After all, my friend from the beauty contest still owes me one.

Good investing,

Andrew Mickey

Editor, Wealth Daily

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.