It's Time to Buy Pot Stocks

Earlier in October, I warned you that cannabis stocks were getting too expensive. There had to be a correction coming. And I advised you stay away from those high-flying growers.

I even called out five companies by name. All of them have great value, but all of them had gotten incredibly expensive.

Investors weren’t investing; they were speculating. They were just plain gambling on the future of an industry they didn’t understand at all.

Your Personal Early Warning System

I warned that the Canadian cannabis industry wasn’t big enough to warrant such high valuations. And I said, “When that reality sets in, these high-flying growers may just take a nosedive back to reality.”

And in the week following my warning, all five of those companies saw their stocks drop by double digits:

But after that massive drop, I saw an opportunity. Everyone was fleeing the cannabis market. And it was creating some impressive deals for those with a good understanding of the industry.

BTFD!

People were worried it was a crypto crash all over again. But as I said in that week’s article…

There’s a big difference between cannabis companies and cryptocurrency.

That’s intrinsic value. These pot companies have [it].

So, I gave you a list of three of my favorite cannabis investments.

These three companies all saw their shares rise to ridiculous levels in the frenzied September buying. And all saw their share prices crash with the rest of the market at the start of October.

But there was real value behind these companies. And now a lot of that overinflated price tag had fallen off.

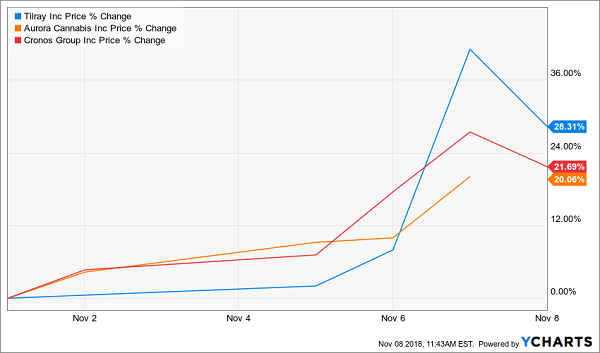

So, I gave the go-ahead to start buying the dip. And all three companies I recommended are up double digits since then:

Even boring old Scotts Miracle-Gro popped 12.5% in the past two weeks.

Did I Stutter?

But many of you ignored my advice. Perhaps you got caught up in the fear. Maybe there was a typo in my article. I really don’t know why you didn’t hear me…

But I’m the giving type. So, last week, I wrote again about the opportunity we’ve still got.

I said cannabis stocks still have way more to grow. But you’ve got to know where the intrinsic value lies.

I gave you three more companies that have valuable operations and should weather the storm with ease. They’re all up double digits in this past week alone:

And they’re going to keep on growing. Because U.S. legalization is no longer a pipe dream. It’s a forgone conclusion. And every day we get more news that signals the time is nigh…

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they

hit Wall Street. Become a member today, and get our latest free report: “Why You Need to Fire Your Money

Manager.”

It contains full details on why money managers are overpaid and provides you with

tools for growing your wealth. On your own terms. No fees, no comission.

Dems Get the House, Everyone Gets the Greenhouse

The major media focus of the midterm elections this week was the shift of power in the U.S. House of Representatives.

But the real news for investors came from three states and one president…

We had four states voting on some form of cannabis legalization. And three out of four voted “yes.”

Voters in North Dakota, where medical cannabis is already legal, voted down a proposition to make recreational grass OK, too.

But both Utah and Missouri relaxed their laws and now allow consumption of cannabis for medical purposes.

The really big — and market moving — news came from the home of Motor City, though. Voters in Michigan approved a measure to make recreational cannabis legal.

And with the massive population in and around that state, the industry stands to see a nice influx of revenue.

Investors liked this and sent shares in cannabis companies up immediately following the results. But those gains were short lived, and most companies gave them up by the next day.

Sessions Out, Cannabis In

Then the real treat came. President Trump made a move folks on both sides of the aisle can agree with and fired Jeff Sessions.

Sessions, in case you don’t remember, was a staunch opponent of legal cannabis. He had gone so far as to threaten to use the power of the federal government to go after companies operating within the confines of their state’s laws and borders.

And pretty much every time he opened his mouth, pot stocks took a hit.

But he’s gone now. And that’s incredible news for cannabis investors in the U.S.

It puts us one very big step closer to federal legalization.

“It’s Gonna Happen”

With Democrats in control of the House and a guy in the Oval Office who’s talked before about the tax benefits of legal marijuana, we’re likely to see some more major progress in the fight for full legalization.

So, I’m begging you to take my advice this time.

I think I’ve proven I’ve got a good understanding of the market. And if you’ve taken my advice in the past weeks, you both saved yourself from taking massive losses and pocketed yourself some very impressive short-term gains.

Now, it’s time to start thinking about the long run.

As sin stocks go, cannabis is going to be bigger than alcohol and tobacco. And we’ve got the opportunity to invest in it at its infancy.

There are still going to be ups and downs, but the long-term trajectory is up. And nothing is going to stop it.

All the companies I’ve recommended so far are great. And they’re going to last for the long haul.

The Happiest Place on Earth

But I’ve saved the absolute best ones — the ones with the biggest potential for quadruple-digit gains and the least potential to crater on any bad news.

I’ve saved them for the members of my investment community, The Wealth Advisory.

And they’re incredibly happy with the results so far. Because they’ve been taking my advice this whole time.

So, I implore you to join us and profit alongside the successful investors in our community.

The founder of our company put together a presentation telling you about our absolute favorite cannabis investment and also explaining the many other benefits of becoming a member of The Wealth Advisory nation.

Do yourself a favor and check it out. Then join us for the wildly profitable ride still to come.

Thousands of other investors have, and they’re all very happy they did.

To your wealth,

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube