Dear Reader,

For the last few months, I’ve been writing on an almost weekly basis about a green fuel that’s already in the process of disrupting the multitrillion-dollar global fossil fuel market.

The fuel is ammonia, and its power has already been tapped for highly specialized applications like NASA’s X-15 program of the 1960s, which produced the world’s fastest-ever powered winged aircraft.

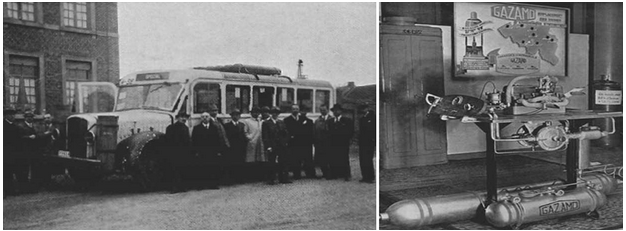

As well as emergency consumer solutions such as Belgium’s public transit system of the 1940s, which called for a quick and efficient alternative to gas and diesel in the wake of Word War II’s fuel shortages.

The fuel produces no emissions, can be used in existing engine blocks, is extremely stable and resistant to auto-detonation, and can be safely stored for extended periods of time.

It is, in short, a near perfect solution for the world’s mounting energy crisis… With just one wrinkle.

Ammonia production has always been a costly, dirty proposition — costly and dirty enough to relegate it the status of a mere chemical solvent, even though a market 100 times as big was within reach.

Today, all of that is changing.

Air + Water + Electricity = Liquid Energy

Thanks to a very recent technological innovation, ammonia fuel can now be produced cheaply, with zero carbon emission, using only air, water, and electricity.

With this piece of the puzzle now securely in place, an interesting opportunity has opened. Ammonia can now be used as a medium for storing electricity.

How would this work?

Just imagine you’re an energy company that owns a field of wind turbines or solar panels. Oftentimes, during peak production hours (late morning to midafternoon), far more electricity is produced than can be immediately consumed — creating a surplus that needs to be stored.

Giant battery arrays are an option, but those come with a host of their own problems.

Lithium-ion battery arrays used for distributed energy storage are costly to produce and require regular maintenance. Plus, they’re often unstable and they lose more of their energy storage capacity with every charge/discharge cycle.

Occasionally, they even explode.

With this new ammonia production method now an option, however, this excess power will be used to produce a zero-emission liquid fuel that can either be stored indefinitely with almost no cost, sold, or turned back into electricity when demand dictates.

Best of all, the carbon footprint for the entire cycle is effectively nonexistent.

Like I said, we’ve been covering this story for months here at Wealth Daily, but now it appears to finally be penetrating the invisible barrier of public awareness.

First Big Customer: Big Shipping

Just yesterday, Mitsubishi Heavy Industries announced its participation in a project to develop guidelines for the safe usage of ammonia as a shipping fuel.

The project is led by the Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping, a Copenhagen-based research institute created to promote decarbonization of the maritime shipping industry.

A week before that, Japanese shipbuilding giant Nippon Yūsen Kabushiki Kaisha, also known as NYK Line, announced that it too was looking specifically at ammonia in its efforts to help achieve a 50% reduction in overall maritime carbon emissions by the year 2050.

We have you covered! Sign up for our FREE newsletter, Wealth Daily, today and gain first access to actionable stock market commentary, regular IPO updates, and weekly technical analysis. Plus, if you sign up right now, we’ll immediately send you our free report: “Wealth Daily’s Top 2 Fuel Cell Stocks.”

And a week before that, the World Bank published a report backing ammonia as a “bunker fuel” — fuel used onboard oceangoing vessels — during a time of near universal decarbonization:

Green ammonia, followed closely by hydrogen, strikes the most advantageous balance of favorable features. The multiple production pathways provide an important strategic advantage insofar as they help alleviate some initial concerns about capacity limits and technology issues.

So there’s no doubt about it: The story is gaining momentum — and so is the share pricing on the one stock most closely tied to this new industrial trend.

You see, just a few weeks ago a relatively tiny, completely unknown Canadian company acquired the intellectual property rights to the clean ammonia production process.

Working in unison with the University of Ontario, this company is currently testing the technology in a series of progressively larger, higher-output production facilities.

Soon enough, this technology could help permanently unseat the $5 trillion/year fossil fuel industry, as well as take a major bite out of the lithium-ion distributed power storage sector.

Not often does so much rest on just a single patent.

Can One Company Be This Important?

This company that recently acquired the technology didn’t just buy the rights. They completely rebuilt the company around the goal of commercializing and spreading this innovation to every corner of every market where it can be utilized.

As I mentioned before, the company is small, but its stock is already public, and investors are definitely starting to take notice.

It’s up over 60% since I initiated coverage. A year from now, if things continue like this, we could be looking at triple-digit gains or better from the current price.

Long story short, there’s no time to waste.

It’s all in the video presentation I released to my subscribers a few weeks ago.

Today, you can see the whole thing, completely free.

Access is instant. Just click here and the video will begin.

Fortune favors the bold,

Alex Koyfman

His flagship service, Microcap Insider, provides market-beating insights into some of the fastest moving, highest profit-potential companies available for public trading on the U.S. and Canadian exchanges. With more than 5 years of track record to back it up, Microcap Insider is the choice for the growth-minded investor. Alex contributes his thoughts and insights regularly to Energy and Capital. To learn more about Alex, click here.