Earlier this week, the world’s biggest manufacturer of construction and mining equipment and the world’s biggest producer of lithium for use in electric vehicle batteries made one of the biggest announcements in their combined history…

Caterpillar, with annual equipment sales approaching $60 BILLION, and Albemarle, the world's leading lithium miner, announced a partnership to create the world’s first ZERO-EMISSION lithium mine.

It’s a huge deal because one of the big sticking points for EV adoption is that until now, consumers weren’t reducing their pollution so much as they were exporting it to the countries where lithium is produced.

And that’s because nearly all of the gigantic mining equipment in the entire world runs on diesel gas and belches out black smoke chock-full of carbon emissions in order to dig up the lithium to make the batteries to power the EVs.

But this huge partnership between Caterpillar, which is rolling out a new line of fully electric mining equipment, and Albemarle, which is reopening the biggest lithium mine in the United States, could completely change all of that. Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

But there’s a catch…

You see, the mining equipment like the trucks and diggers will be battery-powered. But the processing equipment still runs on old-fashioned technology.

And Albemarle’s Kings Mountain lithium mine in North Carolina sits atop a hard-rock lithium formation known as spodumene.

Now, the process for extracting lithium from spodumene is very similar to the process of extracting any metal from hard-rock deposits…

You dig it up, grind it down, transport it to a plant, and then expose it to extremely harsh chemicals to strip out the impurities.

And that process kind of negates the good done by switching to batter-powered mining equipment.

So in order for Albemarle and Caterpillar to make good on their plans for a clean lithium mining operation, they’re going to need some help from a new technology slowly making its way into the mining world.

Remember the Fracking Boom

But before I explain the new technology that’s set to revolutionize the entire global lithium industry, I want to rewind several years to the early 2010s.

Back then, a new technology was making its way into the oil fields of the United States.

It allowed companies to tap previously unrecoverable oil reserves and made the U.S. a leader in the global energy markets for the first time in nearly a century.

That new oil extraction technology was called hydraulic fracturing, or fracking, and it helped U.S. oil companies tap one of the biggest reserves of tight oil in the world.

The United States became a net oil exporter for the first time in most of our lives.

The companies that pioneered the new technology in the field grew to immense sizes.

And early investors who saw how disruptive and innovative this new process was and invested at the start of the boom made out like bandits.

Companies many investors had never heard of a few years before soared to new heights and created a new generation of millionaires and billionaires.

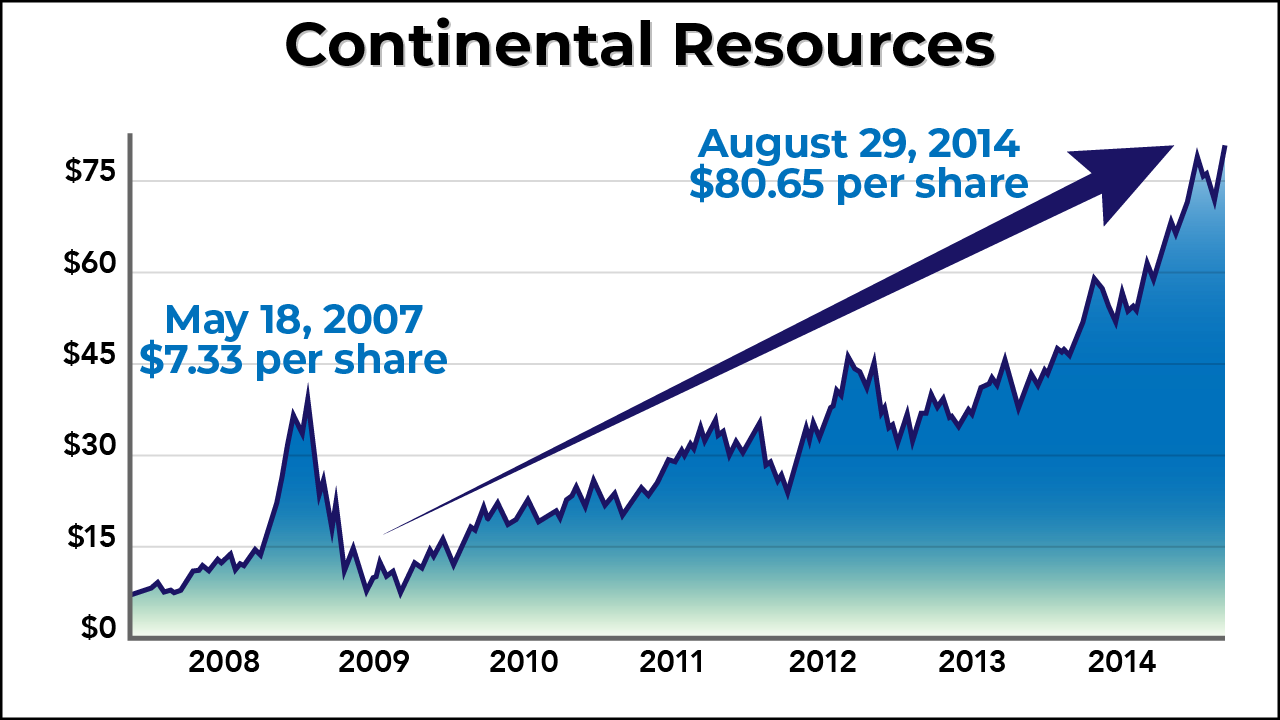

Continental Resources' stock shot up over 1,000% between 2007 and 2014:

Another early player, Northern Oil and Gas, spiked 110% in just six months and another 1,300% in the next two years:

In just two years, Abraxas Petroleum went from $13 a share to $117 a share, scoring investors an 803% gain:

I could go on and on and on, but I think you get the picture…

This new technology unlocked vast riches of previously unrecoverable oil and created fortunes in the process.

That’s EXACTLY what I see happening in the lithium mining industry over the next decade…

And it’s already gotten started.

Lithium’s “Fracking Moment”

You see, I’m convinced that this new technology and its debut in the field is lithium’s fracking moment.

This new extraction technique does for lithium exactly what fracking did for tight oil: It makes previously unrecoverable deposits economically feasible.

In short, it’s unlocking the same kind of vast riches that fracking unlocked. And it’s likely to create similar fortunes in the process.

But, just like fracking, it’s not the big supermajors pioneering the process. Exxon was not the first oil company to experiment with fracking and Albemarle is not going to be the first company to experiment with this new technique.

That task falls on smaller operations who basically have less to lose by investing in a novel technology.

But they’ve got everything going for them if they’re successful in the field. They’ll be able to get mines up and running far faster than the big operators that refuse to evolve.

And they’ll be able to produce more lithium from smaller deposits thanks to the incredible efficiency of this new process (it extracts 90% or more of the available lithium compared with 40% from traditional techniques).

Not only that, but they’ll be able to produce it far more quickly, as well. Current techniques take years to produce usable lithium. This process takes hours.

These small companies are already putting the new tech to use at their lithium assets.

And now that it’s being implemented in the field and proven outside of a laboratory, you can bet your bottom dollar that massive firms like Albemarle (maybe even Exxon) are going to be looking for experienced operations to scoop up so they can take advantage of this advanced technique too.

That’s going to lead to a flood of money flowing directly to these tiny lithium miners and their shareholders.

It’s Happening

And it’s already happening.

You see, the members of my premium nanocap investment advisory service, Future Giants, have been scoring massive wins as the tiny innovators we’ve invested in get acquisition offers from much larger operations.

In fact, one of them, a tiny $100 million-market-cap company when we invested, just got a buyout offer from one of the larger oil and gas companies in the world.

That offer was to buy the whole company lock, stock, and barrel for slightly over $250 MILLION!

That’s a 150% premium to where we invested a little more than a year ago. And it’s far from the last massive premium these megacap companies are going to offer for these innovative little miners.

My team and I have identified several other companies operating in areas once thought uneconomical that are showing just how wrong those assessments were.

They’re all implementing this new technology. And they’re catching up to the supermajors like Albemarle at a breakneck pace.

Either they’re getting bought and delivering a massive profit to investors, or they’re taking those top spots and also delivering massive gains to investors.

Either way, the massive returns are all but guaranteed to come just like they did as fracking revitalized the U.S. oil and gas industry.

And I want you to have a chance to score the biggest profits, so I’d like to share the research that’s already helping my Future Giants investors rake in the big bucks.

Take a little time out of your day today and get all the details so that once markets open back up on Monday, you can get yourself invested and start dreaming of how you’ll spend those “lithium fracking” profits, too.

To your wealth, Jason Williams After graduating Cum Laude in finance

and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private

sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team

responsible for billions of dollars in daily trading. Jason left Wall Street to found his own

investment office and now shares the strategies he used and the network he built with you. Jason

is the founder of Main Street

Ventures, a pre-IPO investment newsletter; the founder of

Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock

newsletter. He is also the managing editor of Wealth

Daily. To learn more about Jason, click here. Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube