Obama Destroys 2,900 Jobs

Here’s the deal: Overt political attacks coupled with an abundance of natural gas is killing the coal industry in the United States.

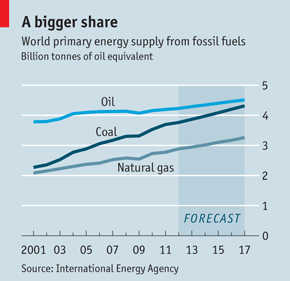

The country is producing — and using — less coal. And this is happening at a time when emerging markets are rapidly increasing their use of coal for electricity.

Here are the facts:

Fact: China’s domestic coal industry produces more primary energy than Middle Eastern oil does.

Fact: The IEA reckons India could surpass America as the world’s second-largest coal consumer by 2017.

Fact: U.S. coal consumption will fall by 14% between 2011 and 2017.

Logic would dictate that the government would smooth the way for exports, and turn America into the Saudi Arabia of coal. This would help balance our global trade deficit, ease debt through export taxes, and create tens of thousands of new jobs.

Coal Killer

The reality is the government is attempting to shut it all down.

The most recent example is the death of the $3 billion Las Brisas coal power plant in Corpus Christi, Texas.

Chase Power announced yesterday it was canceling the project. As reported by the Corpus Christi Caller-Times:

Chase Power… has opted to suspend efforts to further permit the facility and is seeking alternative investors as part of a plan of dissolution for the parent company.

The (Las Brisas Energy Center) is a victim of EPA’s concerted effort to stifle solid-fuel energy facilities in the U.S., including EPA’s carbon-permitting requirements and EPA’s New Source Performance Standards for new power plants. These costly rules exceeded the bounds of EPA authority, incur tremendous costs, and produce no real benefits related to climate change.

The plant would have employed an estimated 2,900. And so it goes for the little guys.

The big boys play by different rules. We’ve told you before how Warren Buffett and President Obama conspired to shut down the Keystone Oil Pipeline…

Make no mistake; the president’s big partner is playing for keeps. Buffett saw U.S. coal use declining and exports increasing, and bought BNSF Railway.

According to Forbes, “Coal is one of the biggest single items the nation’s railroads ship every year, making up 21% to 24% of the total volume and upwards of 31% of the company’s freight revenue.”

Other railroads like CSX are getting hurt because they aren’t on a coal export line, which runs from the upper Midwest to the Pacific Ocean.

U.S. Loses to Canada

Port Vancouver just over the Canadian line is going ahead with three new expansions that will make Vancouver the largest coal port in North America. It plans to go from exporting 8.5 million tonnes of coal to more than 50 million tonnes of coal.

In the Eastern Hemisphere, they have no qualms about coal. China has a pipeline of coal projects estimated to produce 620 million tonnes of coal by 2015, while Australia plans to expand coal exports to 408 million tonnes by 2025.

The ETF

There are a number of ways to play the long-term growth in emerging market demand for coal.

One way is to buy the Market Vectors Coal ETF (NYSE: KOL). The ETF plays miners, equipment producers, and trains. It is down from around $50 in 2011 to $24.90 today. Its top five holdings are China Shenhua Energy Company (HK: 01088), Consol Energy (NYSE: CNX), Joy Global (NYSE: JOY), Peabody Energy (NYSE: BTU), and AURIZON FPO (ASX: AX).

The problem with ETFs is that you get the good with the bad.

In the current market environment, you want to own a piece of the Australian coal industry.

The one that’s going up is AURIZON.

AURIZON is Australia’s largest rail freight company with services operating across five states.

In 2011-2012 Aurizon transported more than 250 million tonnes of freight — including coal, iron ore, other minerals, agricultural products, and general freight.

The company also operates and manages the 2,670-kilometer Central Queensland Coal Network that links mines to coal ports at Bowen, Mackay, and Gladstone.

Maybe this Buffett guy knows a thing or two…

All the best,

Christian DeHaemer

Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.