Remember the first time you heard about lithium?

No? I was just checking. Me either.

But I sure wish I did. Because that would mean I’d been paying attention.

Because if I’d been paying attention and realized the magnitude of what I was hearing about, I would have gone out and found every single lithium producer with a stock that was publicly traded.

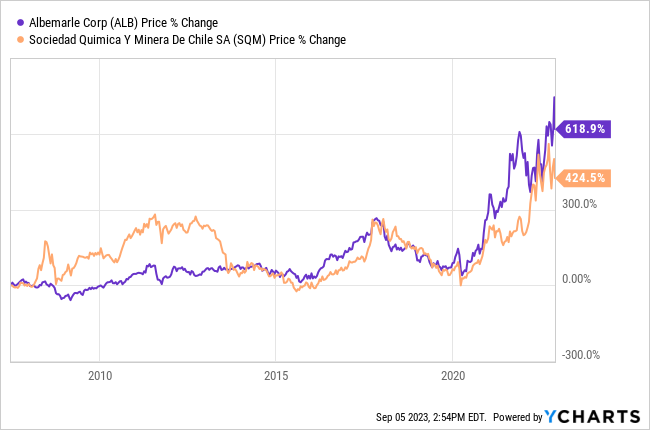

I would have bought major mining stocks like Albemarle and SQM back in 2007 when the first iPhone debuted with a lithium-ion battery that was super-powerful at the time but is now obsolete.

I’d be sitting on not one but two triple-digit gains. All without having done any digging to find “unknown names,” either

And if I had been willing to do a little digging, I’d probably have uncovered Lithium X. And I could have bought it at $0.17 a share in 2010 when Elon Musk took Tesla public. Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

I’d have been able to ride that wave of interest all the way to the 2017 buyout of the entire company for $2.61 per share in cold, hard cash profits.

That’s 14 times more than what it was trading for just a few years earlier. And it would have turned a well-placed $10,000 into a well-earned $153,529.

A little more research might have turned up Lithium Americas Corporation, which could have been bought for just $0.70 a share only 10 years ago.

But by late 2021, it was trading hands for over $50 a share, scoring early buyers a 7,360% gain and turning every dollar invested into $74 to spend on whatever they wanted.

So if you also weren’t paying attention back then when you first heard about lithium, I certainly would be the absolute last to hold it against you.

But if you, like me, weren’t listening then, then you need to be listening now, just like I am…

Because if you think the growth I just got done talking about was impressive, in the words of Bachman-Turner Overdrive, “you ain’t seen nothin’ yet.”

More Phones Than People

According to the Worldometer World Population Clock, there are 8.06 billion people in the world (and counting).

And according to data compiled by BankMyCell, 90% of the people in the world own a mobile device.

But according to Statista, there are about 15 billion mobile devices in the world.

That’s almost twice as many mobile devices as there are people…

And behind every single one of those devices is a lithium battery. Now, there’s not a ton of lithium in each one, but when you add them all up, there are thousands of tons of it combined.

In fact, the 1.5 billion new smartphones sold in 2021 alone required 1,500 tons of lithium to provide the batteries they need to function.

That’s 1.5% of the lithium produced by all the mines in the entire world just to make batteries for the new phones.

That’s obviously a fraction of the story. But it still plays a role.

Because, while we’ll talk about the elephant in the room when it comes to battery demand (electric vehicles, or EVs), we can’t forget that every single electronic device every single consumer in the world uses requires lithium to function, too.

And that’s tens of thousands of combined tons of demand added to an already out-of-balance equation.

Today’s “Technology” Is Tomorrow’s Bottleneck

And we need to keep those small electronics in mind because as the EV market gets bigger and bigger and more and more people transition from fossil fuels to batteries, the very limited supply we have will get stretched thinner and thinner to the point where we just won’t have enough to go around.

You see, EV adoption is projected to increase dramatically over the next few years. Even the most conservative estimates put upwards of 125 million new EVs on the roads by as early as 2030.

All those new electric vehicles are going to require a battery. And all of those batteries are going to require lithium, barring some breakthrough in the newer battery materials currently under testing.

So, using a little simple math, we can figure out what the lithium demand generated by new EVs alone (let alone the used ones that need new batteries) is going to be.

Each EV battery has, on average, about 18 pounds of lithium. So 18 pounds per EV times 125 million EVs puts that figure somewhere in the neighborhood of 2.25 BILLION pounds, or about 1.125 MILLION tons.

Now, let's talk lithium production for a second. 2022 was a banner year for lithium miners. They unearthed more of the metal than ever in history. The total global haul of 130,000 metric tons was 21% more than the previous record, set in 2022.

Let that sink in for a minute… 130,000 metric tons in a year is humanity’s collective record for lithium production.

And by 2030, we’re going to need 1.125 MILLION tons to satisfy the demand from EVs alone…

If that weren’t bad enough, the World Bank recently highlighted another daunting statistic: By 2050, our global hunger for lithium could increase ANOTHER 500%!

That math just doesn’t add up. Not without a whole lot more lithium mines or a MAJOR technological shift in the way we extract lithium…

You see, current mining techniques, mainly extracting lithium from deposits beneath salars, or salt flats, are both time-consuming and environmentally damaging.

After pumping massive quantities of limited freshwater down into the reservoir to pressurize it and drive the lithium up, the liquid is then transported to a gigantic complex of man-made ponds.

There it sits for up to two years under the heat of the sun as the excess water is evaporated away and a slushy sludge is left behind.

The sludge is then treated with harsh chemicals to strip out the contaminants and leave the miner with usable lithium.

It takes several years to produce the lithium. And it’s devastating to the surrounding environment.

Tomorrow’s Technology Debuts Today

So if we’re going to stick with that method, then analysts are right and we’ll need to add another 400 or more lithium mines to the fold (in the next seven years) to keep up with demand.

But since there are less than 100 lithium mines currently in operation, I’m pretty sure that any solution requiring 400 more isn’t a solution at all.

What we need is a transformation.

We need a disruptive force to take the lithium production industry by storm the way that hydraulic fracking did when it unleashed the power (and profitability) of American oil.

And that, ladies and gentlemen, is what I’m convinced we have…

Because I’ve recently uncovered a handful of companies implementing just such a disruptive technology in the lithium fields as you read this missive.

And the success they’re seeing is so phenomenal that one of them is fending off a hostile takeover attempt by investors trying to swoop in and steal all the profits for themselves.

In fact, I’ve taken to calling their technique the “instant” lithium method because we’re talking about lithium produced in a matter of days instead of years. And that’s not all…

The techniques these companies are currently pioneering and perfecting are able to unlock 90% of the lithium hidden away in these deposits.

When compared with the 30%–40% that current standards extract, it’s like racing a hot rod against a horse and buggy… There’s just no competition.

This is scientific innovation at its finest, coming to the rescue at the exact time when we need it most.

After decades of research and development, lab testing and retesting, this instant lithium method of extraction is finally ready to hit the field.

And I’m convinced that it’s about to completely restructure the lithium production industry from the bottom all the way to the top.

Any company that doesn’t figure out how to take advantage of this new technology these companies are pioneering right this moment is dead in the water.

And tiny operations like the ones I’m talking about are either getting snapped up by bigger ones or taking their place at the top of the industry.

That’s how transformative this new technology could be for the companies that were the first to implement it.

In fact, I was so impressed by these companies and their newfound ability to produce “instant” lithium that I put together a special presentation for the members of my premium investing community.

I wanted to make sure they all knew exactly how transformative this new technology is and how profitable I’m sure these companies will be as they harness it.

And today, I want to share that same presentation (and an accompanying report) with you, so you can take advantage of my research the same way the members of our community are.

Take some time today or over the weekend and get all the details so you, too, can start profiting from “instant” lithium… well… instantly.

To your wealth, Jason Williams After graduating Cum Laude in finance

and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private

sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team

responsible for billions of dollars in daily trading. Jason left Wall Street to found his own

investment office and now shares the strategies he used and the network he built with you. Jason

is the founder of Main Street

Ventures, a pre-IPO investment newsletter; the founder of

Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock

newsletter. He is also the managing editor of Wealth

Daily. To learn more about Jason, click here. Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube