Solid-state battery stocks are making waves on the exchanges. And there's good reason for that.

The evolution of battery technology has become a driving force in reshaping industries, from EVs to renewable energy storage.

solid-state batteries are game-changers, pledging increased energy density, safety, and faster charging. For investors seeking opportunities in this dynamic landscape, delving into the solid-state battery industry could yield promising returns.

Today, we're going to explore the world of solid-state batteries and take a look at three solid-state battery stocks. Investors looking to gain exposure to solid-state battery stocks have come to the right place. Now let's get into it… Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they

hit Wall Street. Become a member today, and get our latest free report: “Why You Need to Fire Your Money

Manager.”The Best Free Investment You’ll Ever Make

It contains full details on why money managers are overpaid and provides you with

tools for growing your wealth.On your own terms. No fees, no comission.

What Are Solid-State Batteries and Why Do They Matter?

solid-state batteries differ from traditional lithium-ion batteries by replacing the liquid electrolyte with a solid material, resulting in a safer and more efficient energy storage solution. The lack of flammable parts reduces safety worries, positioning them as excellent options for EVs, electronics, and renewable energy.

These batteries offer a compelling advantage: increased energy density. More energy in less space extends electric vehicle range, minimizing recharging frequency. Moreover, solid-state batteries exhibit faster charging capabilities, addressing a key challenge in the electric vehicle market.

The Market Potential and Growth Prospects

The solid-state battery market is poised for significant growth. Cleaner, more sustainable energy drives rising demand for high-performance energy storage solutions worldwide. Electric vehicle manufacturers are particularly interested in adopting solid-state batteries to enhance the driving range and charging speed of their vehicles.

According to industry reports, the solid-state battery market is projected to experience a compound annual growth rate (CAGR) of over 30% by 2028. This growth trajectory is indicative of the transformative potential of solid-state batteries across various sectors.

The Technology Behind Solid-State Batteries

Understanding the technology that underpins solid-state batteries can provide investors with valuable insights into their potential advantages.

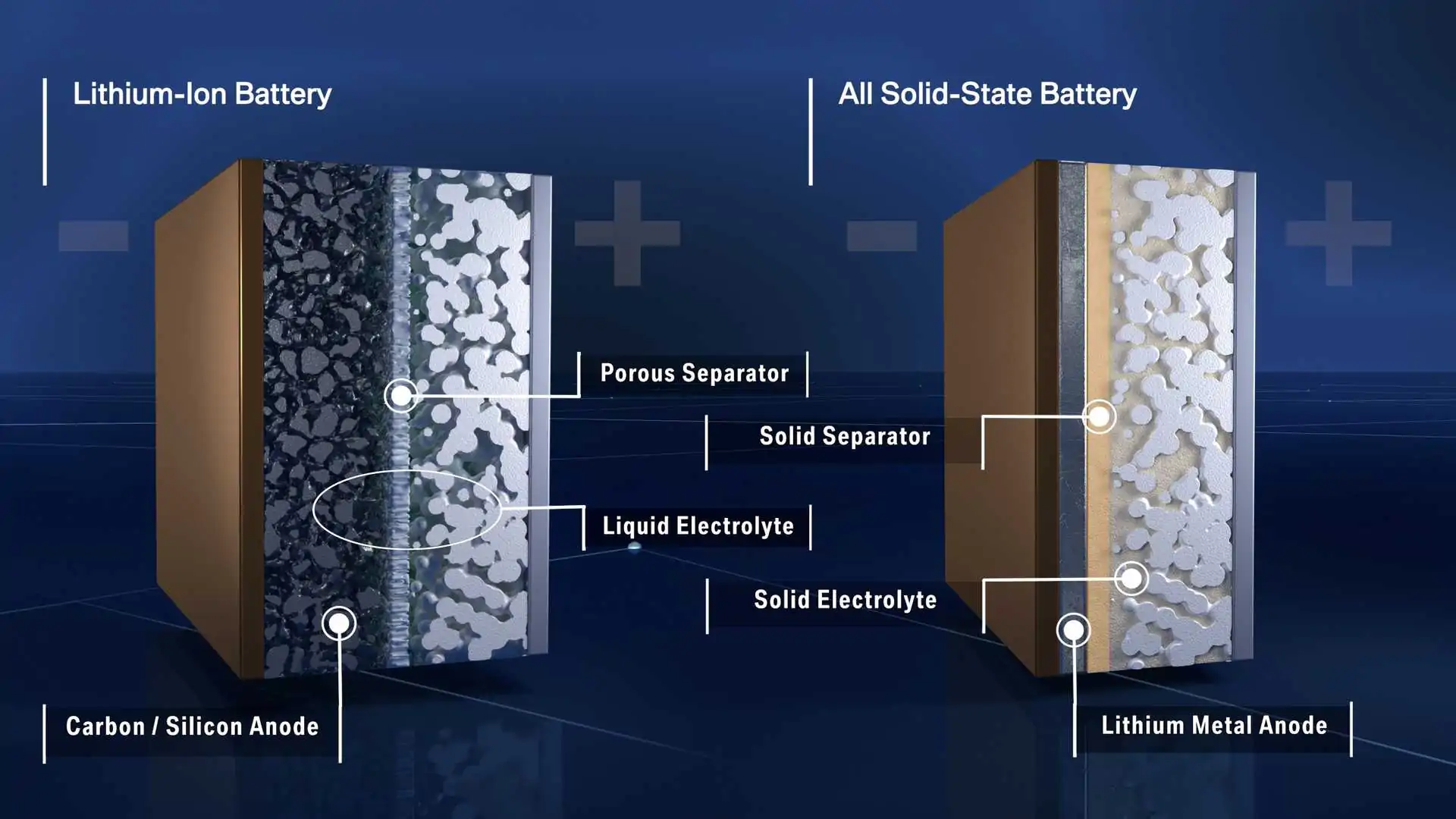

Traditional lithium-ion batteries use a liquid electrolyte to facilitate the movement of ions between the cathode and the anode during charging and discharging. This liquid component, while effective, can pose safety risks due to its flammable nature.

Solid-state batteries, on the other hand, use a solid electrolyte, which eliminates the need for liquid components. This design not only enhances safety but also enables the use of materials with higher energy density. Solid electrolytes can potentially accommodate lithium metal anodes, further boosting the battery's energy storage capacity.

The solid-state design also addresses the issue of dendrite formation. Dendrites are tiny, needle-like structures that can grow within a battery over time. This leads to potential short circuits and reduced performance. Solid electrolytes mitigate dendrite growth, resulting in increased battery lifespan and reliability.

Top 3 solid-state Battery Stocks to Consider

Investors aiming to benefit from the solid-state battery revolution should monitor these three promising stocks:

QuantumScape Corporation (NYSE: QS)

QuantumScape has swiftly positioned itself as a frontrunner in the solid-state battery landscape.

With a focus on advancing energy storage technology, QuantumScape has secured key partnerships within the electric vehicle ecosystem.

Its pursuit of a solid-state battery with groundbreaking performance has garnered significant attention from both investors and industry players.

Solid Power, Inc. (NASDAQ: SLDP)

Solid Power shines as a dynamic player in the solid-state battery realm.

The company's dedication to research and development has yielded impressive results, with its batteries showcasing the potential for enhanced energy density. Collaborations with leading automakers underscore Solid Power's commitment to commercializing its innovative technology.

Ilika plc (LON: IKA)

Ilika plc specializes in miniaturized batteries and materials innovation within the solid-state battery sector.

With a growing portfolio of patents and a strong emphasis on commercial applications, Ilika is poised to capitalize on the expanding demand for compact, high-performance energy storage solutions.

Key Considerations for Investors

While the solid-state battery industry shows immense promise, investors should be mindful of potential risks and challenges. Like all new technologies, challenges could arise regarding mass production, cost efficiency, and competition with established battery makers. Conducting thorough due diligence and staying updated on industry trends is essential for making informed investment decisions.

One significant challenge is manufacturing scalability. Transitioning from lab-scale prototypes to mass-produced batteries requires optimizing production processes while maintaining high-quality standards.

Additionally, cost-effectiveness remains a key consideration. As with any new technology, the initial production costs for solid-state batteries may be higher than those of traditional lithium-ion batteries. However, as manufacturing techniques mature and economies of scale come into play, these costs are likely to decrease.

Conclusion on solid-state Battery Stocks

The solid-state battery industry stands at the forefront of innovation, offering a glimpse into the future of energy storage and transportation.

With the potential to revolutionize electric vehicles, consumer electronics, and renewable energy systems, solid-state batteries have captured the attention of investors seeking growth opportunities in the evolving landscape of technology and sustainability.

Investors intrigued by the solid-state battery industry should approach their investment strategy with diversification and risk management in mind.

While the potential for growth is significant, the landscape of emerging technologies can be unpredictable.

The solid-state battery industry represents a captivating intersection of technology, energy, and sustainability. As these batteries inch closer to commercial viability, their impact on electric vehicles, electronics, and renewable energy storage could reshape entire sectors.

Simply put, Investors chasing innovation can find growth potential by exploring solid-state battery stocks. However, investors should approach this nascent market with caution, understanding the potential risks alongside the potential rewards.