Taking Out the Eurotrash: Buy Silver

All my screens were a happy green this morning…

The Dow was surging. Oil was up to $84. Gold hit $1,627 an ounce. The Hang Seng was up 2.44%. Silver crested 29 bucks an ounce.

Nick Hodge said, “The market loves a bailout,” as he rode by on the office scooter, laughing and shaking his head.

So it does.

Or maybe it’s the debt the market loves…

I remember when I spent the grand sum of $75,000 on my first house.

My family members and friends congratulated me on my purchase, while all I could think at the time was, “I’ll never pay it off!”

I asked my then wife, “Why do people congratulate you on going into massive debt?”

Perhaps it’s human nature.

Debt means you are committed. You literally have a foundation. It’s serious business. No one takes on a large debt without the gravitas of a mortician…

This is why when, over the weekend, Spain decided to forgo its Iberian hubris and ask the European Union for 100 billion euros (US$124 billion), the markets went up.

According to the Christian Science Monitor:

Spain on Saturday agreed to accept a bailout for its cash-starved banks as European finance ministers offered an aid package of up to $125 billion.

The decision made Spain the fourth and largest European country to agree to accept emergency assistance as part of the continuing debt crisis.

The aid offered by countries that use the euro was nearly three times the $46 billion in extra capital the International Monetary Fund said was the minimum that the wobbly Spanish banking sector needed to guard against a deepening of the country’s economic crisis.

Debtors Spend

Spain needed $46 billion, and the IMF gave them $125 million.

Because to a politician or a banker, the answer to a debt crisis is always MORE DEBT.

The markets are finally coming around to this faulty logic.

People don’t like debt; they like things bought and paid for.

Markets don’t rise on debt; they rise on money printing because inflation makes stocks go up even as it destroys the currency.

Debtors aren’t serious because it’s not their money.

Pain in Spain

Spain is in trouble.

Unemployment is at 25% with youth unemployment at 51.5%! Housing prices are down 30%. Bad loans on held by banks are at 8.4%, the highest since 1994.

GDP will shrink 1.8% this year.

Throwing another $124 billion at the problem won’t solve it. It will only make it worse.

Spain will need another bailout before this is all over…

And that one won’t help, either.

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “Silver Outlook for 2019”

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

Bailout City

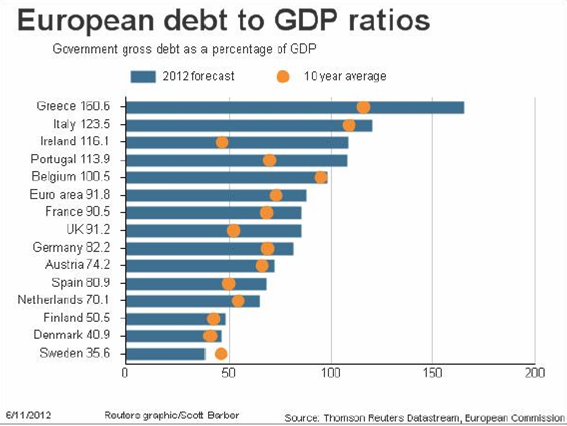

Spain isn’t the first of the Eurotrash to go under, and it won’t be the last.

Italy is in the on-deck circle.

Eurotrash

No one knows where it will end, but we do know there will be more bailouts, more debt, and more malinvestment.

It looks as though the market has run out of “greater fools.”

The screens are red as Wealth Daily goes to print…

Sincerely,

Christian DeHaemer

Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.