This past Monday, my wife and I returned to Baltimore from a seven-week trip to Longboat Key, Florida. Our flight was packed.

So was every other flight.

So much so that many of the major airlines had to cancel, reschedule, or delay fights.

Flying in the United States recently has been a nightmare for many travelers.

ABC reported on August 2:

The airlines [American and Spirit] canceled more than 800 flights combined on Monday and delayed more than 1,000.

A Spirit spokesperson told ABC News the cancellations are the result of a “perfect storm,” blaming weather, staffing shortages and crews reaching the hour limits in which they are legally able to fly.

Transportation Security Administration (TSA) officers screened more than 2.2 million people at U.S. airports nationwide Sunday — the highest checkpoint volume since the start of the pandemic.

All U.S. airlines and the TSA have struggled with staffing as air travel has rapidly jumped from historic lows to approaching pre-pandemic levels.

This is all due to The Great Reopening.

In last month’s analysis of my macro-investment thesis, “The Great Reopening, Part 1,” I laid out the events the United States specifically — and the rest of the globe generally — were experiencing in the beginning of the 1920s decade.

Let me quickly remind you what was happening 100 years ago:

- End of the Spanish flu pandemic.

- End of World War I.

- Emboldened by the Bolshevik Revolution in Russia in 1917, Marxism sweeps across the West.

- Social and political unrest: U.S. Communist Party riots from coast to coast, burning down city blocks and bombing the opposition.

- Social and political liberation: Women’s suffrage.

- Cancel culture: Prohibition.

- A great social flowering with jazz clubs and speakeasies.

- A technological explosion with mass adoption of electricity, indoor plumbing, airplanes, automobiles, radio, and the refrigerator and washing machine.

- Severe economic contraction: U.S. GDP falls nearly 5%, unemployment rises to 11%, and the Dow drops 32%.

Many of these negatives bottomed out, and by 1922, the markets were full of rocket fuel.

The Dow ran up 500%, outpacing the overall economy by a factor of 10 (U.S. GDP increased 42% in the decade).

Fast-forward to 2020–2021. Here’s what is happening right now in the United States specifically and the rest of the planet generally:

- The COVID-19 pandemic is coming to an end.

- The United States is ending its 20-year war in Afghanistan.

- Widespread political and social unrest: A yearlong Marxist (antifa and BLM) riot from coast to coast in the U.S. and a far-right riot on June 6, 2021, at Congress.

- The Dow crashed 36% between February and April 2020.

- 40 million Americans lost their jobs; currently 9 million jobs are unfilled.

- GDP contracted 13%.

- The U.S. savings rate is still at abnormally high levels.

- A social flowering with mass acceptance of cannabis for medical and recreational use and psychedelics for medical use.

- A technological explosion with artificial intelligence, telemedicine, mRNA vaccines, mainstream adoption of electric vehicles, 5G, and commercial acceptance of cryptocurrencies.

I consider these to be the most important economic factors heading into the rest of this decade. But the factors I consider to be the fuel for an epic bull run in the coming years are massive disposable capital in the form of the current savings rate, low interest rates, the massive amount of unfilled employment positions, and an economy that’s restarting at a near-zero baseline.

Let me explain.

My 16-year-old daughter recently lost her job. She worked at an eatery that had become one of the most popular breakfast spots in our county.

But the owner — an immigrant from South America — had to close his doors for good. Why? He couldn’t find enough employees.

Here’s his Facebook post:

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

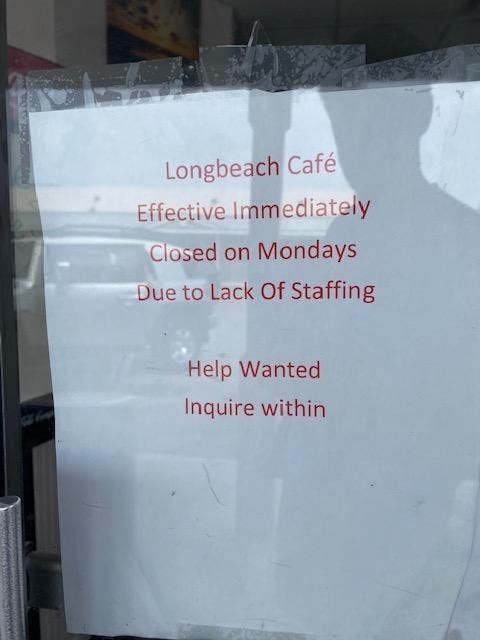

And this was posted on the front door of our breakfast spot on Longboat Key:

There are “Hiring” signs everywhere.

Not just in Florida or Maryland. Everywhere. In fact, there are more than 10 million job listings in the U.S. right now: A record.

But even with the record number of job openings, travel bottlenecks, and the call for more lockdowns and restrictions because of the spike in the COVID delta variant, the markets and the economy march on.

You see, in March of this year, the U.S. savings rate was nearly 27%. Total savings in the U.S. is roughly $2.3 trillion. To give you an idea of how staggering that is, it’s larger than the GDPs of 205 countries.

When that capital starts getting invested and spent (as it is starting to), it’ll act like a trampoline for the markets.

I urge you to listen to Chris’ advice. Two of the stocks he recommended right before the COVID lockdown have returned 440% and 222%, respectively.

You can get his free presentation by clicking here.

Profitably yours,

Brian Hicks Brian is a founding member and President of Angel Publishing. He writes about general investment strategies for Wealth Daily and Energy and Capital. Brian is the managing editor and investment director of R.I.C.H Report (Retired Independent Carefree Healthy) and New World Assets. For more on Brian, take a look at his editor’s page.

P.S. I’ll be speaking next week at the MoneyShow on Tuesday, August 10, starting at 2:40 p.m. EST. I’ll further discuss my Great Reopening investment thesis… and the three stocks I think will be some of the best-performing investments for the next several years.

You can watch my presentation live and online from the comfort of your own home or office. Go here to reserve your spot.