Unless you’ve been living under a rock — or you yourself are currently under quarantine for coronavirus infection — you’ve probably heard about the public health emergency in China. The world’s most populous country has effectively been brought to a standstill by an outbreak of a novel flu-like virus.

Monica Savaglia of Wealth Daily and The IPO Authority gave readers a comprehensive breakdown of the current coronavirus outbreak situation, and its immediate effects on financial markets, here. Check it out if you haven’t been following the news from China closely.

Today, however, we’re looking at the long-term effects of this outbreak on your investments. As we’ll see in a moment, the economic impact of this disease is just starting to show itself…

Why the Coronavirus Outbreak Has Long-Term Significance

Some financial pundits assert that the coronavirus outbreak is “just another disease scare” and that the market will shrug it off.

And to be sure, the virus itself is not the end of the world. Only a few thousand people have been infected, and most have only gotten minor cold or flu symptoms.

However, it could be deadly for babies, the elderly, and people with compromised immune systems. And since it’s a brand new, previously-unknown-to-science virus, there’s no vaccine or treatment protocol.

From a public health perspective, China is reacting appropriately by locking down the city of Wuhan (the epicenter of the outbreak) and shutting down transit throughout the country.

But from an economic perspective, these aggressive quarantine procedures could not be happening at a worse time of year.

You see, last weekend marked the Lunar New Year, China’s biggest holiday by travel volume.

Many of China’s 1.4 billion people traditionally leave the big cities for the holiday and return to their ancestral hometowns to exchange gifts, money, and good tidings with their extended families.

As a result, the Lunar New Year also serves as an economically important nationwide spending spree. Last year, Chinese consumers spent $149 billion across the holiday. This year, that total was expected to rise to $156 billion…

Except, it probably didn’t get anywhere near that high because the entire country was under strict quarantine procedures due to the coronavirus outbreak.

Recent photos from Shanghai and other large Chinese cities show eerily empty roads and trains during what should be one of the busiest periods of the year.

Source: Yahoo Finance

Source: Yahoo Finance

In other words, this virus has likely taken a huge bite out of China’s economically crucial first quarter consumer spending. That could really sting when earnings season comes around, especially for the growing number of American companies that draw most of their revenues from China.

These Companies Could See Their Earnings Hit by the Coronavirus Outbreak

It’s worth repeating the fact that China is the most populous country in the world with some 1.4 billion citizens.

It is also, by certain measures, the largest national economy in the world, with a purchasing-power-adjusted gross domestic product (GDP-PPP) of $27 trillion.

With those statistics in mind, it shouldn’t be surprising that China is one of the largest markets for a number of U.S.-listed companies.

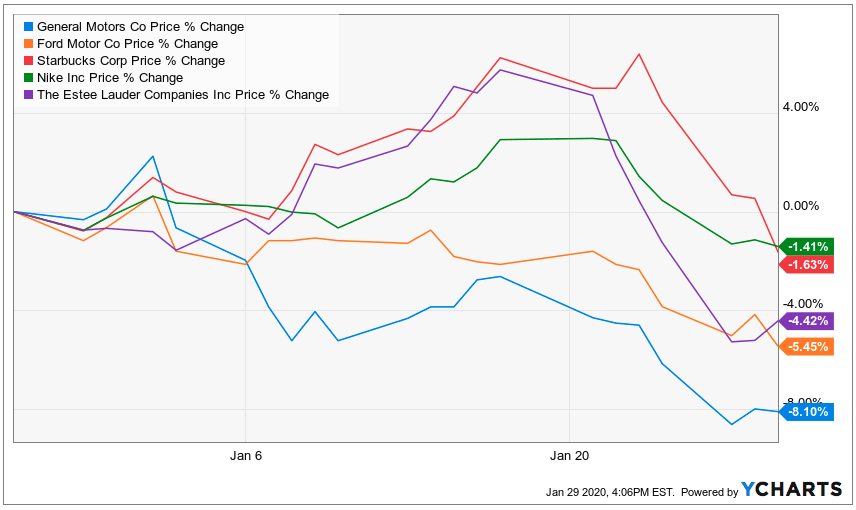

It’s the largest market for General Motors (NYSE: GM) and the second largest for Ford (NYSE: F) and Starbucks (NASDAQ: SBUX).

It’s also a crucial market for several American retailers, including Nike (NYSE: NKE) and Estee Lauder (NYSE: EL), both of which earn 17% of their total revenues in China.

As you can see, each of these companies has traded downward in the last month. And as we just discussed, there’s reason to believe they’ll continue hurting into first-quarter earnings season.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they

hit Wall Street. Become a member today, and get our latest free report: “Why You Need to Fire Your Money

Manager.”

It contains full details on why money managers are overpaid and provides you with

tools for growing your wealth. On your own terms. No fees, no comission.

So if these big American exporters are wavering in the face of the coronavirus outbreak, where should investors put their money while they wait for it to blow over?

The Most Coronavirus-Resistant Stocks

It stands to reason the stocks that will be least affected by the coronavirus outbreak are those with the least exposure to China.

And it’s hard to think of a better example of a set of China-free stocks than Big Tech.

Microsoft (NASDAQ: MSFT), Alphabet (NASDAQ: GOOG), and Facebook (NASDAQ: FB) are all shut out of the Chinese market already; citizens of the country instead use homegrown alternatives like 21Vianet, Baidu, and Renren, respectively.

These three stocks have not necessarily been winners for the last couple of years. In fact, they’ve been under heavy selling pressure amid regulatory scrutiny.

But this selling pressure has brought down their valuations to more comfortable levels. And as you can see, none of these stocks have posted losses during the recent coronavirus outbreak.

These three stocks should serve as relative safe havens from coronavirus-related selling… but there’s another American tech stock with no China exposure that is worth watching in this context.

This former fintech unicorn is up more than 33% since its recent IPO, and IPO Authority subscribers have been banking those profits for months. Learn more here.

Until next time,

![]()

Samuel Taube

Samuel Taube brings years of experience researching ETFs, cryptocurrencies, muni bonds, value stocks, and more to Wealth Daily. He has been writing for investment newsletters since 2013 and has penned articles accurately predicting financial market reactions to Brexit, the election of Donald Trump, and more. Samuel holds a degree in economics from the University of Maryland, and his investment approach focuses on finding undervalued assets at every point in the business cycle and then reaping big returns when they recover. To learn more about Samuel, click here.