Well, it was a rough week in the markets last week…

It all started off with Fed chief Jerome Powell testifying before Congress.

The senators and representatives did their best to take advantage of their time in front of the cameras, but most just showed they have zero understanding of how economies function.

But the testimonies did serve to really hammer home the message the entire Federal Reserve has been trying to get across to markets for about a year now…

“If you think rates are high now, you ain’t seen nothing yet.”

Now the markets are finally paying attention and it seems everyone has realized that a shallow recession is probably the bullish case at this point.

The bear case is for a deep, global recession to rival that of 2008. Or for stagflation to set in and U.S. markets to lose a decade of growth to inflation and poor policy the way they did in the 1970s.

Either way, none of those are really great scenarios — in my humble opinion, at least.

Red Flags for Months

But it’s not like we haven’t had ample warning…

The formerly favored gauge on whether a recession is coming — the Treasury yield curve — has been inverted since last July:

Last time that happened, it lasted about a day and it was all the talking heads on CNBC could talk about for the next month or two.

This time they’ve been pretty quiet about it despite it having predicted the past seven recessions (shown in gray in the chart below):

I could wager some guesses as to why they’re not panicking about it this time (different president in office, different policies causing problems, different narrative to enforce), but that’s not what I’m here for.

I’m here to help you prepare financially for anything the economy and stock market might throw at you.

And right now it’s throwing a monkey wrench of a recession fight into the gears of your economic motor.

In the past, it’s taken between 12 and 18 months for a recession to hit after the yield curve inverts.

So if history is any guide — and it usually is — that means we have until sometime between June (three months from now) and December (nine months from now) before a recession sets in.

It could happen sooner, but that’s the historical window after an inversion, so that’s what we’ll run with for now.

So, with a recession pretty much guaranteed to strike in the next three–nine months, what can you as an investor do to protect your finances? Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

Volatility: A Trader’s Best Friend

Well, first off, you can profit as much as possible before the inevitable strikes.

There’s bound to be a lot of volatility as we approach day zero. There always is.

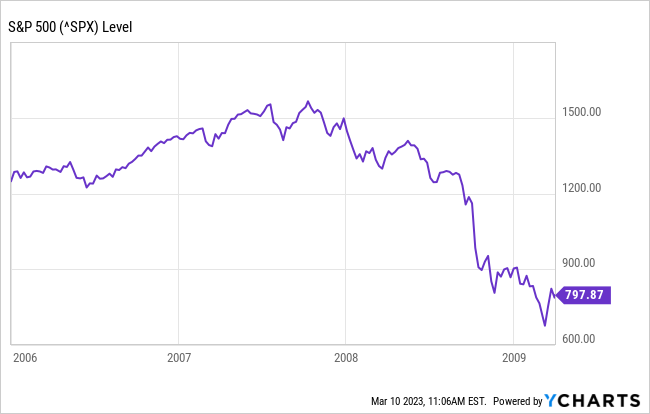

Just take a look at this chart of the last truly recessionary bear market:

That market hit several short-term bottoms on its way to finding a true floor. And every time it did, there was a rally that gave traders a chance for short-term profits.

It’s what the investors in my trading community, aided by our Alpha Profit Machine, have been doing ever since the market started to fall in 2022.

Last year we were invested the whole time and managed to keep our portfolio from falling while markets dropped over 30% in some cases.

We took a few losses, but our gains more than made up for those.

And so far this year, we’ve already closed out three double-digit winners as well as a couple of single-digit ones.

And we’re sitting on even more gains in our open portfolio.

Long story short: There’s a ton of opportunity to make a profit in the final legs of a recessionary bear market, right before the big drop.

[Side note: You can take advantage of our Alpha Profit Machine, too, and supercharge your trading gains. Just go here for a special membership offer.]

But that’s not the only thing you can do to prepare for the inevitable.

It’s not even the best thing you can do. Sure, those quick profits are great.

But long-term gains are really where it’s at.

And for those, you need to invest in assets that pay you no matter what’s happening in the market or economy.

Income: An Investor’s Best Friend

You need to invest in assets that provide steady income year in and year out despite the wild rallies and crashes in the stock market.

You need to invest in programs like the ones I’ve been helping my investment community, The Wealth Advisory, uncover for years…

Programs like “Prime Profits,” which pays investors every time a package leaves an Amazon warehouse and spins off billions of dollars a year no matter what’s going on in the market.

So today I want to help you prepare for what the market just realized is coming (but what my colleagues and I have been warning you about for nearly a year now).

I want to extend a special invitation to join me and the tens of thousands of others who are already splitting multibillion-dollar payouts every year.

People like…

- Tina, a former financial analyst, who’s expecting to pull in $20,173 this year.

- Bill, a former employee at Eastman Kodak, who banked $57,597.32 last year and is expecting over $63,000 this time around.

- And Jeff, who’s been participating in the program even longer than Tina or Bill. He’s calculated this year’s potential haul at a whopping $198,920.28!

I don’t care who you are or how much you’ve got. That kind of money would definitely come in handy during the recession that’s heading our way.

But I’m not doing it just because a recession is most likely right around the corner. That’s only part of the reason…

The real reason I’m sharing it TODAY is that the next payout, which will be the biggest in the program’s storied history, is going to go out later this week.

In fact, it’s going to get calculated TOMORROW… So there’s no time to waste.

On March 14, everyone who’s on the list to get paid will be allocated a piece of a payout that I’ve calculated to be worth a whopping $3 BILLION this year!

And all you have to do is let them know you’re interested in getting paid and you’ll be eligible to collect as much as you want.

But if you’re even a second late and get your name in the hat after markets close on March 14 (that’s TOMORROW), you won’t be eligible for the massive payout coming this week.

Get Your Piece of the Pie TODAY

So do yourself a huge favor and don’t delay. Act right now to claim your piece of this massive prize.

Once you do, you’ll be eligible to continue receiving a portion of that massive pile of cash every three months for as long as you want to participate in the program.

You could even pass your distributions on to your kids and grandkids or nieces and nephews or even your friends and their kids.

And you can spend the cash any way you like.

Some people plow it right back into the program so their payments grow even faster. Others use it to pay their monthly bills.

Others still use it to invest in other opportunities…

And there are sure to be a ton of those when the recession really hits and the markets really find their floor.

That’s when those generational buying opportunities will occur. And this cash will give you an extra cushion to take advantage of those fire-sale prices.

Or it'll help you get through the worst part of the recession without having to cut back on your expenses or pinch any pennies.

So take a few minutes out of your day and check out this presentation in which I explain exactly how you can get a piece of this multibillion-dollar payout starting TOMORROW.

Don’t delay. If you’re even a second late, you’ll have to wait for at least another three months before you’ll be eligible to get paid.

Get set up today and start earning those sweet, sweet “Prime Profits” tomorrow.

To your wealth, Jason Williams After graduating Cum Laude in finance

and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private

sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team

responsible for billions of dollars in daily trading. Jason left Wall Street to found his own

investment office and now shares the strategies he used and the network he built with you. Jason

is the founder of Main Street

Ventures, a pre-IPO investment newsletter; the founder of

Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock

newsletter. He is also the managing editor of Wealth

Daily. To learn more about Jason, click here. Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube