Dear Reader,

How would you like to earn guaranteed income every day, month, or year?

Sound too good to be true?

Well, I'm here to tell you that it’s one of the most basic tenets of investing.

If you understand the concept that I’ll explain below, you’ll be kicking yourself for not taking advantage of it sooner.

You see, first you need to ask yourself one simple question…

Why do I invest?

In other words, what’s the point?

Why go through all this struggle?

Well, personally, I want to be able to live off my investments.

Whenever I tell someone this, they always say something like, “Yeah, that would be nice,” implying that it’s out of the realm of possibility.

But this a very obtainable goal — and something that the richest people in the world do.

So unless I’m looking for some moonshot capital appreciation gamble, more often than not, I like to take the approach of finding companies that will pay me to simply buy and hold their stock, otherwise known as dividend investing.

Now, when I talk to others about investing, a vast majority a) don’t know dividends exist, b) are skeptical of dividends, or c) don’t understand the concept.

I’d like to go through an example from a real company trading in the market today and talk about why this style of investing can potentially add an enormous benefit to your portfolio.

Over my nearly 10 years actively investing in the stock market, I’ve found that dividend investing is the simplest yet most powerful force in the investing world, as it harnesses the power of compound interest.

After all, as Albert Einstein is rumored to have said, “Compound interest is the eighth wonder of the world. He who understands it earns it; he who doesn't pays it."

Now, many investors out there want to make money as fast as possible, which involves greater risk. That’s because there’s no guarantee a stock will go up in price, ever. But if it does go up in a short amount of time and you sell for a profit, you’re dinged with a short-term capital gains tax. That might not matter if you’ve made a lot of money, but typically you want to avoid this, as it eats away your profits.

I’m not a tax professional, but from my understanding, you also have to pay taxes on dividends, but only if you take them as a cash payout. Most savvy investors will reinvest the dividends back into the company. That way, the they prop up the stock and act as a baked-in moat for your portfolio.

So let’s focus on some common questions about dividends first, and then I’ll show you how they work in action. Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

What Is a Dividend?

A dividend is a sum of money — typically in the form of cash — that’s paid to investors who hold shares of a company for a certain length of time. You heard it right: cash. That means if you just own shares of a dividend-paying company, it will deposit cash into your account on a predetermined date. That money comes out of the company’s excess revenues or cash reserves.

Here’s where things get slightly complicated, but I promise it’s just basic arithmetic.

You’ll want to keep track of three numbers: the share price, the annual dividend per share (DPS), and the dividend yield. You can find these numbers through your brokerage or sites like Nasdaq and Finviz, but there are many other sites out there that track these numbers.

Let’s take a real-world example everyone loves to use and look at Coca-Cola (NYSE: KO). As of this writing, Coca-Cola’s share price is $56.91. It pays a yearly DPS of $1.81. Therefore, if we own one share of Coca-Cola, we’ll receive $0.45 each quarter (the annual $1.84 divided by four quarters). If you want to calculate the annual dividend yield, you simply divide the DPS ($1.81) by the share price ($56.91), which gets you 0.031. Move the decimal over two places and you get 3.1%. So now that we know Coca-Cola pays an annual dividend of 3.1%, we can compare it with other companies in the same sector.

But here’s the kicker… If you invest your dividend payment back into the stock — through what's known as a dividend reinvestment plan (DRIP) — you’ll consistently receive a higher and higher payout as the years go on and you accumulate more shares. You can set this up through your broker, and it’s typically a setting you can turn on depending on which service you use.

This dividend payment is most frequently paid out by companies quarterly, but some companies offer monthly payments as well. According to the World of Dividends blog, there are only 60 publicly traded companies that pay monthly dividends. The risk tends to be higher, as they don’t have a track record of consistent payments.

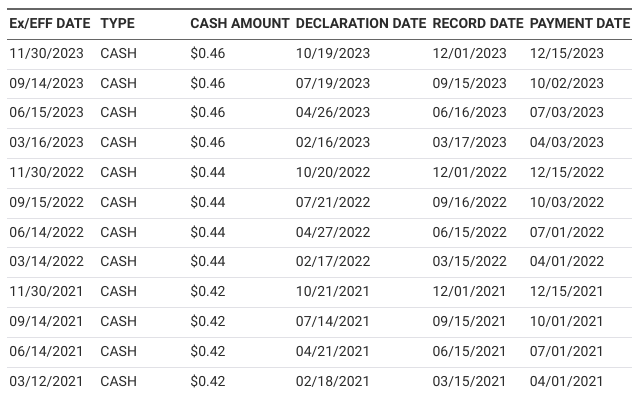

What’s an Ex-Dividend Date?

I mentioned above that a company will pay out the dividend on a predetermined date. When you buy dividend-paying stocks, it’s up to you to keep track of what’s called the ex-dividend date. Think of this as the cutoff date for getting paid. If you own shares up to the ex-dividend date, you’ll get paid for the number of shares you own. This is important: If you buy shares on or after the ex-dividend date, you won’t be compensated for those shares that quarter. You will be compensated in the following quarter, but the payment amount may change.

There’s also the declaration date, which is the day the company announces its dividend payment and payment date.

Risks and Drawbacks

Some investors argue that taking on risk by waiting for the dividend payment doesn’t outweigh just taking the profits if the stock goes up. This is a valid point, and one to consider as you journey through the world of dividends. But, as mentioned above, compound interest is the most powerful force in the universe, so if you want to use it to your advantage, you must reinvest.

Another risk is that sometimes a company won’t have enough money to pay the dividend to shareholders and will have to use debt to make the payment or cut its dividend, which will negatively affect the share price.

Benefits and Strategies

Buying dividend-paying stocks allows you to play different sectors of the economy and get rewarded in the process. You feel like you’re an employee of the company without ever having to do any of the physical work… You let your money do the work for you.

This is the real genius of the stock market. Dividends allow you to slowly build up equity in a company. If you don’t have a lot of cash to throw into stocks, you can start small and let compound interest do its magic. Now, there are three main strategies for buying dividend-paying stocks…

First, you can buy and hold companies that raise their dividend every year and set up a DRIP to reinvest the dividends. There’s a group of companies called the “dividend aristocrats” that have paid and increased their dividend for 25 years in a row. These companies include AT&T (NYSE: T), Exxon Mobil (NYSE: XOM), and IBM (NYSE: IBM). There are also the “dividend kings,” which are companies that have paid and raised their dividend the last 50 years! Companies like Coca-Cola (NYSE: KO), Walmart (NYSE: WMT), and Altria (NYSE: MO) are on that list.

Second, you can wait until the day before the ex-dividend date and purchase shares. This can be a quick way to get paid for owning shares without taking on the risk of holding the stock for an extended amount of time. However, a company’s share price will often go down on or after the ex-dividend date, as investors will sell their shares to take risk off the table but still be rewarded with a dividend payment for owning shares before the ex-dividend date. It’s a bit of a sneaky strategy.

Finally, you don’t have to reinvest the dividends. You can simply take the cash payment in your brokerage account and keep it for a rainy day.

Again, there are tax implications for each strategy, so you’ll want to consult a tax expert if you have questions or concerns.

Real-World Example

Let’s go back to our Coca-Cola example. Here’s a snapshot from the Nasdaq of roughly the last three years’ worth of dividends:

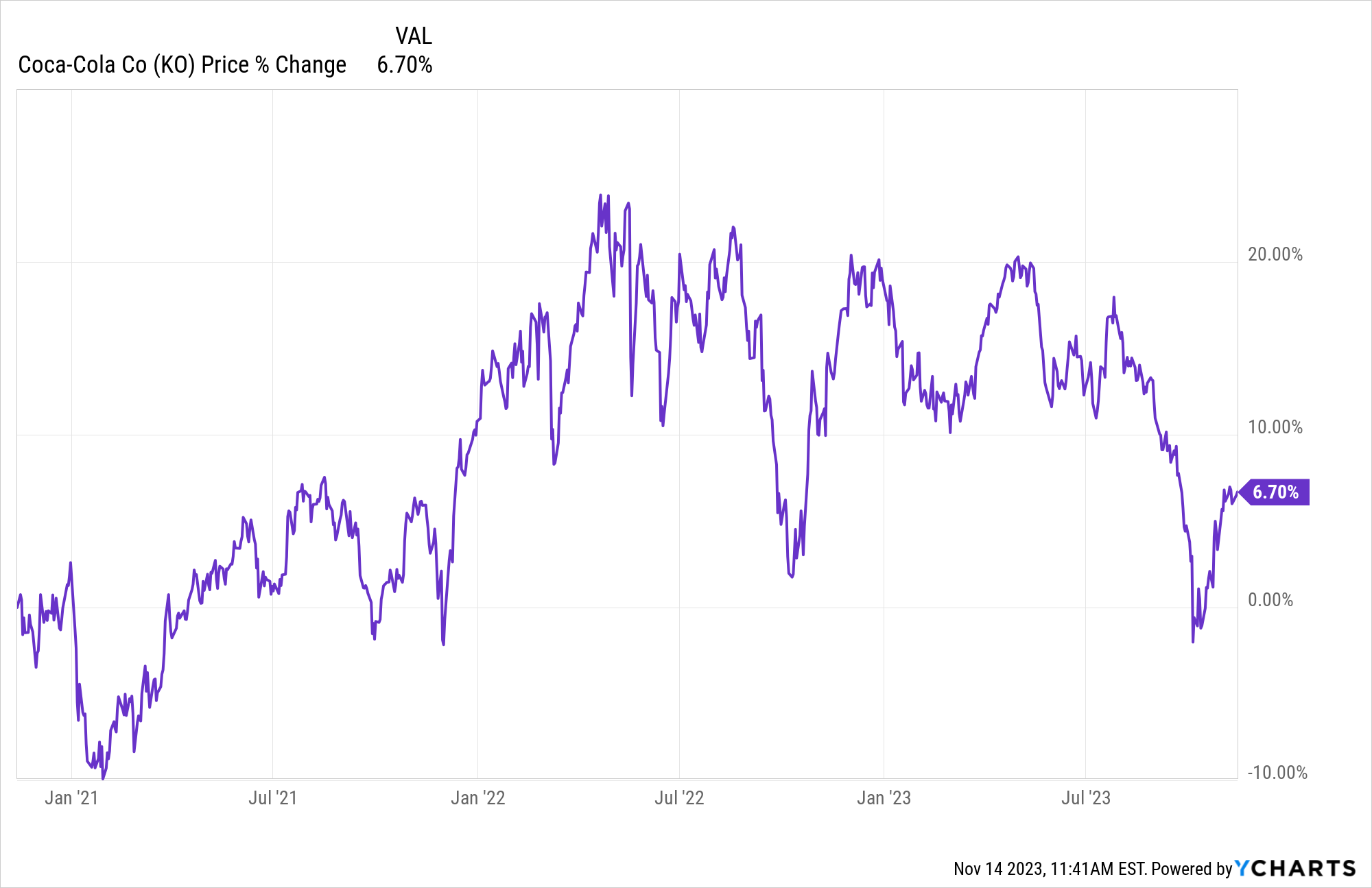

You can see that the company’s raised its dividend payment each year. On top of that, in the same time period, Coca-Cola’s underlying share price has increased nearly 7%.

It’s probably why it’s a top pick for Warren Buffett.

That's because it’s essentially an investing hack that the richest people in the world use to grow their portfolios every single year.

If you're interested in learning more about where the wealthy put their money to keep getting richer, you'll want to watch a presentation I just put together on the topic.

In fact, right now, some of the biggest investors in the market are betting big on one tiny company.

The best part is it trades for less than $1.

See why the rich are buying this tiny company before it's too late…

Stay frosty, Alexander Boulden After Alexander’s passion for economics and investing drew him to one of the largest financial publishers in the world, where he rubbed elbows with former Chicago Board Options Exchange floor traders, Wall Street hedge fund managers, and International Monetary Fund analysts, he decided to take up the pen and guide others through this new age of investing. Alexander is the investment director of Insider Stakeout — a weekly investment advisory service dedicated to tracking the smartest money on the planet so that his readers can achieve life-altering, market-beating returns. He also serves at the managing editor for R.I.C.H. Report, a comprehensive service that uses the highest-quality investment research and strategies that guides its members in growing their wealth on top of preserving it.

Check out his editor’s page here. Want to hear more from Alexander? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

Editor, Wealth Daily

Check us out on YouTube!

Check us out on YouTube!