There’s a huge shortage hitting the electric vehicle industry that could stop mass adoption in its tracks…

And that same shortage is also hitting the solar industry, the wind energy market, even the market for consumer electronics.

You see, there are only a couple of things that those industries all rely on. One is the metal that conducts electricity — but we’ll get to that in another installment.

The other is, as I’m sure you’ve already guessed, lithium.

EVs need lithium for the batteries that make them go. Solar and wind farms need lithium batteries to store the energy they produce for when that energy is needed.

And every single hand-held electronic device in the world needs a lithium battery to keep its user connected.

But as the demand for lithium continues to skyrocket, the supply is increasing at a snail’s pace, at best.

And that’s got analysts, carmakers, alternative energy enthusiasts, and investors the world over pretty nervous about where they’re going to get all that lithium to keep this revolution going.

In fact, analysts are expecting a MASSIVE supply/demand imbalance to hit as soon as 2029 and to only get worse from there:

To put that into perspective, this research suggests we’ll need to bring at least 400 new mines online in the next decade just to break even.

And we’ll need to keep bringing new ones online after that to keep pace with the expected continued growth in demand.

That’s a lot of mines. And each mine takes years to get to the point where it can actually produce lithium.

So even though there are around 300 new lithium projects in the pipeline right now, it’s unlikely that many of them will be producing lithium by that deadline…

What’s the Holdup?

There are many reasons it takes a long time to get a mine up and operational. Some have to do with politics, others with supply chains, and still others with resource viability.

First, you’ve got to find the area you want to explore and see if it even has a good resource. That takes time and money and often yields nothing in return if the lithium isn’t economic to mine.

And if you do hit the jackpot and uncover a productive lithium resource on your property, it can take an equally long time to get all your ducks in a row and cut through all the red tape to get a permit to open a new mine on your site.

Then you’ve got supply chain snafus, which seem to pop up on a weekly basis ever since we shut down the global economy in 2020.

On top of that, labor shortages aren’t just a thing at your local restaurant. They’re a global issue and they’re making it tougher to staff a mine with qualified employees.

And, of course, you’ve got the elephant in the room that is inflation. It’s doubled the price of many supplies necessary for constructing and operating a lithium mine.

And it’s sticking around despite the Fed’s best efforts to tamp it down with high interest rates.

Oh, yeah. I almost forgot about those. High interest rates make it harder and a lot more expensive to finance your exploration, construction, and production.

And even when you finally get your mine set up, staffed, constructed, and operational, using current extraction methods, it can take up to two years before you get any usable lithium you can sell…

Why So Long?

And that’s because the vast majority of the world’s lithium reserves are contained in what’s known as brine reservoirs.

These reservoirs deep beneath the Earth’s crust hold vast amounts of water, and in that water are dissolved lithium salts that can be extracted and refined into the lithium required for the world’s energy needs.

We’re talking about an estimated 70% of the lithium on the planet dissolved in these massive underground lakes.

But the current extraction technology, if you can even call it that, involves pumping fresh water down into the pools to pressurize them and then pumping the brine up into new pools on the surface.

Once in these pools, also known as evaporation ponds, the brine sits for a good two years while the sun does its work and evaporates away the water, leaving a slushy mixture of lithium behind.

Now, as I already told you, this method takes about two years to produce any lithium, which is pretty inefficient. But that’s not where the inefficiencies end.

When you use evaporation to extract your lithium, you’re only able to recover about 40% of the lithium contained in those brines.

The other 60% is unrecoverable and ends up as toxic runoff that pollutes the surrounding countryside.

And if that weren’t enough of a reason to look for a new solution, the process has farther-reaching impacts on the local environment…

These brine reservoirs are typically found in places without much fresh water. And what fresh water they do have is getting siphoned off to pressurize these pools and drive the brine upward.

That means the people living in these already dry regions have to fight the lithium miners for access to clean water to drink, cook with, and water their crops.

It’s not an efficient process, and it’s not incredibly environmentally friendly or socially responsible.

Yet for decades, it’s been considered the best way to extract the majority of the world’s lithium.

But that’s all about to change thanks to a new breed of lithium miners that are pioneering an entirely new way of extracting that precious resource.

Not only are they completely changing the way lithium gets produced, but they could also solve the world’s looming supply/demand imbalance… and make their investors a boatload of cash in the process. Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

Closing the Gap

You see, these small, practically unknown companies are leading the charge on implementing a new kind of lithium mining that’s faster, friendlier, and far more efficient.

Instead of monopolizing the scarce fresh water surrounding their resources, they’re targeting resources that are already naturally pressurized by the Earth’s volcanic and tectonic activity.

Instead of relying on evaporation to extract 40% of the lithium over the course of two years, they’re employing an innovative new process that can extract over 90% of the lithium in just a few days (sometimes as little as a few hours).

They’re literally revolutionizing the entire lithium mining industry, and they’re doing it from the ground up.

These aren’t huge companies like Albemarle and SQM, the world’s two largest lithium producers.

Those guys have far too much to lose by investing in a new and unproven technology.

These are tiny companies with access to great assets that are just looking for a leg up to help them compete against multibillion-dollar competitors like Albemarle.

And that’s likely why they’re not getting any press coverage, despite completely disrupting one of the most profitable and important industries of our time.

They’re too small for institutional investors like the ones who go on CNBC to “talk their books” to invest in.

And they’re not paying the mainstream media for coverage like the big guys can afford to.

For that matter, many of them aren’t even getting analyst coverage because they’re so small and so new to the market.

But they’re all plugging along anyway, revolutionizing the lithium industry and potentially saving the alternative energy (and EV) revolution.

And every day, they’re closing the gap between them and their massive competition.

In fact, one of the companies I’ve pinpointed for its breakthrough extraction technology just released results from its first test extraction at one of its several resources.

And, much to my excitement, the results were even better than anyone had hoped. You see, in the lab, this company had been able to extract as much as 90% of the lithium contained in the brine samples.

But in this most recent field test, it was able to get even more, nearly 95% of the available lithium in the samples.

That’s a massive leap from just 40% using the traditional methods of evaporation.

And it didn’t waste thousands of gallons of groundwater, disrupt hundreds of acres of land, or release any toxic runoff in the process.

It’s proof that this new technology can work in the real world and could completely change the entire industry.

And it’s evidence of the immense value packed into this tiny company (it’s got a market cap below $25 million) and its pioneering peers…

A value that the market has yet to recognize.

The Opportunity of a Lifetime

And that’s where the opportunity lies for shrewd investors…

This new technology is akin to what the oil and gas industry unlocked when it developed fracking to access tight oil in the U.S.

That led to massive gains for the companies pioneering it (and for their investors). Tiny, unheard-of companies became massive multinational operations practically overnight.

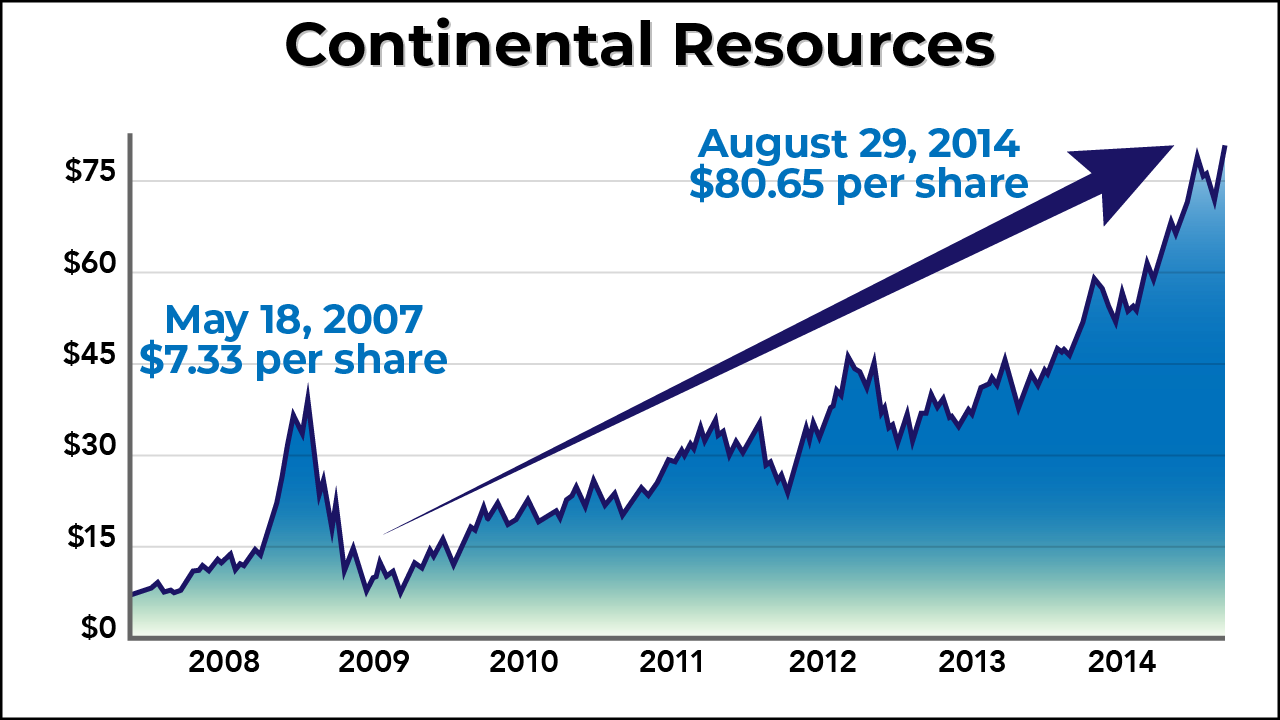

For example, Continental Resources went from a stock that cost $7 in 2007 to one that would run you over $80 by 2014, scoring investors over 1,000% in profits!

And a new generation of millionaires and billionaires was born from the early investors.

That’s exactly what I see happening in the global lithium market right now. This is lithium’s “fracking moment.”

And it’s poised to lead to equally massive, perhaps even bigger gains for the small companies willing to take a risk and bet on this groundbreaking new extraction technology.

In case you can’t tell, I’m more than a little bit excited about this. But, honestly, who wouldn’t be?

We’re talking about the potential to ride a company from a $25 million market cap to a $2.5 BILLION one!

So, because I’m pretty jazzed about the technology and the opportunity it presents to investors, I’ve put all my research into an easy-to-read report.

And you can get access by watching this equally informative presentation I recently had produced.

You’ll get all the information about the headwinds facing the industry, the details on this new technology and how it could unlock vast lithium resources previously thought inaccessible, and the specifics on the companies most likely to capitalize on this breakthrough advance in lithium extraction.

It’s all free for you because I’m so adamant that everyone needs to get a piece of these companies BEFORE they become the giants of industry and replace the current leaders.

So take a little time today or even over the weekend to check out my research. But don’t wait too long.

These companies are making huge leaps forward on almost a daily basis. And eventually the rank-and-file world is going to catch on.

Then you’ll see the CEOs and investors popping up on CNBC promoting the companies and the technology. And by that time, the biggest gains will be gone.

So don’t let this opportunity pass you by. Take a few minutes out of your schedule to learn how you can ride this building wave all the way in for massive profits.

And then enjoy your weekend.

To your wealth, Jason Williams After graduating Cum Laude in finance

and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private

sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team

responsible for billions of dollars in daily trading. Jason left Wall Street to found his own

investment office and now shares the strategies he used and the network he built with you. Jason

is the founder of Main Street

Ventures, a pre-IPO investment newsletter; the founder of

Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock

newsletter. He is also the managing editor of Wealth

Daily. To learn more about Jason, click here. Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube