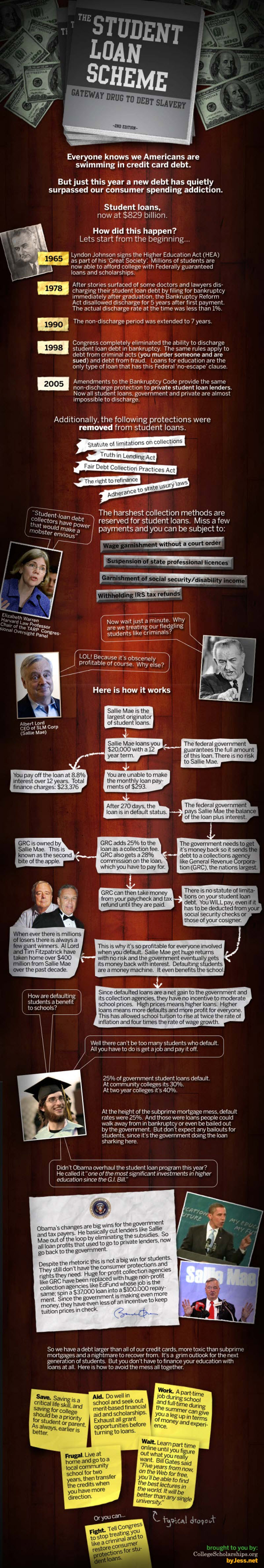

Here’s a great graphic that I found this morning on The Big Picture. It perfectly describes how college students are run through the ringer as they try to pay off thier massive college debts on entry level wages.

And while I know that no one put a gun to thier heads when they signed the loan docs, I also know that the majority of them do it chasing down dreams of careers and better lives.

Unfortunately, all that some of them end up with is a bill that they can never possibly repay. Instead of financial freedom, they end up mired in debt slavery long before they have ever earned thier first paycheck.

And here’s the other part of the story that one wants to talk about: the universal availiblity of the loans themselves actually drives up the cost of higher education.

In this case is matter of simple economics—an unlimited pool of money chasing a “must have” item. As a result, the cost of college education has no where to go but up.

Here’s a look at how it works. Click here for a larger version.

Infographic by College Scholarships.org

This, to me at least, is absolutely shameful.

Something to think about over a long holiday weekend….

Related Articles:

The Brewing Pension Funding Crisis

Public Pension Funds Head to Vegas

Chanos: The “cracking of state and local municipalities is coming”

Elizabeth Warren on The Shrinking Middle Class

To learn more about Wealth Daily click here.