There’s no doubt about it. This year’s bull market has legs. And a lot of that is thanks to the excitement continuing to build over developments in artificial intelligence, or AI.

But that’s got a lot of bearish forecasters crawling out of the woodwork to compare the current situation to the bubble that formed in internet stocks in the late 1990s.

You see, from about 1995–2000, any company even remotely connected with the budding internet sector could raise tons of money in the private markets, go through an IPO, and cash out to the tune of billions of dollars.

Investors were betting on anything that had ".com" in the name, even companies without business plans, assets, or any technology at all.

But this didn’t just start in 1995. In fact, it had been going on all decade. And from the start, bearish investors were waving the red flag, trying to alert people to the imminent demise of that market. Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

Missed It by That Much

Famed investor Jeremy Grantham (who’s currently calling for a market implosion — and has been since 2018) made his name in finance by “predicting bubbles.”

And because he was one of the earliest to spot what was brewing in the world of internet-related stocks, he kept his investors out of all of them.

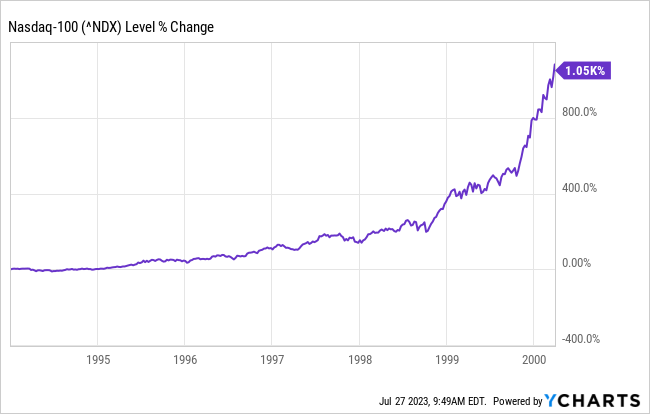

That turned out to be good for them when the market for those companies crashed. But this is what they missed out on:

That’s a 1,000% gain his investors missed just between 1995 and 2000. And all so he could avoid a 75% loss when the bubble burst.

But if he and his investors had taken on a little risk yet stayed cautious, they could have profited and avoided the crash.

Now, I’m not trying to badmouth Grantham at all. He’s a legend in his time and has protected the investors in his funds from numerous crashes.

What I’m trying to show you is that bubbles can build for a lot longer than even supposed experts think they can.

Grantham spent a decade avoiding the hottest stocks on the market because he was certain a crash was right around the corner.

But it took 10 years from when he identified a bubble to when it popped and sent all those speculative stocks crashing down to Earth.

"The Market Can Remain Irrational…"

So when you hear people out there saying that AI stocks are in a bubble, while they may be right, they’re often incredibly early.

As economist John Maynard Keynes said, "Markets can remain irrational longer than you can remain solvent."

That means bubbles can grow for a lot longer than most experts expect they can.

And Grantham, who’s probably the best bubble-spotter out there, was 10 years early with his call and missed well over 10x gains because of that.

So I’m not going to say that the AI market doesn’t look a little bubbly. It does.

But what I will say is that bubbles don’t burst until they’ve gone through a massive expansion.

And if you’re going to compare AI to dot-com, you need to realize that we’re in a 1995 moment, not a 2000 one.

We’re at the point where the bubble starts to form, but we’re nowhere near where it bursts. Not yet.

So, with that in mind, you’ve got to ask yourself a question: Am I willing to pass up what could be 1,000% gains (or more) now to avoid a little pain in the future?

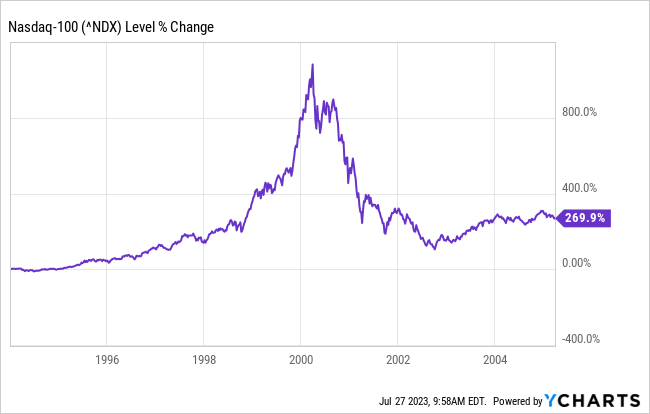

And you’ve got to remember that investors who rode that wave all the way up during the internet boom and then all the way back down during the dot-com crash came out ahead…

They did see those 1,000% gains turned into 100% gains, but they were still up. And that put them in a better position than Grantham’s investors who sat out the entire decade of growth.

Plus, they had ample time to react and bank most of those gains before the bottom really fell out. So many investors probably did even better than that chart suggests.

Fortune Favors the Bold

So, without knowing your answer, but knowing that you’re here reading this article because you’re a smart investor who’s looking for an edge on the competition…

I want to share some potential investments you can make in the AI industry while this bubble grows, because, as we like to say around here, fortune favors the boldest investors.

And I also want to give you a chance to join my investment community so that you’ll have the best chance of capturing the lion’s share of the growth still to come while avoiding the brunt of the losses likely to follow, because even the bold can benefit from having a guide on their journey.

You see, I’ve been really digging into this new generative AI trend we’re seeing in the markets.

I wanted to know what it’s really all about and why people were so excited by a computer program that can chat with you over the internet.

And what I uncovered was that applications like ChatGPT are just the tip of the iceberg.

And while they might be fun to play with and even helpful for getting a little help writing a paper or an email, they’re not where the real money will be made in this revolution.

That accolade is going to generative AI technology that’s more beneficial.

I’m talking about technology like conversational AI that will allow companies to ensure their customers have the most positive and helpful experience when they call for customer service…

Technology that will be able to understand any language, spoken in any accent, and respond in kind…

Technology that will allow the nearly 1 trillion illiterate adults around the globe to access the internet, emails, text messages, and more with the same ease as a Harvard grad with a degree in literature…

Technology that will allow driverless cars to become a reality and to safely navigate highways, byways, and neighborhoods without crashing into people, houses, or other vehicles…

Technology that will allow you to navigate the roads of a foreign city as if you were in your own hometown, walking down the streets you grew up on…

It’s this kind of technology that’s really going to change the way that we all interact with the world around us.

It’s the companies developing and pioneering it that will be the Googles, Amazons, and Apples of the future.

The AI Triumvirate

And after tireless research performed over countless hours, I’ve pinpointed three companies poised to do just that: disrupt the world and claim the top spots from the incumbent firms.

One is a leader in that conversational AI that will allow companies to better serve customers and technology to better serve everyone, no matter their level of education.

The second is a company that’s been building platforms that help you navigate through places you’ve never been before with the ease of a local.

And the third is a tiny company that’s created a platform that will power the internet of things (like all those smart devices in your house) with artificial intelligence to make everything work together seamlessly.

All three have developed patented technology that’s not only in demand now, but will be for a long time into the future.

All three have the makings of companies that will become the giants of their industry in the near future.

And all three have the potential to return 1,000%, 2,500%, perhaps even as much as 5,000% or more!

But since I’ve already taken up a lot of space explaining what they do and why they’re likely to keep rising in value far longer than even the “experts” think…

I don’t really have a ton of space to give you the nitty-gritty details on the companies and why I’m convinced they’re going to be some of the biggest winners as this market keeps growing.

So I’m including free access to a special presentation I recently put together explaining the nascent industry, the technology I’m convinced will be in highest demand, and the companies poised to reap the biggest rewards as this all plays out.

And if you’d like to capture some of the gains that are still to come, I highly suggest you take some time today and learn what I have.

There’s no cost and no commitment. I just want to get this information out there to help as many people as possible navigate this complex industry as it grows to maturity.

So take a few minutes to watch my presentation, or read this report that includes all the same details.

Then get yourself invested, because the biggest gains are still ahead of us…

And they’re likely to keep coming for a lot longer than anyone can predict.

To your wealth, Jason Williams After graduating Cum Laude in finance

and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private

sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team

responsible for billions of dollars in daily trading. Jason left Wall Street to found his own

investment office and now shares the strategies he used and the network he built with you. Jason

is the founder of Main Street

Ventures, a pre-IPO investment newsletter; the founder of

Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock

newsletter. He is also the managing editor of Wealth

Daily. To learn more about Jason, click here. Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube