This Company Makes Tanker Cars

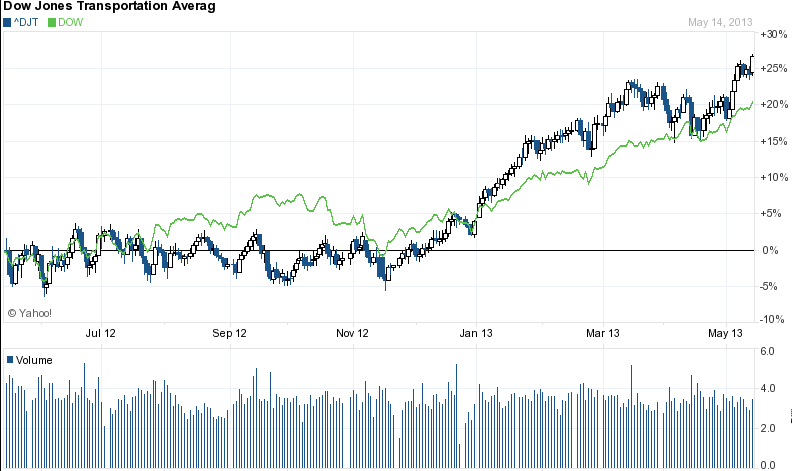

Take a look at this chart.

Just look at it!

You see that big fat candlestick at the end there?

That’s the freakin’ Dow Jones Transports throwing a kegger.

I don’t know if you’ve heard about the Dow Theory before, so here’s a little background…

The idea was dreamed up by Charles H. Dow in the late 1800s. (Charles also happens to be the guy that founded the Dow Jones Industrial Average, as well as a small-town rag called the Wall Street Journal.)

Dow’s idea was simple: If the industrial companies are doing well, they have to ship stuff. And if the shipping companies are doing well, then they must have something to ship. In other words, if the transports and the industrials confirm each other, then you have a trend — up or down.

As you can tell by the chart above, the transports just launched. The industrials confirmed. The trend is bullish.

Casey Jones, You Better Watch Your Speed

The 26% rally in the Dow Transports this year has, surprisingly, been driven by the railroads…

Union Pacific (NYSE: UNP) has operating margins of 32.54%! That’s unheard of for a boring old railroad. Union Pacific just hit another 52-week high and is now a $73 billion company.

CSX Corp (NYSE: CSX), another railroad, is also hitting a 52-week high.

The primary reason for this is our old friend, the Bakken.

As you know, we love the Bakken more than late-60s muscle cars or WWII movies…

Not only is it turning America into an independent energy state again, but it’s also the reason behind all this oil driving up demand for rail tankers.

It’s no wonder Warren Buffett bought up BNSF and had Obama shut down the Keystone Pipeline.

Shipments Down in Q1

As we all know, nothing is as it seems in the stock market. Looking on the face of it, total railroad freight was down in the first quarter. That’s according to a recent Association of American Railroads report: The total load carried on North American rails dropped 1.5% in the first quarter…

In fact, Union Pacific saw loads drop by 2%.

What gives? Why is UNP hitting new highs?

It’s all about oil.

Petroleum traffic has seen a jump of 46% in Q1. The United States is now producing more than seven million barrels of oil a day.

Over the past four years, oil shipments as a percentage of total rail volume have grown from 3% to 30%. And this trend is just getting started…

Crude by rail traffic is expected to increase by 300,000 units in 2013. Canadian Pacific alone estimates crude shipments to reach up to 70,000 oil tank cars by the end of the year — and 140,000 by 2015.

That’s massive growth in a staid old business.

Get Tanked

One company you might want to put on your radar is American Railcar Industries, Inc. (NADAQ: ARII). This $764 million company, in terms of market value, makes, repairs, and refurbishes hopper and tank railcars.

They have a forward P/E of 8.5 and a dividend yield of 2.9%. Quarterly earnings growth is 49.40%.

And get this: Our old friend Carl Icahn has been buying. He now holds 55% of the outstanding shares.

The share price is off from its highs of $45 and back to $35.

ARII seems like a solid bet,

Christian DeHaemer for Wealth Daily

P.S. National Bank of Greece (NYSE: NBG) is now at $1.72. That’s almost a double.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.