That heading has a lot of numbers in it, huh? That’s the first thing I thought when I typed it, at least. But that’s exactly what this article is. And it looks even funnier if you spell it all out: Three Five Gee Stocks Under Ten Dollars.

So, that’s the headline I settled on. It’s got its own simple kind of beauty, I guess. But enough of me talking about my choice of headlines. Let’s get into me talking about my choice of topics, instead.

The Revolution Is Upon Us

I’ve been writing about the 5G revolution for a while now — years at least. And I’ve tried to explain how important it is and what a major opportunity it creates for investors.

But I’m afraid some people still aren’t seeing the whole picture. And I get it. When someone talks about the possibilities of the future, a lot of us just hear the teacher from Charlie Brown:

The Possibilities Are ENDLESS

I mean, unless you spent a lot of time during your childhood reading science fiction novels, some of this stuff is incredibly hard to imagine.

I mean, driverless cars, that makes sense. It’s a car that can drive itself. Basically, what everyone thought we had when they introduced “cruise control” so many years ago. OK. I can picture that.

And virtual reality is pretty easy to imagine. I can put on goggles and gloves, maybe eventually a full body suit, and I can “feel” like I’m in a different place or world. I can get so close to the video game that I’m completely immersed in the experience. Again, that’s pretty easy to picture.

But what about the other things? Like augmented reality, connected cities, and smart homes…

Welcome to Your Custom Home

Well, I guess smart homes are pretty easy to imagine, too. Right now, you can let your home’s digital assistant know you’re getting close. It’s cold outside, so it brings the temperature of the house up to where you like it and when you pull into the driveway, the lights come on to greet you and the door unlocks as you approach.

But with 5G capabilities, the range of smart devices will be nearly limitless. So, your digital assistant will be able to know when you’re getting close from your phone’s GPS. And it’ll warm up the house, put on some light jazz, turn on the lights, uncork a bottle of wine, and get dinner started, too.

See Beyond the Picture

And augmented reality, again, is something I can picture from Back to the Future Part II (arguably the worst of the three best movies about time travel ever made). Remember when that shark hologram scares the living daylights out of Marty McFly?

Or, you can just think of the digital billboards we’ve already got along the highways, the ones that run through several ads an hour. Now, imagine those weren’t billboards on the side of the road but messages that pop up on a screen or the lens of your glasses reminding you that you need to stop and pick up toilet paper, or wine, or whatever your smart house noticed you’ve been getting low on.

But it could be so much more than that. While you’re walking down the street, your glasses will be able to help you find where you parked by showing you an arrow pointing down at it in a sea of cars.

They’ll be able to spot weeds in your garden (and highlight them for you) just because you glanced in that direction.

Or, say you’re in a big open place, like the National Mall in Washington, D.C. You’re looking for your friends, and you’re pretty sure they’re near the reflecting pool. But you’re not sure which side. Well, your AR glasses will be. They’ll be able to identify your friends and point you right to them. So you don’t have to wander around looking lost and confused.

A Better World for Everyone

That leaves connected cities. That concept is a little more complex, but it’s got even more possibilities.

In a smart city, streetlights can track pedestrian volume and save energy by only operating as needed. Connected devices can monitor air quality, sewage, water quality, and garbage collection. Sensors on roads and bridges can catch damage before it becomes a dangerous and expensive problem.

Programs will be able to go back through decades worth of fire and accident data and help firefighters and emergency medical personnel shorten response times. Sensors will be able to monitor traffic, both vehicular and pedestrian, and will help alleviate congestion on city streets.

More and better data will help make cities more accessible and inclusive for people with disabilities. Information and high-resolution images of pavement and sidewalk conditions will help people in wheelchairs navigate city streets and will help cities focus on making their streets more accessible.

Data can be analyzed by artificial intelligence to help cities better prepare for disasters, too. It will help optimize post-disaster response plans. It will also allow urban planning that takes into account potential disasters in that area.

The possibilities are truly limitless when we combine the advances that we’ve made in technology with a wireless network capable of handling massive amounts of data and maintaining blistering speeds.

And that’s why the development of 5G and its rollout across the U.S. and the globe is so exciting and will be so profitable for companies and investors alike.

So, now that I’ve gotten you thoroughly excited about the possibilities that 5G will bring, let’s talk about some 5G companies that you can get for less than $10 a share. Because, who doesn’t like a bargain?

The Old School Duo

Back in the 1990s, before smartphones dominated the market, the best cellphone you could get was made by a Finish company with a not-so-Finnish-sounding name. But it lost the top spot when Apple debuted the first iPhone. And it just never regained the cellphone title.

But its management weren’t overly dismayed because they’d quietly been building out the services side of the company, knowing that there’s only so much money in phone sales. And Nokia became the second-largest telecommunications networking solutions company in the world.

That move also set it up to be in the number two spot in the telecom 5G race as well. The only company to be further ahead in the 5G race, Huawei, has been banned from doing business in the U.S. and is losing supporters around the globe as its connection to the Chinese government becomes clearer.

That leaves Nokia and Ericsson to pick up the slack.

Ericsson, in case you need a reminder, was the backbone of the 3G wireless systems of the 1990s and early 2000s. It also partnered with Verizon to make the first 4G data call a reality. So, it’s held a top spot in wireless communication since the very beginning.

And it also leaves the U.S. government mulling a stake in either or both companies to help them develop better 5G solutions faster.

Both Nokia (NYSE: NOK) and Ericsson (NASDAQ: ERIC) stand to benefit from the continued expansion of 5G networks around the globe. And both happen to trade for less than $10.

Of the two, Nokia is my favorite. But both are solid 5G stocks that trade for less than 10 bucks.

The Other Fruit Company

Apple isn’t the only fruit that stands to be able to cash in on 5G. There’s another company that goes by a fruit of a different color. It’s an end-to-end mobility solutions provider now, but, like Nokia, it got its start as a dominant force in the cellphone market.

I think of it as the precursor to smartphones. For the first time ever, people could check emails. And because of the technology, emails could be received in real time. So, even when the iPhone debuted, these held their shine in the business world for years. But, eventually, every businessperson wanted an iPhone or Android, and the BlackBerry faded into history.

But the company behind it, Research in Motion wasn’t ready to give up just yet. It took the name of its trademark device and rebranded itself as BlackBerry (NYSE: BB).

The company already had a good relationship with businesses and governments who viewed its phones as more secure than others. And now BlackBerry provides intelligent security software and services to enterprises and governments worldwide.

It also owns over 38,000 patents related to technologies that will be used in smart cities, smart homes, driverless cars, and many other applications. Those aren’t worth much without a high-speed 5G network to run on.

And that’s part of the reason BlackBerry’s shares trade for less than $10. But as the network comes online and those patents start to be in demand, BlackBerry’s share price is likely to reflect the growing interest.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. When you become a member today, you’ll get our latest free report: “The Nvidia Killer: Unlocking the $100 Trillion AI Boom.”

It contains the most promising AI companies and sectors poised for explosive growth. Our team of expert analysts has conducted thorough market research to uncover a hidden gem currently trading at just $2.

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

Bonus Stock: The 5G Tollbooth Company

I’ve saved the best of the bunch for last. Not only is it the best 5G stock you can buy under $10, but it’s one of the best 5G stocks you can buy, period. Right now, it’s trading for about $9. And just a few weeks ago, it was down in the $4-range with Nokia and BlackBerry.

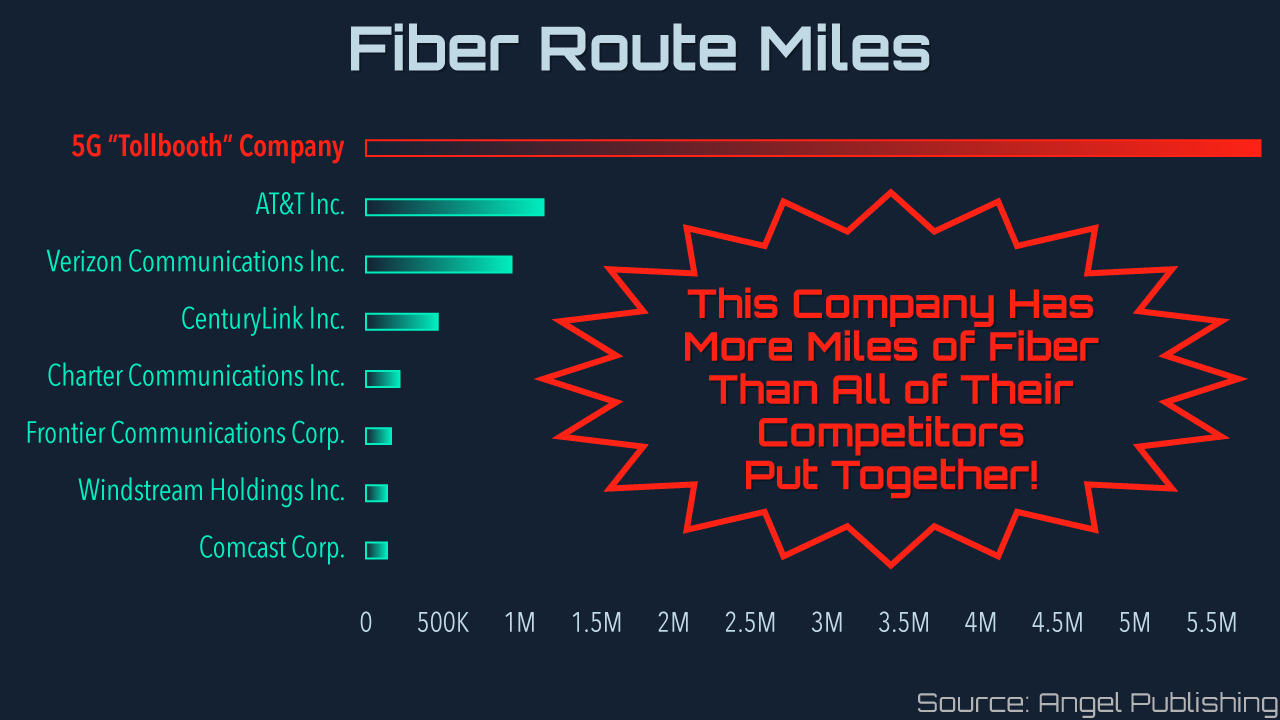

But investors are taking notice of the value its operations represent. You see, this company spent the past several years accumulating a massive network of connections that are vital to the 5G network in the United States.

It quietly built up an empire of this asset and now it owns more than all of the major wireless carriers and the biggest cable companies combined. And the thing is that this asset is critical to the deployment of 5G.

That’s because while 5G is a very fast wireless network, the data that travels across it lives in physical locations called servers. These servers are generally housed in farms with millions of others. And they’re all connected to each other and the outside world via fiber optic cables.

These cables are the only physical connection that can carry high loads of data at the same high speeds 5G will. And that means 5G antennas will need a way to connect to fiber optic networks so that the data can get to the servers.

Since this company has one of the biggest fiber networks in the country, all the other 5G players are lining up to get access. And this company is happy to grant it… for a slight fee, of course.

It’s like collecting a little toll every time a car uses the highway. Each one isn’t that big, but when you add them all up, you’re talking billions of dollars a year.

So, now you should be starting to realize why this small company’s massive fiber optic network is so important. And maybe you’re wondering why the stock still costs less than $10.

Well, the only reason this stock is still under $10 is because not many people have heard of it. It doesn’t have an exciting name or website. And it doesn’t spend money on “investor awareness” campaigns.

But it’s starting to get noticed. Shares have doubled in price over the past few weeks. And once it breaks that $10 threshold, there’s no telling where it’ll stop. In fact, before all is said and done, this $10 5G stock could be worth $65 a share or more.

Your Invitation Is Waiting

Now, I’ve already given you three 5G stocks that trade for under $10. And I’ve also already used a ton of space covering the topic. That means, I’m running out of room to give you all the details on the “5G Tollbooth Company.”

Fortunately, my partner and I have created a whole presentation on the opportunity. And you can watch it and get all the rest of the details by clicking here.

We’ve also created a written report for those of you who prefer to cut to the chase and read through the information. You can get a copy of that by clicking here.

And do yourself a favor: Don’t file this away under “things I’ll do later.” This stock is already making early investors rich. Like I said, it’s doubled in just the past few weeks.

And it’s going to break through $10 very soon. Once that happens, there’s no telling how high it will climb as more and more investors take notice.

You’ve already missed the first 100% gain. Don’t miss out on the massive profits still to come.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube