I hope you enjoyed that special "sneak preview" of my article you got last night. Obviously, we had a few technical glitches in the back end here, but we've got them worked out thanks to a herculean effort by our IT department. So thanks for your patience, and here's the REAL article. I hope you enjoy it even more today. I'll talk to you soon.

— Jason

In a market like the one we’ve been in the past few months,

there are a lot of companies’ stocks that are sitting on very thin ice.

Historical stimulus and easy-money conditions led to

massively inflated valuations across the board on Wall Street.

Some perma-bears were calling it the “Everything Bubble,”

because everything seemed way too expensive.

A lot of people laughed at them. I did at first. But then I

looked under the hood a little more and realized they might just be onto

something.

And I started warning you of hard times to come nearly two

years ago

. So you’ve had ample time to prepare.

But today, in case you’re still holding onto any of these

potentially toxic stocks, I want to get even more specific.

In the past, I’ve talked about sectors and industries I

expect to do well. I’ve talked about whole asset classes that look very

appetizing.

But today, I’m going one step further and naming names.

Because these three companies have been flying high, but

unless they completely change the way they do business, they’re destined to

fall even more than the rest of the

market.

Toxic Stock #1

First up is a stock that might just surprise you…

It’s one of the biggest names in the world of clean energy.

And it was the first renewable energy-focused company to overtake a major oil

stock in market capital.

It is also the largest operator of electric utilities in the

United States. And that’s why I bet you’re surprised to see it here.

Traditionally, utility stocks were the favored investments

of “widows and orphans,” because they’re not incredibly volatile and they pay

cash distributions in the form of dividends.

You see, this electric utility manages a vast network of

wind turbines and solar panel farms to generate electricity. And those projects

are all expected to expand.

But the rub with that kind of electricity is that it must

be used the instant it’s created. And if you don’t need it right then, you can

either store it or lose it forever.

And right now, the only good option for storing that energy is in gigantic stadium-sized lithium-ion batteries.

But the problem with those lithium batteries is multi-pronged:

- They’re massive so you need an extra football field worth of space to install one.

- They’re incredibly expensive and go for tens of millions just to get one big enough to power a few thousand homes.

- They’re prone to explosion and sometimes don’t even make it through testing before they blow up.

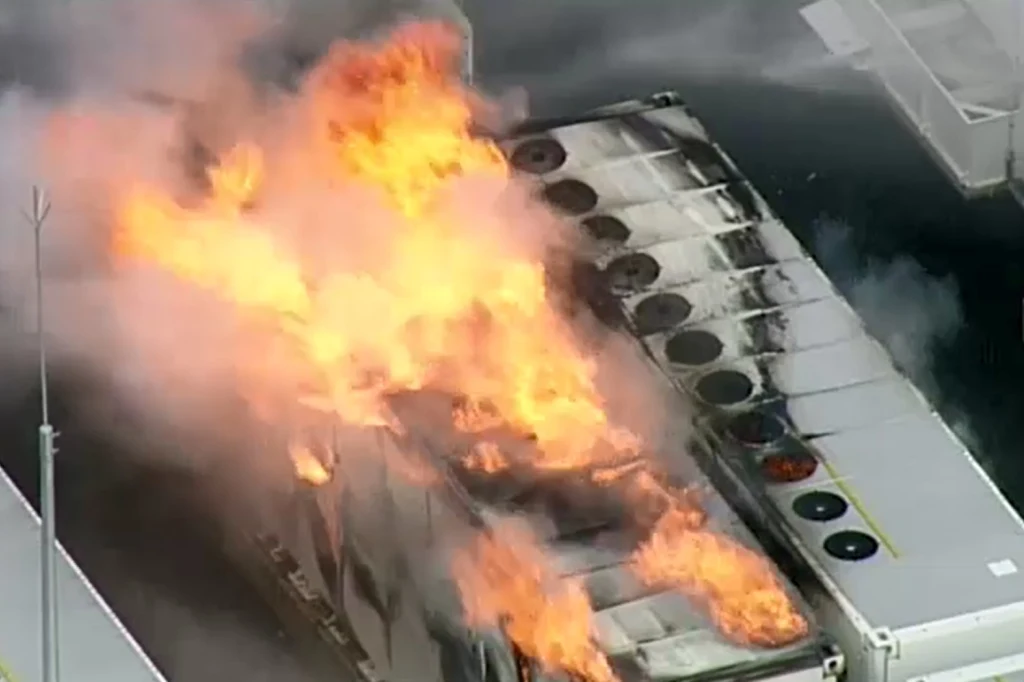

In fact, the world’s largest lithium-ion battery storage

site burst into flames this year (for the second time since last September).

And the latest fire (that took out about 10 million-dollar

batteries) all started from a faulty ball bearing in a fan somewhere up the

line.

And that’s why my first toxic stock to drop is NextEra

Energy (NYSE: NEE).

If it doesn’t figure out a better, more efficient, and safer

way to store its renewable electricity, it’s destined to go up in flames just

like those mega-expensive battery packs.

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “Options Made Easy”

It contains full details of tips on how options investing can be very simple.

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

Toxic Stock #2

Next up on the list is another stock that’s inextricably

linked with renewable energy in the United States.

In fact, it’s one of the leading generators of electricity

through wind and solar projects across the country.

It’s got solar and wind projects across 26 states and is

still developing more. And its goal is to provide clean power to its customers

at a low cost.

But again, it’s running into the same issues as our first

toxic stock: It’s great at generating that energy, but it’s got terrible

options for storing it.

It’s a partial owner of the largest wind farm in the U.S., the

Alta Wind Energy Center (AWEC) in California. That site can generate a whopping

1,550 megawatts.

But if that energy isn’t needed the second it’s produced,

it’s either lost forever or stored for later.

And again, the best thing they’ve come up with isn’t that

great: It’s big, expensive, and dangerous.

This company hasn’t had any explosions just yet, but give it

a little time and I’m sure you’ll see sparks.

When investors realize that, they’re likely to cut its

valuation in half. And that’s why Clearway Energy (NYSE: CWEN) is my second

toxic stock to drop.

Toxic Stock #3

Are you starting to sense a pattern here? So far, both of

these stocks belong to companies that rode the wave of ESG investing and happy

thoughts to ridiculous valuations.

But they’ve both got a critical fault in their business

model that’s no fault of their own. Neither Clearway nor NextEra actually make

those batteries they’re forced to rely on.

And neither does this company. But fortunately for its

investors, it doesn’t only rely on batteries to store its energy.

That puts it on the right track to save itself and its

investors, but it’s going to need help along the way.

You see, this company stores the majority of the energy it

generates in hydropower systems like massive reservoirs behind equally massive

dams like this one:

If you remember from last Friday, that’s actually how 96% of

the world’s energy is stored.

But there are only so many places you can put a dam or a reservoir.

You’ve literally got to flood an entire valley to make one.

So while this company had the right idea by refusing to

rely on big, expensive, dangerous lithium batteries, it’s quickly running out

of space to build more storage.

And if it can’t figure out a better way to save that energy

it’s generating through those renewable projects, investors are going to dump

its stock as fast as they can.

That’s why Brookfield Renewable Partners (NYSE: BEP) is my

third toxic stock to drop before the next market drop.

There’s Still Hope

But the thing is, those are only stocks I’d drop IF they

don’t start to make a change. In times like this, the only companies that will

survive are the ones that can pivot.

And all three of those companies need to make a BIG pivot if

they hope to hold onto those luxury valuations.

But there’s still hope for all three of them. Brookfield is

probably the farthest ahead of the pack, but even it has a lot of changes to

make.

And I’ve pinpointed the ONE company that can help them ALL make

that a reality.

You see, instead of focusing on making renewable energy like

NextEra, Clearway, and Brookfield, this company’s spent its entire existence

figuring out better ways to STORE that energy.

The engineers helping develop its technology saw the problems plaguing the energy storage market.

The solutions offered either weren’t that good or were

dangerous as all get-out.

So they set out to develop a better way to store that

renewable energy…

A way that didn’t involve mining tons of lithium from the

earth’s crust…

With a technology that can be applied anywhere on the

planet…

Using a resource that surrounds us all the time (and that’s

100% FREE for anyone to use).

And they finally did the impossible and created an energy

storage system without any of the hazards posed by lithium batteries.

Under the Radar

But the thing is that this company is still flying right

under the radar of almost every investor out there.

They don’t realize that the future of batteries has nothing

to do with Elon Musk, Tesla, or lithium at all.

So they’ve looked right past

this incredible opportunity to

corner the energy storage market.

But I’m hoping you won’t be one of them. I’m hoping you’ll

take my advice and get yourself invested now, while the market is ignoring and

discounting the shares.

And I’m hoping you’re one of the new generation of

millionaires I expect this company to mint.

So take a little time out of your day right now and check out the incredible opportunity I’ve uncovered.

It could easily be the most profitable time you’ll ever

spend.

And keep an eye out for my emails and articles because I’ll

be back soon with more ways for you to take advantage of the disconnects this

turbulent market is creating.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube