Warren Buffett has never been one to follow the crowd. In fact, he often makes his biggest moves when everyone else is panicking. So naturally, when the Oracle of Omaha starts making bold buys during times of uncertainty, we pay very close attention. And the question on everyone’s mind right now is simple: What is Warren Buffett investing in now?

Well, it turns out he’s doubling down on a handful of sectors that might surprise you. And if you’re wondering whether these moves signal a major market shift, you’re not alone.

So let’s take a look at what Buffett is buying, why he’s buying it, and what it could mean for smart investors looking to follow in his footsteps.

What Is Warren Buffett Investing in Now? Oil Is Still King

Despite the push toward renewables and the never-ending headlines about ESG investing, Buffett is still all-in on oil…

That’s right — while others are fleeing the fossil fuel sector, Buffett is loading up. Berkshire Hathaway has grown its stake in Occidental Petroleum (OXY) to over 28%, and that isn’t just a passive investment.

He has explicit approval from regulators to buy up to 50% of the company.

Why is Warren Buffett investing in oil now? Simple. Cash flow. Occidental is generating serious profits, paying down debt, and buying back shares.

And with oil demand still robust despite global economic headwinds, Buffett sees a long runway ahead. He’s not just buying into oil; he’s buying into leadership in oil.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”

It contains full details on why dividends are an amazing tool for growing your wealth.

What Is Warren Buffett Investing in Now? Think American-Made Energy

It’s not just Occidental. Buffett is also increasing exposure to Chevron (CVX).

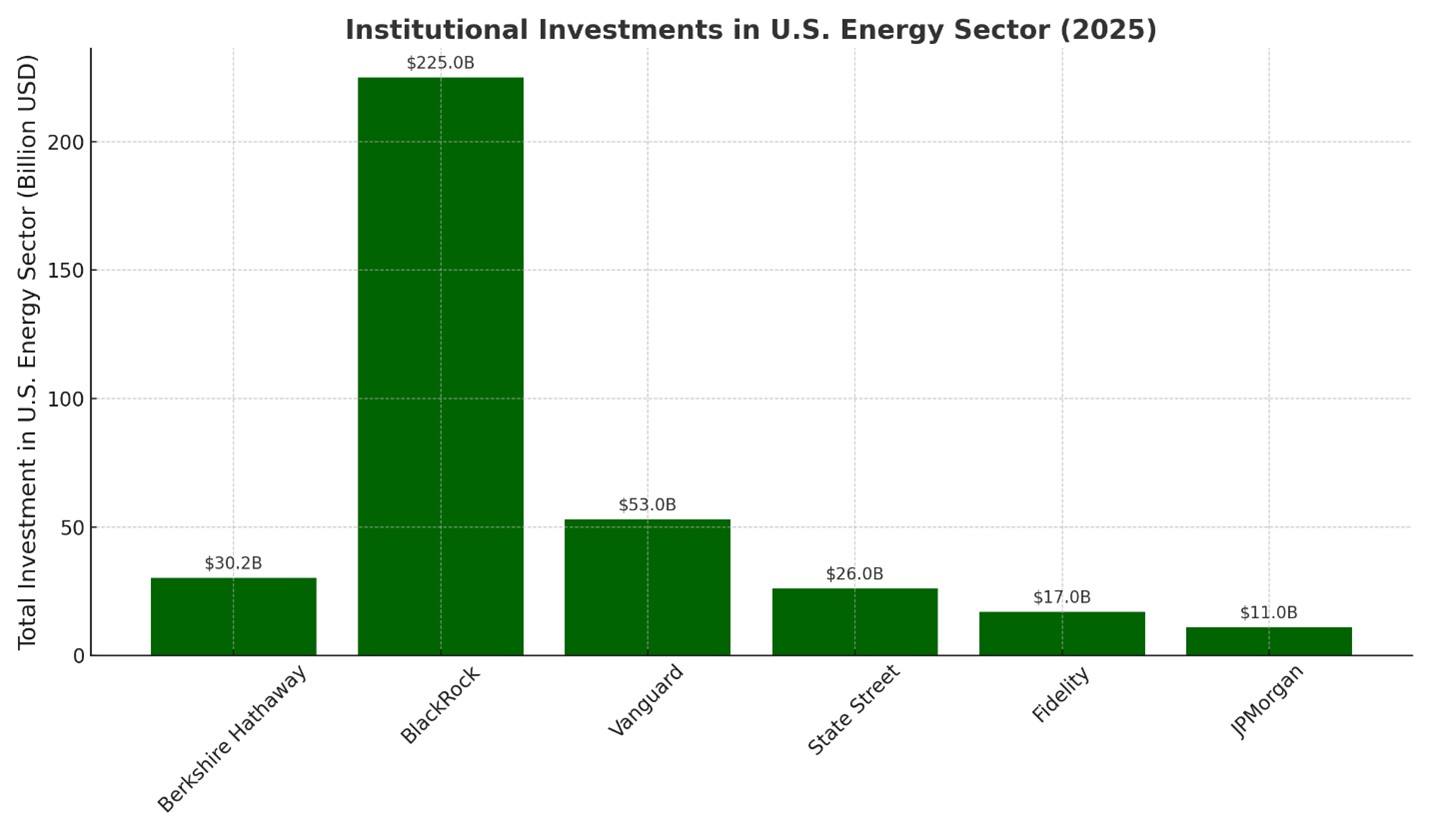

Taken together, his oil investments make Berkshire Hathaway one of the biggest institutional players in the American energy sector.

That’s a big bet on domestic production, energy independence, and — let’s be real — a contrarian view of where the world is headed.

With energy prices fluctuating and geopolitical tensions threatening supply chains, Buffett’s move feels prescient.

What is Warren Buffett investing in now? He’s investing in American strength. He’s investing in companies that can weather the storm and come out stronger.

If you're betting on the resilience of the U.S. economy, this is how you do it.

What Is Warren Buffett Investing in Now? A Bet on Building

Here’s something else that might fly under the radar: Buffett is betting big on construction and housing-related companies.

Berkshire recently added shares of D.R. Horton (DHI), the largest homebuilder in the United States. He also scooped up stakes in Lennar (LEN) and NVR (NVR).

These aren’t small potatoes, either. Berkshire has poured billions into these housing stocks.

So what is Warren Buffett investing in now that housing markets are tight and interest rates are high? He’s investing in the companies that are building the future.

Despite higher mortgage rates, homebuilders have pricing power, limited competition, and strong demand. With the U.S. still facing a housing shortage, Buffett sees opportunity where others see roadblocks.

What Is Warren Buffett Investing in Now? Credit Where It’s Due

Buffett has also quietly been building a position in Capital One (COF). Yep, the credit card company.

It’s not a flashy tech stock or a high-growth AI play. But it is a cash-generating machine with a massive customer base and plenty of pricing power.

So why is Warren Buffett investing in financials now? As always, he loves predictable income. Credit card companies thrive on interest payments and fees, and Capital One has done a great job managing risk.

If you think the consumer is still strong — and Buffett clearly does — this investment makes perfect sense.

What Is Warren Buffett Investing in Now? Going Global Through Japan

Buffett isn’t just looking at the U.S. In fact, he’s been quietly building a position in Japanese trading houses for years now, and in 2023 he doubled down again.

These aren’t just any Japanese companies. We’re talking about names like Mitsubishi (MUFG) and Mitsui (SMFG). These conglomerates are diversified across commodities, shipping, energy, and finance — exactly the kind of broad exposure Buffett loves.

What is Warren Buffett investing in now overseas? Companies with deep roots, global operations, and fat dividends.

He’s even said that he could increase these stakes further. It’s a reminder that Buffett doesn’t just look for value in America — he looks for it everywhere.

What Is Warren Buffett Investing in Now? The Apple of His Eye

Let’s not forget Buffett’s biggest position by far: Apple (AAPL). It makes up nearly half of Berkshire Hathaway’s equity portfolio. That’s not a typo.

And even though he trimmed the position slightly in recent quarters, it’s clear he remains bullish. Apple is a cash cow, a brand juggernaut, and a dividend-paying machine.

So what is Warren Buffett investing in now when it comes to tech? He’s sticking with the winners.

He’s not chasing the latest AI hype or jumping on every startup that promises the moon. He’s putting his money in a proven performer that has built an ecosystem almost impossible to escape.

Get Invested Before the Herd Catches On

By now you should have a pretty good sense of what Warren Buffett is investing in now. He’s betting on oil, housing, American resilience, global conglomerates, and world-class tech.

He’s not chasing trends — he’s spotting value and pouncing when others hesitate. That’s how legends invest.

If you want to follow in Buffett’s footsteps, the time to act is now. Before Wall Street catches on. Before the headlines start echoing what Buffett already knows.

Get your hands on our free report to see exactly where the Oracle is placing his chips — and how you can too.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube