Picture this: You’re 20 years old, sipping coffee, scrolling through your phone. Future you pops up and says, "Hey, start investing now and you’ll be financially free before you know it." Sounds nice, right? Well, that’s not just wishful thinking; it’s a reality if you take action early.

Investing when you’re young gives you a serious advantage, letting your money work for you, instead of the other way around.

So, while markets are down, let’s take some time to talk about why getting a head start is the best financial decision you’ll ever make.

Time Is Your Best Friend (And Your Money’s, Too)

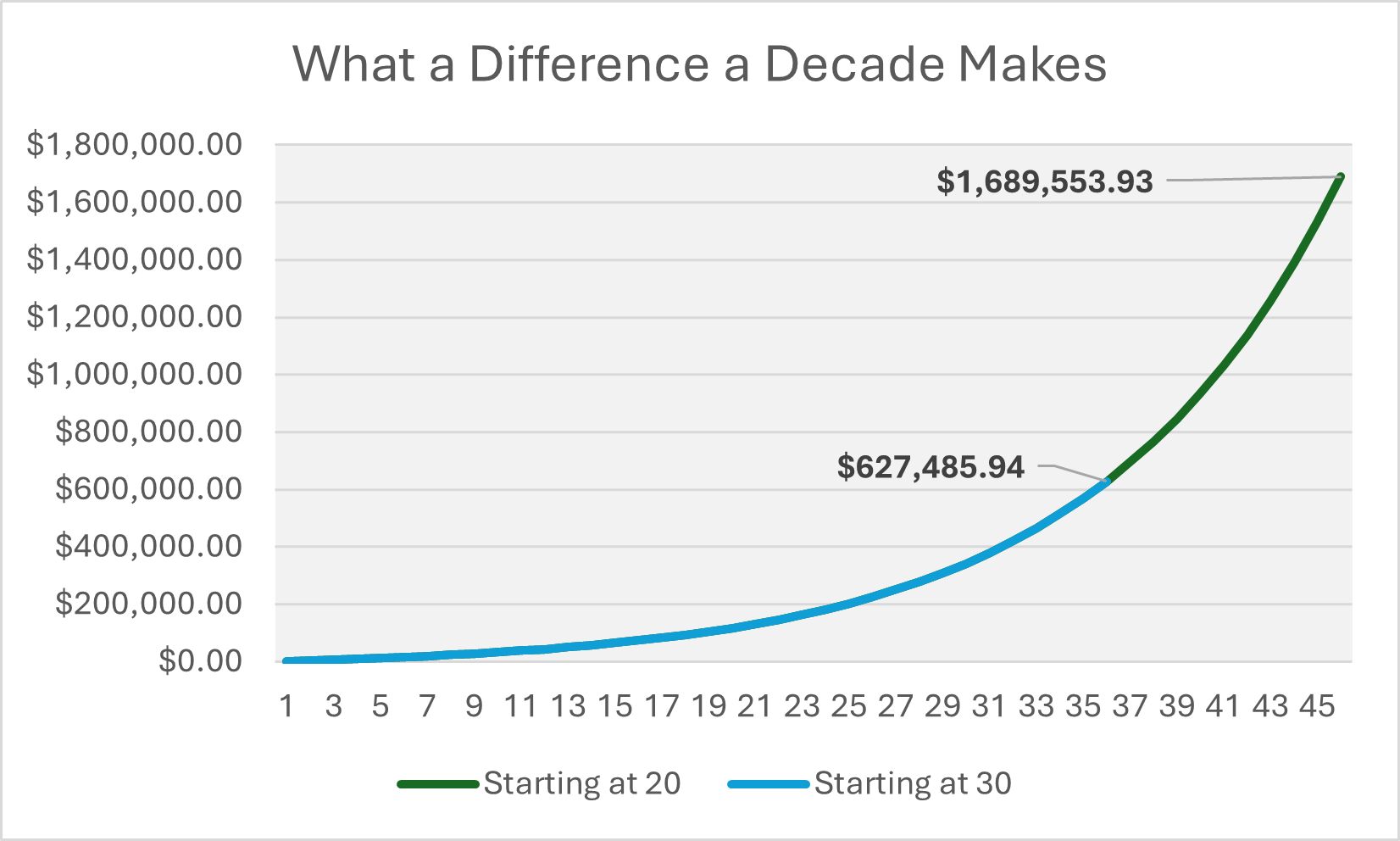

The biggest advantage young investors have? Time. And when it comes to building wealth, time is pure gold. The earlier you start, the more time your money has to grow. Let’s say you invest just $2,000 a year starting at age 20.

By the time you hit 65, that could amount to a fortune — especially compared to someone who waits until 30 to start the same habit.

The difference? Potentially more than $1 MILLION, all thanks to those 10 extra years of growth. Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they

hit Wall Street. Become a member today, and get our latest free report: “Why You Need to Fire Your Money

Manager.”The Best Free Investment You’ll Ever Make

It contains full details on why money managers are overpaid and provides you with

tools for growing your wealth.On your own terms. No fees, no commission.

The Magic of Compounding: Your Money, Making Money

You’ve probably heard of compound interest, famously called the "eighth wonder of the world." It’s what happens when your investments earn returns, and then those returns start earning returns of their own.

It’s like a snowball rolling down a hill. It starts small, but the further it goes, the bigger it gets.

This is why starting to invest early is so powerful. Even small investments can turn into significant wealth over time, all because of compounding.

Taking Risks? Now’s the Time!

When you’re young, you have a unique superpower: the ability to take risks. With decades ahead before retirement, you can afford to invest in higher-risk, higher-reward assets like stocks. Unlike someone nearing retirement, you have plenty of time to recover from market dips.

Given time, markets recover from even the harshest drops. That said, investing isn’t about being reckless. It’s about finding the right level of risk that works for you and sticking to a smart, long-term plan.

Investing Early = Financial Freedom Sooner

Want to retire early? Travel the world? Start your own business? Investing young puts those dreams within reach. The more wealth you build early on, the less you’ll have to rely on a paycheck later in life.

Financial freedom isn’t just about having money. It’s about having choices. And the earlier you invest, the more choices you’ll have down the road.

Where to Put Your Money? You’ve Got Options

One of the best things about investing today is the variety of options available. Whether you’re conservative or willing to go all-in, there’s something for everyone:

- Stocks, Bonds, and Mutual Funds — Stocks offer growth potential, bonds provide stability, and mutual funds give you a mix of both.

- Exchange-Traded Funds (ETFs) — Like mutual funds but easier to trade, ETFs let you invest in a bunch of companies at once.

- Retirement Accounts (401(k)s and IRAs) — These accounts come with tax benefits that can supercharge your savings.

- Real Estate and Alternative Investments — Buying property or exploring other investment avenues can help diversify your portfolio.

- Cryptocurrencies and Digital Assets — While risky, these offer potential high returns if you do your homework.

How to Win at Investing (Without Losing Sleep)

Investing isn’t about getting rich overnight. It’s about smart strategies and discipline. Here’s how to stay on the right track:

- Set Clear Goals — Know what you’re investing for: retirement, a house, or just general wealth-building.

- Diversify, Diversify, Diversify — Spread your money across different investments to reduce risk.

- Use Dollar-Cost Averaging — Invest a fixed amount regularly to smooth out market ups and downs.

- Reinvest Your Returns — Let your earnings compound to accelerate growth.

- Balance Risk and Reward — Choose a mix of aggressive and conservative investments based on your comfort level.

Staying the Course: Don’t Let Fear Derail You

Markets go up and markets go down. That’s just how it works. The key is staying focused on the long game, because markets tend to go up over time.

Avoid chasing trends, and don’t panic when the market dips. Remember, downturns can be great buying opportunities!

If you ever feel lost, consider getting advice from financial pros like me and my team here at Wealth Daily or using scheduled investment plans to help automate your buying.

Also, don’t forget about financial fundamentals — like keeping an emergency fund and managing debt — while you invest. A well-rounded approach will keep you on solid financial ground.

Think You Missed the Boat? Think Again

Maybe you’re reading this and thinking, "I wish I had started earlier." Good news: It’s never too late.

Whether you’re 25, 35, or even 50, starting today is better than waiting another year. The key is consistency — even small contributions add up over time.

Strategies like dollar-cost averaging can help smooth out returns and reduce risk, while taking advantage of market downturns can boost your long-term gains.

Your Future Self Will Thank You

Investing isn’t a sprint; it’s a marathon. And the sooner you start running, the easier the race becomes.

Whether you’re just getting started or looking to improve your investment game, the most important step is to take action.

So what are you waiting for? Your future self is already cheering you on!

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube